No matter if owning a home is where the majority of people build guarantee and build money, the current state need specific mindful consider.

From the Provided price hikes of the past couple of months which have seen average 30-year home loan rates of interest change from around step 3% annually to the current eight.5% per year, few some one want to sign up for mortgage financial support. In addition to, current people that would have planned to sell and you may disperse someplace else is actually dissuaded of doing this as they prefer to keep their 3% locked-in rates on their thirty-12 months mortgages, than create the higher of those. And that there is certainly almost no way today.

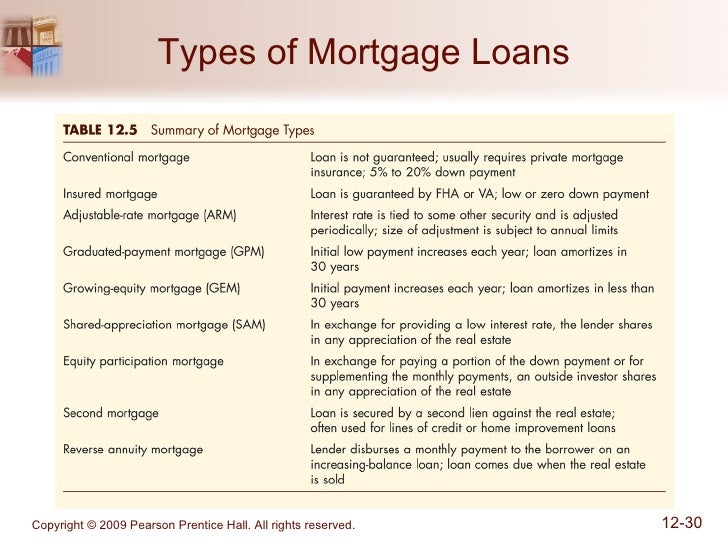

To thrive and you may create organization, certain builders have to give balloon-sort of mortgages and you may step 1% advance payment mortgage loans. Just like the a real house investor, before anything else particular when you look at the-depth information about these choices.

Into the balloon-particular mortgage loans, a buyer may have a highly lower payment per month program for a couple of age, but then needs to pay an enormous lump sum then sophistication period features elapsed. The problem is whether your customer enjoyed the fresh sophistication months however, doesn’t genuinely have the fresh new punishment to save right up to your swelling contribution percentage. Following you to definitely closes defectively due to the fact a foreclosure.

As previously mentioned, the fresh new step 1% down payment financial only needs a 1% downpayment. Then developer otherwise provider adds an additional dos% to obtain the full advance payment to step three%. Seems like much, but in facts, it’s still best to save yourself to own a higher down payment in the event that sensed out-of an extended-title perspective.

No matter if home ownership is how many people build security and generate riches, the modern disease needs some careful consider. They are both not even optimal selection. Always, the most suitable choice to possess a potential buyer remains to save if you’re able to getting a bigger downpayment therefore, the mortgage bit try smaller. Remember that, no matter if few customers does it, the least expensive treatment for get a home is always to negotiate which have the seller when you have the cash. The higher the borrowed funds matter, additionally the large the speed, more a buyer turns out investing.

Most of us obtained private deals inside pandemic out-of government cash presents regarding the CARES Operate plus the undeniable fact that we primarily only existed at your home and you will did not have much to invest with the. You to definitely private coupons has been exhausted even as we made an effort to normalize our lives and have now already been replaced by the enhanced loans using, a great amount of they to your handmade cards. Credit card debt provides ballooned to around an effective trillion cash. Enhance the undeniable fact that anyone who has student loans often resume money into the . For a number of united states, trying out an excellent seven.5% home loan right now in such a case isnt a beneficial approach.

Home Individual: The latest Cons off Balloon and you may 1% Down-payment Mortgages

Along with, look at the simple fact that average home values in a number of components (not absolutely all) was in fact . Keep in mind that mediocre does not mean that family are sensed often decrease in rates. It setting towards a nationwide average, there can be a small decline. Therefore if a purchaser performs an enormous mortgage to have a great home towards large desire whose price is losing worth, chances are they try taking a loss.

An individual purchases a house, they’ll be accountable for the assets fees, insurance, and you may house repairs. When you are renting try strictly a price, simple fact is that landlord whom handles many of these can cost you. And additionally when the home loan speed is high, enough their repayments actually just get into servicing those individuals focus payments and never the primary mortgage for the household. Both the best way to pick a property would be to book first, rescue whenever you can to own a down payment, when the eye rates look better and you will a purchaser provides discover our home they actually such, that’s when you should pounce.

Exactly what a purchaser needs doing was sit having a monetary adviser otherwise play with a professional mortgage calculator to work away how much cash for each and every solution will cost. For each and every consumer must work out how much they can comfortably be able to spend for home loan repayments each month.

A great percentage to aim to own is just about 29% of the loans-to-money ratio. That means that in the event that a purchaser will pay 29% of their bring-home income because of their financial, the remaining 70% will go toward other bills and you may discretionary using. One thing higher than 29% will get as well tiring for many individuals and you will advances the odds of foreclosure and you may damage to your credit rating.

Simultaneously, teenagers who have a jobs tend to become paying a good parcel for the affairs they don’t really you prefer otherwise use. Its expenses either is really just so they can. When it comes to those times, if they can gather the new punishment, capable conserve to possess a big down-payment, following attempt to pay back the borrowed funds as quickly as possible. That way, they will not waste the new fruits of their work towards the inadequate commands. As an alternative, they may be able rescue and construct riches by buying a household very early.

Owning a home is still one of the best ways for we to grow guarantee and create wide range. Although not, both an informed path to wade someplace isn’t the straight you to. Both renting basic and you will rescuing for that large equity deposit if you’re waiting around for straight down financial prices is the better solution. That is if the folks have the new abuse to store to own an effective down payment and never splurge they somewhere else.

Note that no person can assume the near future and you will state which have confidence you to mortgage rates is certainly going highest or all the way down next season, or the season just after. But it’s however a far greater choice to make an effort to save your self toward greatest downpayment you could muster while starting one to instead out of instantly signing as opposed to cautious believed to those people balloon and you can step one% financial price arrangements.

Every piece of information considering listed https://paydayloanalabama.com/satsuma/ here is not funding, income tax, otherwise financial suggestions. You ought to talk to an authorized elite group to own guidance concerning your particular disease.