Given that assets thinking are absurdly exorbitant where I real time, I’ve a lot of household equity right now, about through to the bubble grandfather.

I have been saving upwards for many expensive domestic ideas, especially rewiring. Create We feel smartest to simply get a HELOC today and obtain the works done, otherwise ought i keep placing pieces of cash in savings and you can thought long lasting?

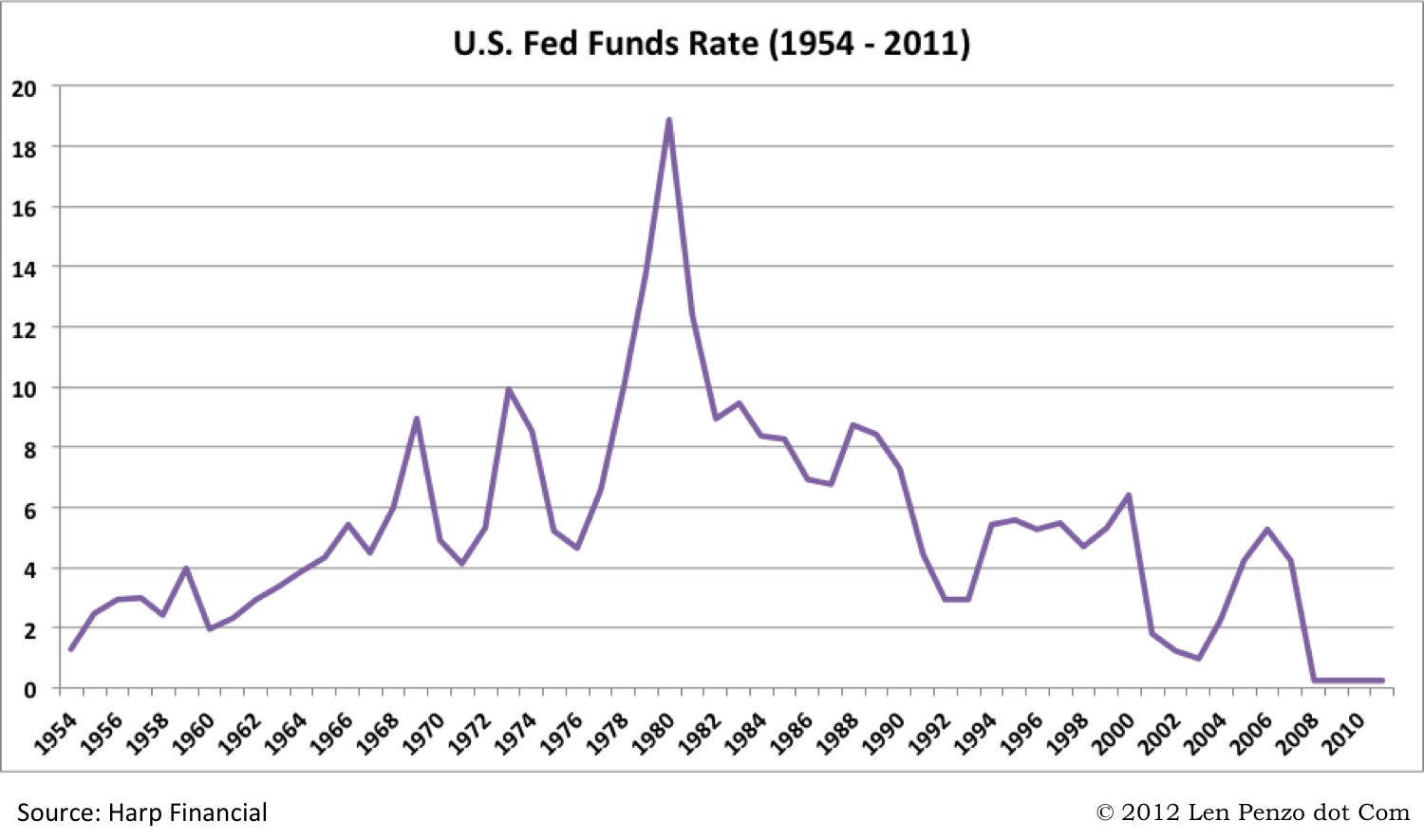

Despite expert credit, the fresh HELOC pricing cited for me was indeed fairly high*

You will find good credit but absolutely nothing experience with just how to power my guarantee, thus go ahead and keep in touch with me such I’m dumb. Thank you so much!

The brand new downside to a great HELOC is the fact you might be paying interest to the the cash you acquire. But it is nevertheless less expensive than for those who energized the balance towards the credit cards (unless you could possibly get a separate card with a no-attention introductory rates, and will repay it before rates develops.) For people who save up, you can easily shell out no notice.

Or even, you could potentially hop out the newest personal line of credit unlock and rehearse given that requisite

Here’s how I’d consider it – how much commonly the project pricing? – how much most (focus and fees) do you shell out if you use the fresh new HELOC? – how long does it take to save that much on your individual? – what can become monthly installments to the HELOC? exactly how convinced will you be you could conveniently manage to generate the individuals repayments for the whole period of the mortgage? – what’s the price of waiting? could there be a protective risk from inside the wishing? precisely what does it replace your well being getting they over sooner or later? – what exactly is your financial back-up seem like? for people who urgently you would like money for another costs (say a tree failure in your rooftop and you ought to replace it urgently) are you experiencing other sources of finance? (this is often enhancing the number of the fresh HELOC)

I think once you learn the solution to all those inquiries it was clear what you want to do. published by the metahawk at Am towards the Oct dos [six favorites]

Not your financial coach. but I’m on the think amount to possess a property enterprise and checked HELOC choice. Since my existing financial harmony are very low (rather than sub 3% rate), it made a lot more experience in my situation to obtain another type of first financial. I will have the bucks beforehand in place of pulled as needed, however, I’m able to get a significant rate putting it from inside the T-expenses or high-produce FDIC family savings for the next six-9 months. The new math mathed ideal for me in that way rather than staying my personal low LTV home loan and you can adding an excellent HELOC.

Key to this is actually remaining new financial less than 80% LTV. If you need to borrow secured on the remainder 20% of your own home’s really worth, that’s another type of tale.

*The us government backed entities (Fannie, Freddie, etc) will be the most affordable cash loan payday solution to availability investment to have housing. even so they cannot perform HELOCs (even when Freddie have advised giving next mortgage loans). Thus you will be outside the very prices-advantaged pond regarding capital having an effective HELOC. released from the mullacc at Have always been with the October 2

Probably, your home is your own largest asset. Today for many who own someplace in which home prices are skyrocketing, HELOC was reducing your asset well worth. I have produced more funds on around three houses You will find lived-in, and you may purchased, than simply We actually did out of my personal work. Okay, a little bit of an exaggeration.

I supply a brilliant low-value interest, very refinancing is going to charge you particular products In my opinion. Men and women situations is bad, negative VPs