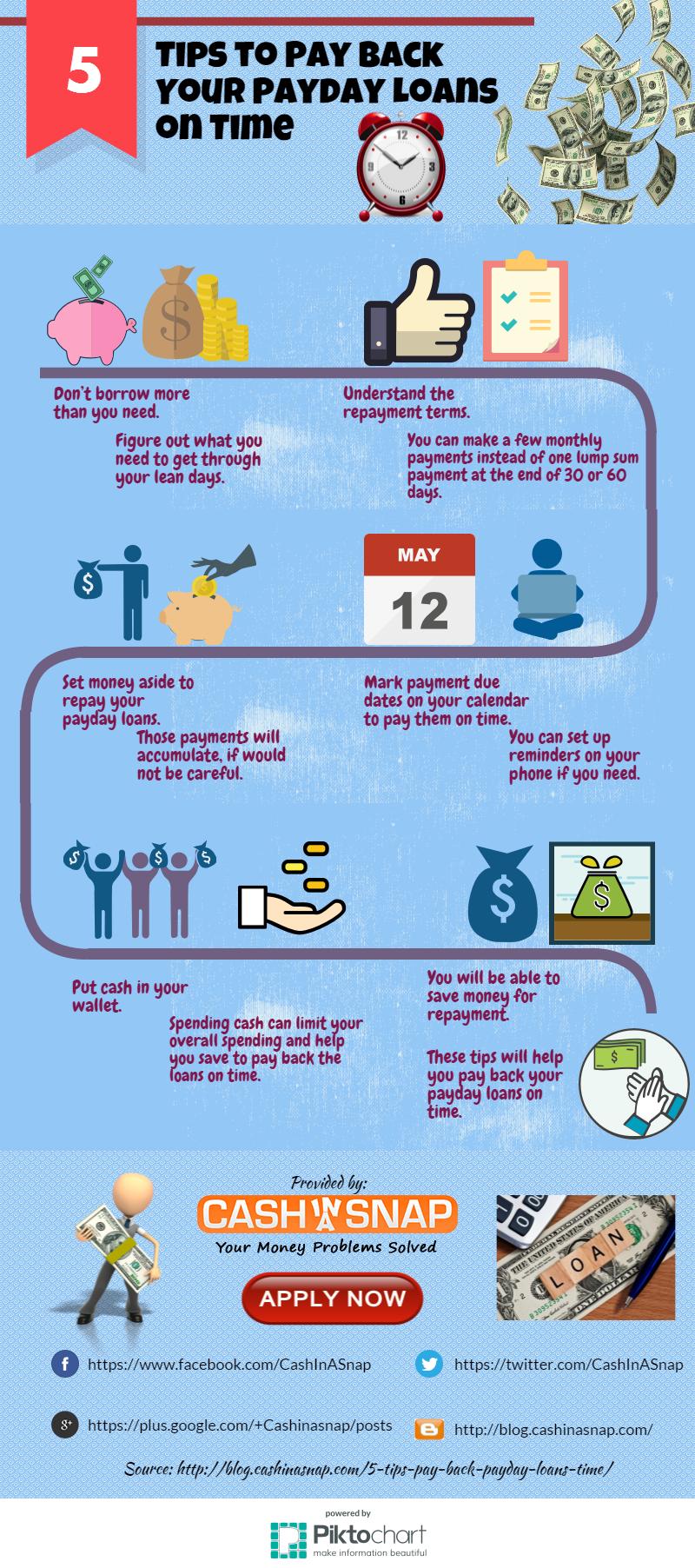

Zero. Repayment may be accomplished from the refinancing the reverse mortgage which have a antique „forward“ home loan, otherwise through the use of other assets.

Certain opposite mortgage loans have a keen origination percentage, normal settlement costs, upfront and you will repeating Financial Insurance fees and you may a monthly repair percentage. Normally these types of costs are going to be paid back from the reverse mortgage by itself, which makes them no quick burden to your consumers; the expenses try placed into the principal and reduced at stop, when the financing becomes owed. But not, there are now reverse financial products that charge greatly less fees and zero initial otherwise repeating Home loan Insurance premiums and you will/or no origination charge and in some cases no settlement costs at all, except for brand new counselling percentage and you may one condition certain charge that will be a little nominal.

+ How much cash am i going to must put together initial to pay for origination costs or any other settlement costs?

One of the main benefits of an other home loan is that you are able to the bucks obtain from your own house’s equity (dependent upon last computations) to fund the many costs (that will start around almost nothing in order to countless built for the final equipment). The expenses are only set in the loan balance. You have to pay all of them right back, also interest, in the event the loan becomes due – which is, if the last surviving borrower permanently actions out from the household otherwise becomes deceased.

+ Is actually contrary mortgage interest rates repaired otherwise changeable?

Opposite mortgages can either end up being fixed or has actually an adjustable price that is linked with a monetary index that can are very different according to market standards.

+ What’s „TALC“ and why ought i understand it?

TALC stands for „Overall Annual Loan Cost.“ They brings together the costs away from an opposing mortgage for the an individual yearly mediocre rate. It may be quite beneficial when comparing one kind of contrary mortgage to a different. Reverse mortgage loans are different much more to look at, pros, and you will can cost you. It’s not very an „oranges to help you apples“ assessment. If you are considering an opposite financial, make sure to pose a question to your All the Ca Opposite Mortgage specialist or therapist to spell it out this new TALC prices into various opposite home loan products.

+ Have there been taxation outcomes? Think about my Personal Safeguards and you may Medicare masters?

Given that contrary mortgage loans are believed financing improves and not earnings, the fresh Irs considers this new continues received by them to be low-nonexempt. Similarly, which have a face-to-face home loan must not connect with their Personal Shelter or Medicare gurus. Excite speak to your tax coach to assess your specific disease. For individuals who located SSI, Medicaid, or any other personal guidance, their contrary mortgage loan advances are merely measured while the „quick assets“ for individuals who keep them in the an account at night stop away from new calendar month where you discover all of them. You truly must be cautious to not ever allow your https://cashadvancecompass.com/personal-loans-il/ overall liquid assets become more than such programs allow. You should discuss the feeling off a contrary financial toward government, state or regional assistance applications which have a professional advisor, like your geographic area Agency to your Aging, your accountant otherwise taxation lawyer. Fundamentally, yet another income tax reality to consider is the fact that appeal on contrary mortgage loans is not deductible on your own taxation returns through to the loan is paid down totally…put differently before the attract is actually paid.

+ Will it be true that I want to meet with a completely independent counselor in advance of finishing my personal opposite financial software?

Yes. That is a great federally mandated function of the reverse home loan process that’s readily available for your protection. Your The California Mortgage Contrary Mortgage pro tend to counsel you to the getting in contact with a different regulators accepted therapist.