The most significant difference is the fact using this type of solution, your merge your current mortgage and you will collateral loan for the a single consolidated financing. An earnings-away refinance will be a simple and simpler solution to loans renovations, specifically if you had been already provided refinancing your home.

Going for a profit-away re-finance try an exceptionally great option whenever home loan rates try lowest. The reason being they allows you to refinance your home during the a reduced price whilst acquiring finance to own a renovation. But not, whenever interest rates is actually high, a finances-away re-finance can significantly improve month-to-month mortgage payment.

Choice step three: Recovery Mortgage

In place of an equity mortgage otherwise refinance, a restoration loan allows you to borrow money in line with the property value this new increased domestic. Thus, repair money are a good selection for people who haven’t yet mainly based up adequate guarantee so that you can cover the cost of brand new renovations. There are two head kind of renovation financing: government and private.

Federally supported renovation loans, including the Sallie Mae HomeStyle Mortgage, provides smaller deposit criteria, however, include a great deal more rules and you will hoops to dive due to. Concurrently, private financing tend to have higher advance payment requirements than simply federal funds, but promote an even more flexible and you can customized funding feel.

Step four: Get Prequalified

Once you’ve chose mortgage to invest in your house advancements, you may then need to get pre-accredited. Prequalification is actually a cards imagine that displays lenders simply how much money you could potentially properly secure. They functions as verification that you are economically in a position to fund the renovate.

Employment Records

Taking detailed a position and you will earnings background shows economic balances and repayment potential. This permits lenders to assess your qualification and discover new financing amount your be eligible for.

Typically, you need to offer paystubs during the last at least a couple of years that show a constant money. The lending company may get hold personal loans Pennsylvania of your companies to ensure all the information your give.

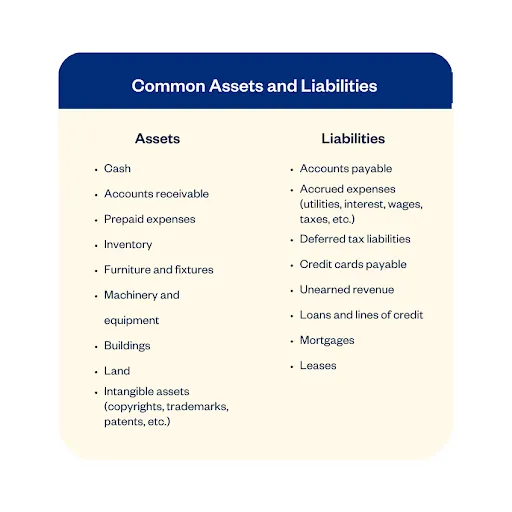

Assets, Bills, & Expenses

The lending company tend to generally request you to express financial suggestions, and additionally assets, bills, and you may expenditures. Pointers such as this lets lenders a thorough look at your financial condition, permitting them to look at your debt-to-income proportion and you will legal capability to manage financing financial obligation.

Credit assessment

A credit score assessment analyzes creditworthiness due to examining your payment records, borrowing from the bank utilization, and you can credit rating. They influences financing terminology and you can rates of interest. This is why delivering particular borrowing from the bank information is crucial for delivering an informed prequalification terms and conditions you’ll.

Step 5: Framework Your home Advancements

Both you and your framework group often come together to grow a flat away from structure preparations for the restoration enterprise. Since your activities get shape, you get while making specific conclusion for the concept, materials, and appearance of the renovation.

All the restoration business handles the shape process a small differently. No matter what and therefore builder your hire, it is important which they get a working character in common the new venture from exceeding the fresh new budget details created prior to now along the way.

Regarding the framework techniques, a great builder tend to constantly change and you can track estimated costs for the fresh new home improvements. In that way, your run a reduced amount of a risk of getting to the conclusion of your build techniques and having a final pricing one much exceeds the accepted lending matter.

Step 6: Undertake Rates

Since the form plans are over, the create team have a tendency to assess the complete price of the project. If you are using a firm instance Lamont Bros. using a predetermined-cost contract, you can easily lock in your own rates after you signal the fresh new contract.

This implies that you’ve got a definite comprehension of the project’s monetary issue and that means you do not run into one shocks or exceed their acknowledged lending amount. Instead of contractually confirming your own structure will set you back at the start, it could be much harder in order to safer financial support.