With an increase of collateral inside your home this season, I accumulated this new courage to make contact with our financial, CBA, and ask for a much better package. With little stress it dropped its rate by the 0.15%.

With additional security in the house in 2010, We accumulated new bravery to contact our financial, CBA, and ask for a much better deal. With little challenge it fell its price by 0.15%. I mentioned a much more tempting rates within a rival with an effective $cuatro,000 cashback render, the better they may carry out was a further 0.02%.

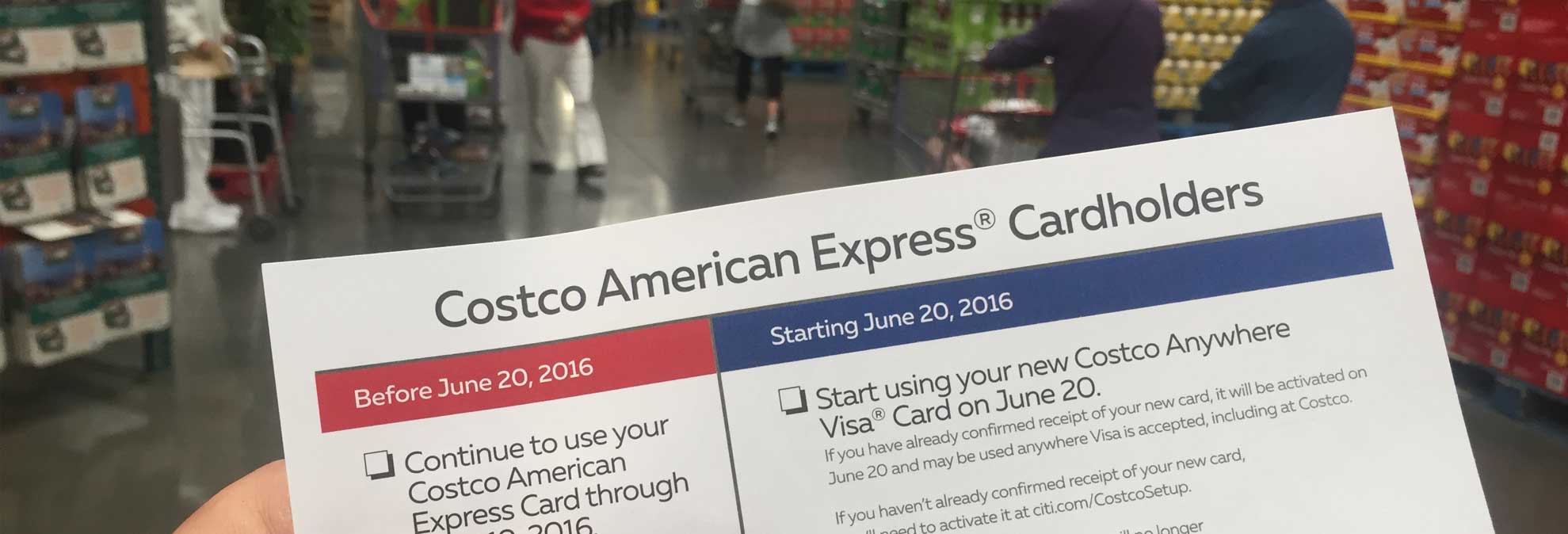

Therefore we started the new refinancing station. I politely indicated we made them aware of so it before deciding to follow the higher bring. Many thanks for everything you create!

And it also cannot hold on there. Putting one $2,000 up against the loan is about to has a great compounding perception over the years, slashing enough time it needs you to definitely getting financial obligation-free.

Having said that, I would getting lured to take at the least a hundred or so cash and get an adore-trousers eating. Your are entitled to it!

My a lot of time-distress publisher, Wally, wants to joke as you are able to give the newest monetary heart circulation away from the country out of a look https://paydayloanalabama.com/bellamy/ inside my email. Whatsoever … many people of various age groups, from throughout the nation, build in my opinion about what is actually worrying them out.

My personal enough time-suffering editor, Wally, likes to joke you could give the latest monetary heartbeat from the country regarding a glimpse within my inbox. After all … thousands of people of various age groups, of throughout the world, build for me on the what exactly is stressing them aside.

It’s true. Nowadays the fresh new threat‘ off ascending rates of interest was at fever mountain. It has been spurred to the of the certain masters predicting one to interest levels usually struck 3.5% because of the next year. To place you to in framework … that might be 13 additional nature hikes in the almost as much months.

But not, the surging rising prices which is happening in the world will demand much higher rates moving forward … but really You will find little idea exactly how large they will go, or when.

The brand new CBA has accessible to cure all of our speed underneath the competitor price and thrown inside the $dos,000 in cash so you can award us if you are a loyal buyers

My chief point would be the fact higher rates was basically totally foreseeable – hell, I’ve been talking about them for many years! 5%, plus they limboed it-all just how down seriously to 0.1%.

The you to takeout throughout the last few years is that the world is a risky and you can unstable place. Weird posts is when you least assume they. Crappy blogs goes for those who haven’t ready to accept they.

Well, if you’ve been following Barefoot Methods, the answer try: you’re already doing it! You may be aggressively paying off debt, gathering a profit shield, and you may using longterm with the offers via your lowest-costs, tax-energetic super financing.Put another way, manage what you are able handle. Alot more Big date Night, quicker Tv news.

Is me: Zero you simply will not. Regardless if prices get smaller a little, you will be shooting within the a newspaper purse with just 29% of the grab-domestic remaining.

Once we had filled out a variety of models due to a broker, the loved ones on the CBA were in contact asking why we planned to release the financing

Past Friday early morning I found myself with my students in the Lego store inside Melbourne whenever i got a text from a buddy: Anyone is impersonating your on Myspace and you may running a scam to wool your audience!

Talk about moving about branches! I would personally suggest you own an event within campfire and get anyone to start putting up into let reduce one loans.