This is certainly backed blogs. All viewpoints and you may viewpoints would be the advertiser’s and don’t fundamentally reflect the views and you may viewpoints off WXYZ Channel 7.

Poor credit finance may be the next ideal thing if you are searching getting loans with no borrowing checks. If you find yourself bad credit lenders dont prioritize credit score when comparing borrowers, it however conduct mellow monitors.

This includes checking their employment background otherwise earnings info. Hence, taking recognized for a financial loan tends to be a constant activity to own some individuals. This is especially true when you’re eager to escape regarding a monetary quagmire.

This is why this short article directories from websites you can check out to locate let. With the help of our platforms, you will never exposure and then make an adverse med as they are all the legitimate. It works with picked dependable loan providers.

1. United states Less than perfect credit Fund – Get personal loans with no credit checks and guaranteed approval2. CocoLoan – A quick way to apply for an emergency loan with bad credit3: WeLoans – Get connected quickly with reliable lenders for quick loans4: iPaydayLoans – A safe and secure platform to apply for payday loans and get money quickly5. EasyPaydayLoans – Visit this platform to get loans easily as soon as the same business day6. UnityLoan – Get personal loans with no hard credit checks required7. HonestLoans – Access payday and same day loans from the comfort of your home8. British Poor credit Money – An easy way to get up to ?5,000 in short-term loans in the UK9. Pay day loan British – Visit Payday Loans UK for the best bad credit loans good site and competitive rates10. GetPaydayLoan – Get connected with reliable lenders in the UK for bad credit loans

All of us Bad credit Fund makes every effort to connect clients with approved lenders as soon as possible. Since it’s difficult to obtain a loan these days and some unreliable platforms just rip off desperate borrowers, US Bad Credit Loans focuses on finding trustworthy loan providers.

And, you don’t have to care about delivering your own advice since the your website uses higher-prevent security tech to help keep your information safer.

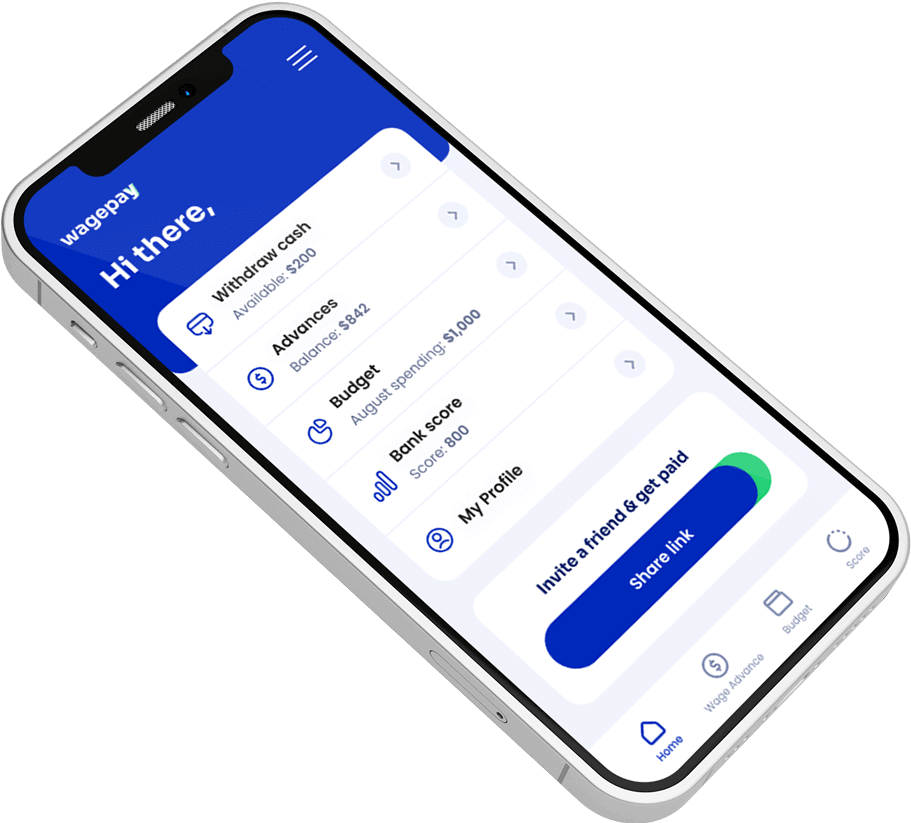

You could complete your whole processes from the comfort of your own household on the mobile if you enjoys an online union. Seeking a loan is generally time-ingesting and difficult. This program connects one to in past times vetted lenders. You simply will not need visit 10s out-of other sites, fill out multiple forms, or stand in range during the a city financial.

Even then, will still be it is possible to to boost your chances of acceptance whether your income background is actually high enough or you alter your FICO credit score

- You’ll receive loan offers in accordance with the guidance your promote

- The web app procedure try easy

- Borrowers can get funds into the as fast as a comparable day

Even so, it’s still possible to boost your chances of acceptance in the event your earnings records is actually sufficient or if you alter your FICO credit rating

- Extent you qualify for are restricted on account of crappy credit

The CocoLoan platform is for you if you need money urgently and have bad credit. CocoLoan is a lending platform providing broker services that connects borrowers with a network of credible lenders. Lenders have their own interest rates and fees, which they disclose to the applicants before they agree to take out the loan.

Even then, will still be possible to increase your odds of acceptance in the event the earnings history was high enough or you alter your FICO credit rating

- Need to be at the very least 18 yrs old

- Must be a great Us resident otherwise a long-term resident

- Get very own checking account

- Features evidence of stable income

The application form comes to completing your data and your consult have a tendency to end up being forwarded in order to an over-all community away from loan providers. Many times once you have offered your information, a lender commonly address your within minutes.

Adopting the mortgage acceptance, searching from the terms and conditions and costs, and you may through to contract, the lender have a tendency to deposit money in to your finances.

Even then, it’s still you can to improve your chances of acceptance in the event your income records is high enough or if you improve your FICO credit rating

- It’s less than perfect credit friendly

You can visit WeLoans to obtain loans to assist you in paying your emergency bills like medical bills, and other unforeseen expenses. The company’s network of lenders provides loans for people with poor credit. You can take out these loans because they are a quick way to receive money and you can complete the whole process online.

You’ll be able to have the fund you need from just one of platform’s of numerous loan providers. This really is when the pursuing the business day in the event the a loan provider is present once you over your internet function.

Candidates could possibly get acquire ranging from $50 and you can $5,100 to have cash advance and up so you’re able to $35,one hundred thousand basically-label fees money. However, the actual number you qualify for are very different considering their lender.

If for example the financing are authorized, their financial will let you know of every charge with it, additionally the rates of interest prior to signing the loan contract. You could potentially discuss after which agree to this new lender’s words.

There’s absolutely no such as issue while the protected fund. not, bad credit loans has actually more 80% mortgage acceptance rates simply because they dont disqualify consumers that have crappy credit.

You can purchase quick-title funds which have poor credit out of poor credit loan providers. They have been payday loan, cash advances, identity funds, and private funds. Very poor credit finance can be found in smaller amounts and get less fees periods ranging from two to four days to possess cash advance, or more to three years for personal repayment financing.

Bringing a poor credit financing is a quick and easy ways to eliminate the quick economic issues. The latest discussed people in this article hook your on top no-credit-evaluate loan providers that have protected acceptance. As you make your app, always remember to endure every give and ensure your consent with the terminology ahead of investing any loan.