Express this short article

Property owners who have currently lent as much as the most repair lender loan limit from $31,000, or those who don’t want to take out a supplementary bank loan, is generally tempted to rather get an out in-family loan given by the interior build company they have engaged.

4 Restoration People with in-Household Financing

Although this may seem like a quick and you may convenient provider on the time, taking on particularly financing merely to done your own home improvements will get turn into an awful idea.

In-family renovation money away from design enterprises aren’t common, listed here are 4 renovation businesses that render within the-home restoration finance inside the Singapore:

Should i grab an in-house mortgage from renovation company?

Be mindful and prudent inside it pertains to getting any loan. To not ever move to fast, however,, while given a call at-household recovery loan from your indoor designer, do not bring it upwards unless you do not have most other option. Here is as to the reasons.

step one. In-mortgage loans is actually supported by subscribed moneylender

First and foremost, why don’t we have one issue straight. So you can legally provide cash in Singapore, entities need sign up for the right licences. This type of licences are just reserved having loan providers, such as for example finance companies, boat loan companies and you may authorized moneylenders.

As such, design providers is actually impractical to obtain the correct licensing so you can bring unsecured loans in addition to their repair qualities. And also for the rare pair that do, they are going to most likely advertise each other tracts regarding businesses since the hey, it’s yet another source of income, so why not?

In this case, just how can interior planning firms present a call at-household recovery financing? The best response is which they mate with good lender, one that is signed up so you can give unsecured loans to your societal.

It will be easy you to an internal structure organization may mate upwards which have a financial supply the repair loan packages so you’re able to subscribers but if you will find people online, i haven’t online payday loans Illinois been aware of all of them.

Yet not, it is more inclined that cluster offering the financing try an authorized moneylender. Considering how very aggressive the latest licensed moneylending industry is, you can consider moneylenders partnering with interior design businesses in an effort to reach a lot more potential customers.

dos. High interest levels

You’ll find nothing wrong along with your indoor developer giving that loan from a licensed moneylender by itself, as long as the moneylender is actually securely signed up and also in a great reputation, you can be certain away from a specialist and above-panel experience.

The problem is the interest rate recharged because of the licensed moneylenders is much more than men and women energized from the banking institutions and you will finance companies occasionally, with ease outstripping their mastercard interest rates!

You need to know you to subscribed moneylenders are allowed to fees focus of up to 4% monthly as compared to financial renovation money that go getting between step 3.2% to 4.55% yearly.

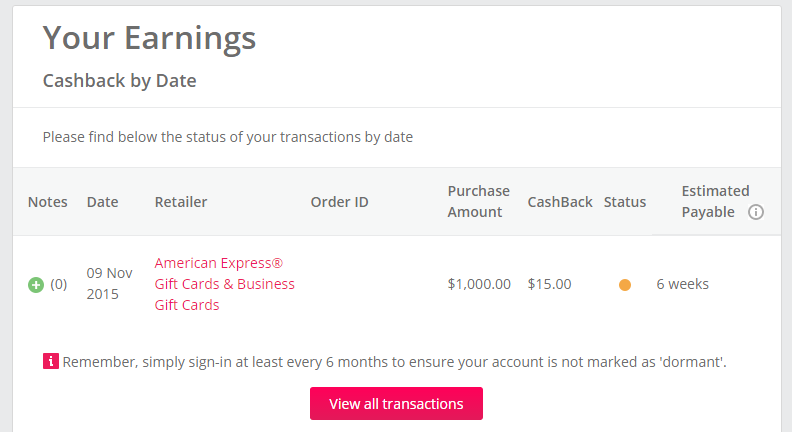

Is an easy evaluation between a licensed moneylender financing and you will an effective bank repair loan, utilising the respective providers‘ on the internet hand calculators.

Interior Designer In the-Home Renovation Loan

It really should not be stunning, given how well-supported the marketplace try, with a lot of financial and boat finance companies giving competitively valued repair fund here.

Apply for Repair Loan inside the Singapore

Irrespective of where you are taking the recovery loan away from – financial, licensed moneylender, otherwise your own recovery organization – you need to look out for the following when considering a repair loan offer.

step one. Rate of interest

Due to the fact we have depicted over, the speed toward a restoration financing (or any sort of borrowing from the bank, for that matter) ‚s the single the very first thing.

Financing with a high interest is more tough to pay off, plus a performance that’s only quite higher is also convert in order to a significant difference in the buck words.

2. Financing tenure

Mortgage period essentially refers to the date you need to pay back the loan. Banking companies generally leave you step one to 5 years for you to pay the renovation mortgage. This enables that spread the debt out, causing straight down monthly repayments which can be better to do.

Although not, note that the brand new expanded you are taking to pay back, the greater monthly attract you will have to spend overall. But not, it is advisable to decide a lengthier period whilst to not ever overburden yourself.

Of numerous authorized moneylenders was unwilling to offer that loan period expanded than just 12 months, which means your restoration loan monthly payments will be very high possibly even larger than you could potentially easily manage.

Today, if you feel that the latest monthly obligations for the repair mortgage is too highest, never grab that recovery mortgage, as you are in danger away from shedding toward a loans pitfall, rather than-stop punishment charge.

My interior designer provided me an in-domestic recovery mortgage. How to handle it?

Towards the unusual options your indoor developer offers a call at-home renovation loan, make sure you cautiously studies new small print of one’s financing, particularly the rate of interest and mortgage course.

When your bank try good moneylender, you may check the Ministry regarding Law’s certified list of signed up moneylenders. Make certain the latest moneylender is not suspended otherwise blacklisted.

If you find yourself getting advised the in the-household financing exists from the a financial, don’t just bring your interior designer’s word for it. Separately discuss with the financial institution in question, and make sure the interest rate, period, costs and you will costs, and other conditions and terms are the same.

However, instance i told you, in-domestic renovation finance are not quite common during the Singapore, so your chances of experiencing one is likely to be reduced.