American Share keeps hitched which have rival digital loan providers to test out just how the cardholders answer financial now offers. Spencer Platt/Getty Photos

- Credit-cards monster Western Share is actually testing out financial proposes to discover cardholders.

- The business have hitched that have a few enterprises, Quicken Loans and higher, to offer $dos,500 so you’re able to consumers whom refinance or take aside yet another home loan.

- It’s not yet , clear whether the quick-scale rollout can lead to a bigger work that have either partner to own Amex, that is recognized for the high-stop credit-credit products that include rich rewards and you can concierge functions, also hefty annual charges.

- Click on this link to get more BI Prime tales.

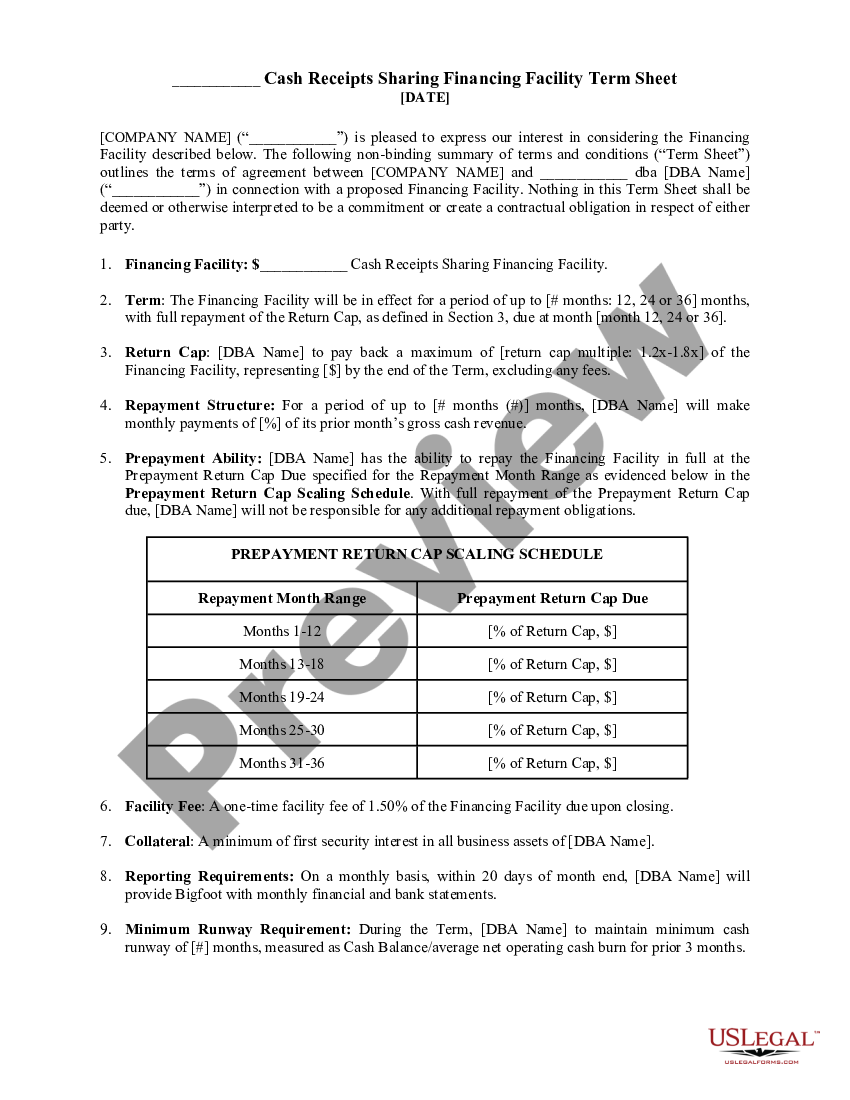

American Display is on the side concentrating on come across cardholders that have house-loan also provides away from mortgage rivals Quicken and better

The credit-cards monster are handling Quicken Money and better to a target find credit customers which have offers to re-finance and take out a financial – the first occasion the company has actually launched an effort about All of us as much as individual household financing inside previous memory.

Almost every other card people made concerted perform nowadays so you’re able to take advantage of brand new huge All of us consumer household-loan world – which really stands during the $9.4 trillion inside the an excellent obligations – having combined overall performance. Amex has actually largely steered free of home lending options given that very early 2000s.

But in previous weeks, Amex keeps on the side started testing exactly how their users answer financial also offers linked with their playing cards.

People already been showing up inside the community forums instance Reddit the other day reporting has the benefit of to have a beneficial $2,five-hundred report credit away from Amex whenever they bought a mortgage otherwise refinanced a preexisting one to.

Specific consumers have been directed having also offers associated with Quicken, which has evolved into the greatest non-financial bank after starting their Skyrocket Home loan electronic offering from inside the 2016, if you’re most other now offers featured Most useful, a quickly broadening digital lending business having attracted over $2 hundred billion into the capital out-of backers – plus American Display Options.

Western Display spokeswoman Age Crosta verified the fresh new rollout of render so you’re able to Team Insider, and you will told you it absolutely was the business’s first promote so you’re able to cardholders involving mortgage loans.

It’s a tiny effort, but it may lead to one thing larger

It isn’t yet , obvious if the bake-out-of will result in a bigger energy or loyal service that have either lover having Amex, that’s recognized for their higher-avoid borrowing-card products that are included with rich perks and concierge loans Upper Witter Gulch characteristics, also hefty yearly costs.

Very first testing out the loan now offers in short batches which have several some other companies can give Amex a windows on buyers passions and tastes, Crosta told you.

„We believe they both provides compelling however, various other products,“ Crosta said off Quicken and better, adding that they was basically keen on the brand new electronic-very first opportunities each and every business.

„We have been very happy to be handling Western Share to bring yet another, light glove, digital-first mortgage sense on their card participants,“ Vishal Garg, Better’s originator and you may Ceo, said when you look at the a contact in order to Company Insider.

„All of our union with American Show is a perfect complement. Exactly as American Show set the newest pub to own card people, Rocket Mortgage will continue to increase the club to own lenders,“ Michelle Damanskas, divisional vice president of company innovation during the Quicken Financing, said in the a contact to help you Business Insider.

It’s a tiny airplane pilot initiative, nonetheless it nevertheless signals a cravings to help you take advantage of the more than $1 trillion in home financing People in america remove on a yearly basis.

When you are Amex will never be actually lending having mortgages, partnering which have a friends you to definitely currently possess a high-airline electronic program manage probably make it Amex to advance strengthen their concierge qualities so you’re able to users.

JPMorgan Pursue, home to among the many nation’s premier mortgage operations also while the a chief opponent so you’re able to Amex throughout the credit-card company, has already established achievement appealing the credit users with household-loan now offers.

During the 2017, Chase tested away providing people of their spectacularly popular Sapphire Set aside cards around 100,000-reward points, worth doing $step 1,five hundred, to get home financing. It absolutely was a hit, plus the financial restored it when you look at the 2018, having lower perks bonuses, and you may longer it to any or all cardholders.

Amex’s airplane pilot bring was richer than Chase’s. However, often new response build adequate love to validate a long-term provider so you’re able to its cards participants?