Do my personal financial features a diminished speed than I could rating? The key signal away from refinancing is to find less rates. If you can’t safer a diminished price or perhaps matches current price in your first mortgage, combining might be a bad disperse. Refinancing to another interest rate will simply enhance your attract charges.

Tend to my refinanced financial need PMI? PMI was an additional cost with the traditional loans should your LTV ratio is higher than 80%. It indicates you don’t have adequate guarantee to re-finance and you may combine your financial. To compensate because of it deficiency, loan providers costs PMI. You need to stop that it extra cost. Hold off a couple of way more months if you do not provides the lowest adequate LTV to guide free from PMI.

The bottom line is

Refinancing are a procedure that makes you restructure their new home loan and you may replace it with a very positive price and you can title. It’s basically taking out fully yet another home loan which will help raise your discounts. As well as rate and label refinances, you might also need an earnings-aside alternative and this lets you borrow on your house equity if you’re changing your home loan. The difference between their remaining mortgage equilibrium and your the newest loan ‚s the number you obtain from the lender.

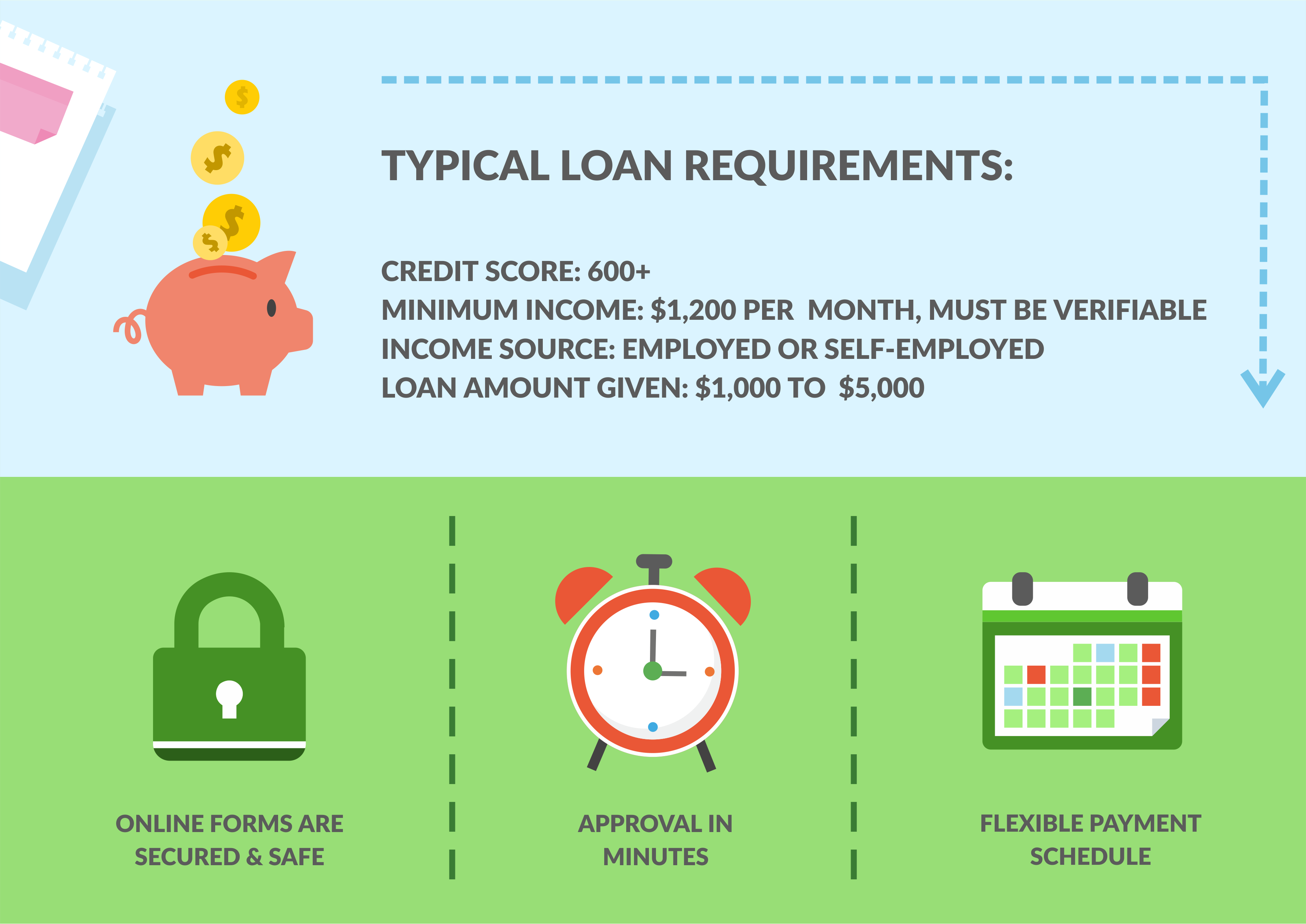

To get qualified to receive refinancing, individuals must have a credit rating with a minimum of 620. But not, increased credit history is recommended so you’re able to secure a lower speed. You really need to if at all possible keeps a keen LTV proportion regarding 80% otherwise lower than to get rid of individual mortgage insurance coverage after you re-finance. Furthermore, it entails expensive closing costs, which is doing 3% to 6% of your loan amount. Since the refinancing is a costly proposal, it should simply be complete whenever you can receive a considerably straight down price just in case you wish to will still be long-title in your home.

Besides dollars-away refinancing, you’ll be able to tap house security compliment of the next home loan such as for example just like the a HELOC or house equity financing. HELOCs started while the an effective revolving personal line of credit that gives your access to dollars to a prescription limitation. In addition it boasts a changeable rate, which means that your monthly payment increases if the sector rates go up. You only need to pay interest on matter your debt. At the same time, home equity financing are provided once the a single-date lump sum payment dollars, that is ideal if you’d like a quantity. Referring having a fixed-rate construction, so your costs dont changes. When taking the next financial, you will be making another payment to your basic financial plus next lender.

For those who get a moment home loan, there is the solution to merge the first and second home loan. This really is named mortgage combination refinancing. When you favor this package, you have to make certain to safer a speeds which is below your first or second mortgage. Lenders in addition to allow you to combine their mortgage when you yourself payday loan Hidden Lake have not provided HELOC distributions for around one year. Do not combine your mortgage in the event it might possibly be paid-in a decade otherwise less. Performing this tend to stretch their mortgage and then leave you which have high desire costs.

