Introduction

Are you gearing to delve into the field of homeownership? Well done on the getting so it tall step for the protecting your following! Prior to your go on that it fascinating travels, it’s necessary to allow your self into the equipment and studies needed to browse the complexities from financial data. Full Mortgage’s Financial Calculator is your go-in order to resource getting easily quoting their home loan repayments and you can knowing the financial ins and outs inside.

How exactly to Use Overall Mortgage’s Financial Calculator

Calculating their mortgage repayments must not be a frightening task. That have Overall Mortgage’s member-amicable Mortgage Calculator, it is a breeze. The following is a step-by-step self-help guide to playing with our calculator effortlessly:

Get into Your residence Information: Start with inputting very important suggestions like the home speed and your down-payment amount. Whether you’re to shop for a separate home or refinancing your existing you to, the calculator accommodates your position.

Identify Your loan Facts: Customize their calculation by typing information like the loan term and you may rate of interest. Whether you are opting for a fundamental 29-seasons mortgage or investigating reduced conditions, our calculator will give you instantaneous facts in the monthly installments.

Cause of A lot more Costs: Overall Mortgage’s calculator happens the excess kilometer because of the estimating additional expenditures like property fees, homeowners insurance, HOA costs, and you may home loan insurance coverage. From the bookkeeping for those costs upfront, you possibly can make informed conclusion about your finances and you may monetary coming.

Mention Amortization Solutions: Explore the excess costs loss to explore the loans Pleasant Valley fresh new impression out of even more repayments in your financial. Regardless if you are given prepaying the home loan otherwise changing your own commission plan, the calculator allows one to photo this new a lot of time-term consequences on your mortgage.

If you are considering speeding up their mortgage payoff or adjusting their fee volume, select deals with Bi-Weekly costs: Plunge with the all of our calculator’s has to know the potential savings off switching to a beneficial bi-per week fee schedule.

Figure out Your property Value: With these calculator, effortlessly figure out how far home you can afford from the inputting your revenue and you will month-to-month costs. Rating a clear knowledge of your financial budget for purchasing a house, and come up with told monetary conclusion.

Understanding the Areas of The Mortgage payment

A home loan payment contains several elements past merely principal and you can attention. Complete Mortgage’s Home loan Calculator falls out white within these elements, letting you gain a comprehensive understanding of debt loans. Is a report on regular will cost you included in a mortgage payment:

A way to Reduce your Month-to-month Mortgage repayment

- Opt for a long Loan Name: Stretching new payment months cuts back your monthly payment, albeit at the expense of expenses more interest over the loan’s years.

- Downsize Your property Finances: Opting for a less costly possessions leads to a smaller sized monthly mortgage obligations.

- Look for All the way down Interest rates: Whenever you are pursuing lower rates is also fade your monthly payment, remember that certain excessively low pricing may require using factors, an initial expenses.

- Boost your Deposit: Adding a larger down payment upfront ount, thereby cutting your monthly payment duty.

That it algorithm helps with viewing rates to ascertain your reasonable construction assortment. Instead, you can make use of the home loan calculator to gauge debt limitations.

Choosing Your residence To purchase Finances

Undecided exactly how much of your own earnings to help you allocate to help you construction will cost you? With this calculator, you can with ease imagine your purchase finances centered on your earnings, month-to-month bills, interest, and you will advance payment matter

This allows you to change a monthly payment amount that meets their fincancial disease, towards the a more concrete finances number hence lets you know simply just how much house you can afford. By modifying this new details towards state you could make a keen advised financial choice and be a whole lot more ready to create a deal in your dream home.

Home loan Calculator: Solution Spends

A lot of people fool around with a mortgage calculator in order to imagine this new payment to the a new financial, but it are used for almost every other purposes, also.

Attending pay their mortgage very early?

Utilize the „Even more money“ effectiveness your mortgage calculator to find out how to shorten their identity and you can rescue also the newest much time-run if you are paying more cash towards the your own loan’s principal. It is possible to make these types of most money bi-weekly, monthly, a-year if not one time.

To assess the fresh new offers, click the „additional payments“ key and you can enter into the loan details, and also the kind of and amount of the a lot more repayments. The fresh new calculator will then show you the coupons with respect to one another money and time.

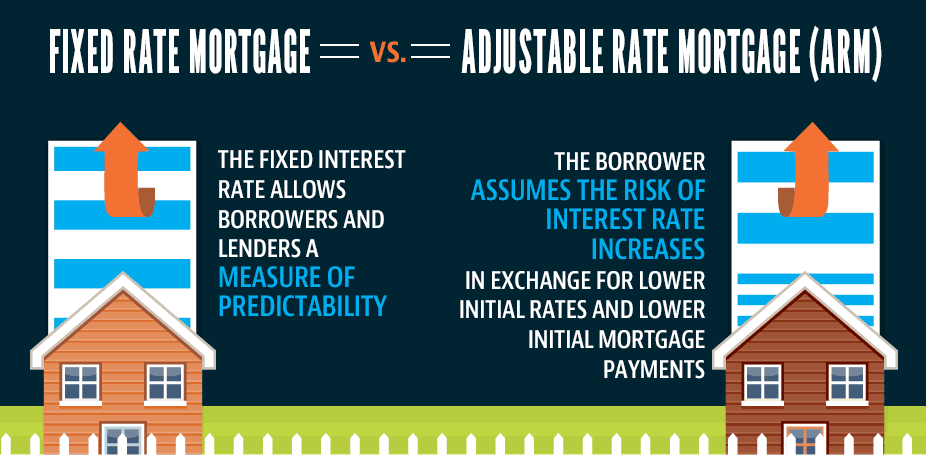

Decide if an arm may be worth the danger.

The lower initial rate of interest out-of a varying-rate financial, otherwise Arm, are appealing. If you find yourself a supply could be befitting specific individuals, someone else will discover the straight down initial interest wouldn’t clipped their monthly obligations to they think. To locate an idea of just how much possible really help save very first, was entering the Arm rate of interest to the home loan calculator, leaving the phrase due to the fact thirty years. Upcoming, examine those costs to the repayments you have made once you enter into the pace to own a normal 30-year fixed financial. Doing this will get show your own very first expectations concerning benefits associated with a supply — otherwise leave you a reality have a look at in the if the potential plusses off an arm extremely provide more benefits than the dangers.

Understand when to cure personal mortgage insurance policies.

You need the loan calculator to decide when you will have 20% collateral in your home. This is the magic count getting requesting you to a lender waive their personal home loan insurance demands. For many who put less than 20 percent down when you bought your house, you’ll want to shell out an extra monthly fee above of your typical homeloan payment to help you counterbalance the lender’s risk. Once you’ve 20 percent collateral, one to commission disappears, which means that more income on your own pocket. Just input the original quantity of the financial and time your signed, and then click „Reveal Amortization Schedule.“ Next, re-double your original home loan count because of the 0.8 and you will fulfill the cause this new nearest matter for the far-correct line of one’s amortization desk to find out when you are able to arrived at 20% equity.