The fresh security you prefer getting a property equity personal line of credit (HELOC) relies on the lending company additionally the particular financing terms.

A good HELOC loan lets consumers to use their property equity as security, such as a home security financing. A good HELOC performs much like a credit card – shortly after approved for the line of credit, you might use as much as the total amount readily available and use it to own any kind of mission you deem called for. Individuals have a tendency to fool around with a good HELOC when they you desire use of highest quantities of money to make renovations or even to pay-off obligations.

However, collateral standards is a little more nuanced than a very good commission as loan providers and additionally get other variables into consideration.

What things to learn about household guarantee having a good HELOC

- The borrowed funds-to-value proportion (LTV) is considered the most popular algorithm used by loan providers to choose collateral. This new LTV ratio was calculated from the separating the mortgage amount from the the property’s appraised worthy of.

- Discover an effective HELOC, you’ll need to use that have a loan provider as well as have your home appraised to evaluate value securely.

- Regardless of if Look for Lenders cannot render HELOCs, you happen to be eligible to acquire between $thirty five,000 to $300,000 that have property guarantee mortgage.

What’s home guarantee?

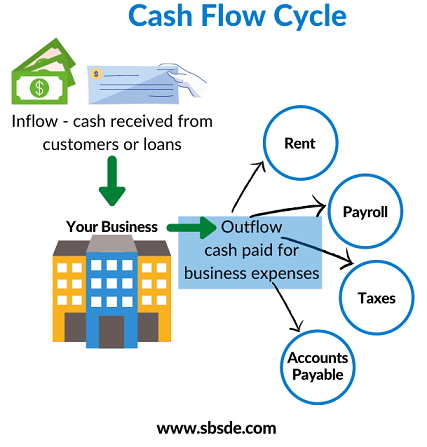

Household security is the difference in exactly what your house is well worth in the present markets and exactly how much your debt in your financial. And come up with mortgage payments and you can advantageous field standards is also grow your equity.

Therefore, since you pay off your own financial or help with their home, the worth grows, and so does your property guarantee.

Even though some individuals play with their home equity once the a form of coupons otherwise crisis money, of several capitalize on so it house if you take away a HELOC or household equity loan.

Exactly how much collateral create I wanted for good HELOC?

To find an effective HELOC, you’ll need to apply which have a loan provider and also have your home appraised to assess well worth securely. The lending company following spends a formula to determine how much cash equity you really have of your home. The preferred formula is the loan-to-really worth proportion (LTV).

The LTV ratio is the amount borrowed split by the property’s appraised well worth. Eg, when you yourself have an effective $100,000 mortgage along with your home is appraised in the $two hundred,000, their LTV ratio is 50%. Lenders generally agree HELOCs when your LTV ratio is about 80% otherwise shorter. So, making use of the analogy significantly more than, owing more than $160,000 on your own mortgage make it difficult so you can qualify for an effective HELOC.

However, all of the bank has actually additional requirements, making it usually far better check with multiple lenders before applying for a loan.

House security financing vs. HELOC

House collateral loans and you may HELOCs is one another an easy way to borrow on the worth of your property, however, there are many important differences between both. Having a house guarantee loan, your obtain a lump sum payment of money and then make repaired month-to-month money more than an appartment months.

HELOCs works in another way – you’re approved to possess a personal line of credit as possible mark for the as needed, up to a certain limitation. As a result you have to pay focus towards quantity of currency your pull from your borrowable limit, and you have a whole lot more flexibility when it comes to whenever and how you create payments.

Family security loans routinely have lower interest rates than other funding alternatives eg unsecured loans or playing cards, which makes them ideal for significant costs such as for example domestic fixes or home improvements. not, because they are covered by the household, defaulting on a property guarantee loan you could end up property foreclosure.

Just how to be eligible for property security mortgage or HELOC

Qualifying to possess a property security financing otherwise HELOC can seem to be overwhelming, it doesn’t have to be. By the understanding the maxims from how these types of loans functions, being aware what you will want to meet the requirements, and having enough security, you can start securing the funds you prefer for your forthcoming opportunity.

Credit score

Your credit score plays a vital role on your own qualifications having property collateral mortgage or HELOC. Generally, high fico scores make you a better threat of delivering approved.

Good credit can also help lessen the interest for the any mortgage you are taking away. When your credit history isn’t in which it should be, begin by checking your credit history to own errors and you may making certain your repayments was cutting edge.

Income

Lenders need to make sure you can afford the new payments related to the loan, so that they look at the full earnings or other supply such due to the fact investment, leasing assets earnings, and you will old-age finance.

Debt-to-money (DTI) ratio

DTI ratio identifies how much cash of one’s total money happens with the hop over to the website paying established loans every month (including your most recent financial). Lenders have a tendency to choose candidates which have straight down financial obligation-to-income percentages because may indicate that you’ll have less difficulties and work out costs on your own the latest financing including current debt. A good guideline is that if your debt-to-money ratio is higher than 43%, it may be tough to get acceptance from loan providers.

Such as for example, in case your complete monthly debts total up to $dos,000, however you make $3,000 monthly gross income, their DTI ratio would be 66% ($2,000 divided because of the $step three,000). This may set you vulnerable to being denied to possess a beneficial HELOC.

Loan-to-value proportion

Brand new LTV proportion considers the value of your home and you can measures up they having how much money you are inquiring to help you obtain regarding lender.

The low so it proportion was, the better your opportunity of going accepted because can show there is enough collateral offered is to anything go awry towards cost bundle. Loan providers typically believe programs that have LTV percentages up to 90%.