What exactly is Apr (APR)?

Apr (APR) refers to the yearly attract generated by an amount that’s charged in order to consumers otherwise paid back to dealers. Annual percentage rate was shown since a share that represents the true yearly cost of loans along the name of a loan otherwise money generated into the an investment. This includes people charges otherwise even more costs associated with the order but will not simply take compounding under consideration. The new Annual percentage rate will bring customers that have a bum-range matter capable compare among loan providers, credit cards, otherwise resource situations.

Secret Takeaways

- An apr (APR) is the yearly rate energized for a loan otherwise made because of the a financial investment and has notice and costs.

- Creditors need to reveal a monetary instrument’s Apr before every agreement are signed.

- The newest Apr will bring an everyday reason behind presenting yearly interest information to manage people out of mistaken ads.

- An apr may not echo the genuine cost of borrowing from the bank once the loan https://paydayloancolorado.net/twin-lakes/ providers provides a fair quantity of freedom when you look at the calculating they, leaving out certain costs.

- Apr must not be confused with APY (yearly fee produce), a computation that takes brand new compounding interesting into consideration.

How Apr (APR) Functions

An apr was expressed since an interest rate. It calculates what portion of the primary you can pay each year if you take things such as monthly payments and costs into account. Annual percentage rate is also brand new yearly rate of interest paid down with the investment rather than bookkeeping to the compounding of interest within this one to 12 months.

The actual situation within the Credit Act (TILA) out-of 1968 mandates one to loan providers disclose the fresh new Annual percentage rate they costs in order to individuals. Credit card companies can promote interest rates into an excellent monthly basis, but they need certainly to certainly declaration new Annual percentage rate so you can consumers in advance of they signal a contract.

Credit card issuers increases your own interest rate for brand new instructions, yet not current stability if they provide you with forty-five days‘ find earliest.

How Is Apr Computed?

Apr is calculated because of the multiplying the brand new unexpected interest because of the quantity of attacks during the a year where it actually was used. It will not suggest how often the pace is actually placed on the balance.

Brand of APRs

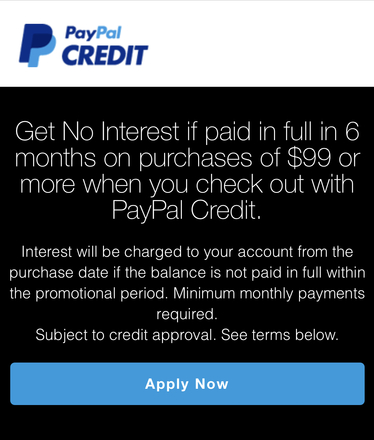

Bank card APRs will vary based on the particular fees. The financing card company can charge you to Annual percentage rate to have sales, an alternative for cash enhances, yet a different sort of getting balance transfers out-of another card. Issuers and costs high-price penalty APRs to customers to own late money otherwise violating other terms of new cardholder agreement. There’s also new basic Apr-a minimal otherwise 0% rate-with which of a lot creditors you will need to bring in new clients to sign up for a cards.

Loans from banks basically feature possibly repaired otherwise changeable APRs. A predetermined Annual percentage rate financing has an interest price which is protected not to ever change inside lifetime of the mortgage or borrowing business. A variable Annual percentage rate financing is interested rates that will changes any moment.

The newest Annual percentage rate consumers was energized together with depends on their borrowing from the bank. The rates available to those with advanced level credit was somewhat lower than those offered to those with poor credit.

Material Attract or Effortless Notice?

Apr doesn’t take into account the compounding of great interest in this a particular 12 months: It is centered just towards the effortless attention.

Apr against. Annual Commission Produce (APY)

No matter if an annual percentage rate merely makes up easy interest, the annual commission give (APY) requires compound attract into consideration. This is why, a loan’s APY exceeds the Annual percentage rate. The better the pace-and a lower the amount, the smaller the compounding episodes-the greater amount of the essential difference between the new Annual percentage rate and you can APY.