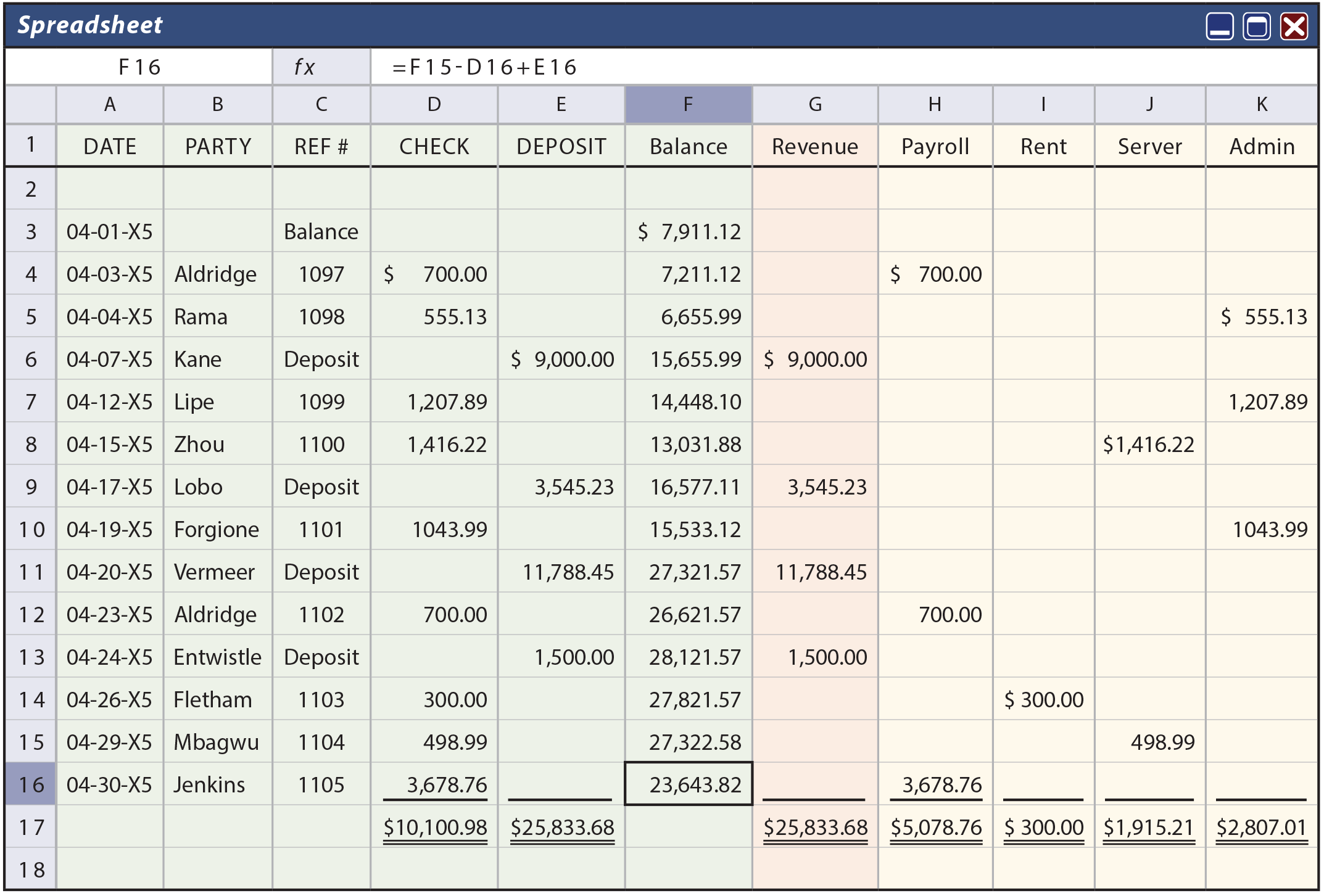

Just how performed the first Family Saver Membership functions?

Since 1 July this current year, the first Household Saver Account (FHSA) has stopped being open to upbeat basic home buyers.

The new account considering savers having tax vacation trips and you will co-contributions throughout the regulators. It seemed pretty good however, by the time it absolutely was scrapped, discover merely around 47,000 active accounts, according to prices about Australian Prudential Regulation Expert (APRA).

The new strategy was badly constructed and the threat of getting the put money ending up in the extremely funds wasn’t obtained better of the majority of folks!

If you were an account proprietor or you was indeed going to subscribe to the original House Saver Membership, discover what this means to you and ways to cut home financing deposit since the fresh new FHSA is not any more.

- You’ve lodged a taxation come back or you’ve lodged an FHSA alerts regarding qualifications function if you don’t have to hotel a tax return.

- Your bank account seller keeps lodged a task report into Australian Income tax Place of work (ATO) by the .

If the membership was closed, you might done a federal government contribution appeal nomination setting which you find into ATO website.