In conclusion, refinancing is a possible method that will decrease your mortgage’s attract can cost you. Whenever done correctly, it will optimize your deals that assist pay their home loan prior to.

You will find hitched which have Mortgage Lookup Heart to assist homebuyers and you can refinancers uncover what financing applications he’s entitled to and you may link all of them with regional loan providers offering aggressive interest levels.

Yet not, note that getting a profit-out refi increases their the equilibrium. What’s more, it provides financing limitations, this is exactly why need high family equity before taking such loan. For more information on cash-away refinancing, visit the guide toward cash out refi calculator.

Budget for Closing costs

Prepayment punishment is a charge energized because of the loan providers in order to impede individuals away from promoting, refinancing, and you can paying its home loan very early. Its an expensive fee which is doing step one% to help you dos% of the loan amount. Prepayment penalty typically lasts for the initial 3 years off a mortgage. To avoid which costly rates, you could potentially re-finance following penalty months is finished. By the period, you have a lowered LTV ratio in order to be eligible for refinancing.

Although not, Arms end up being high-risk when sector pricing continue broadening the modifications several months. This may make your monthly installments expensive. If you cannot remain and also make money, you could clean out your residence to help you property foreclosure. To quit which exposure, of several Sleeve consumers eventually re-finance with the a predetermined-speed loan. New predictable costs also are simpler on your own monthly finances. Possession are also utilized by homeowners whom propose to move around in a couple of years. It promote their house up until the interest increases to cease high money.

One minute financial was a loan you take aside up against a beneficial family one to currently has a home loan. Make use of the newest guarantee of your house just like the equity so you’re able to obtain currency. When taking the second home loan, your own financial requires a beneficial lien facing a percentage of your house that you’ve paid down.

While doing so, domestic collateral loans is prepared with fixed mortgage costs. That it guarantees you can easily improve same monthly prominent and you may notice payments throughout the mortgage. Referring in various terminology, together with 5, fifteen, and you will 3 decades terminology. Although market prices improve, you need not love pricey money. Possible pay off your loan from inside the agreed identity.

Secure a lower Interest rate

Often my personal home loan be distributed of soon? It generally does not add up to help you consolidate the mortgage for individuals who simply have ten years or smaller on your identity. This will unreasonably offer your own financial. If you find yourself you will have all the way down monthly installments, you will end up with a lot higher interest charge.