Thus, brand new awkwardness: new money box had regarding the $100,000 in it

Right here I shall recognize specific residual middle-class guilt to own talking straightforwardly from the profit, but I believe it is beneficial https://speedycashloan.net/personal-loans-ky/ to understand for that it tale and also for the large problem of knowing the bank system.

(The brand new banking system must, however, apparently process transactions which can be larger than various comfort levels. The class norm of not these are currency silos every piece of information throughout the people deals, on hindrance regarding one another class people and greater personal. It has been replete into the conversations of the financial drama. Many commentators perform during the mock horror so you’re able to talks out-of account which have over brand new FDIC insurance policies restriction inside, because if one did not were every team with well over 10 team in the nation.)

This seemed like a great dicey matter getting an open-concluded commitment having functionally no money when you’re support several property when you look at the high-pricing locations.

Today I will features received innovative from inside the resource personal expenses, but I prominent investing the majority of my personal go out to the VaccinateCA. Thus i got a brief negotiation that have Earliest Republic, where I inquired to possess (and you can got) good $100,000 line of credit “for cash management objectives.” My recall is that so it took lower than couple of hours complete, including for you personally to write the mortgage software.

I happened to be maybe not raised getting enthusiastic out-of personal debt, but inking one to credit hook is actually a huge save for my situation

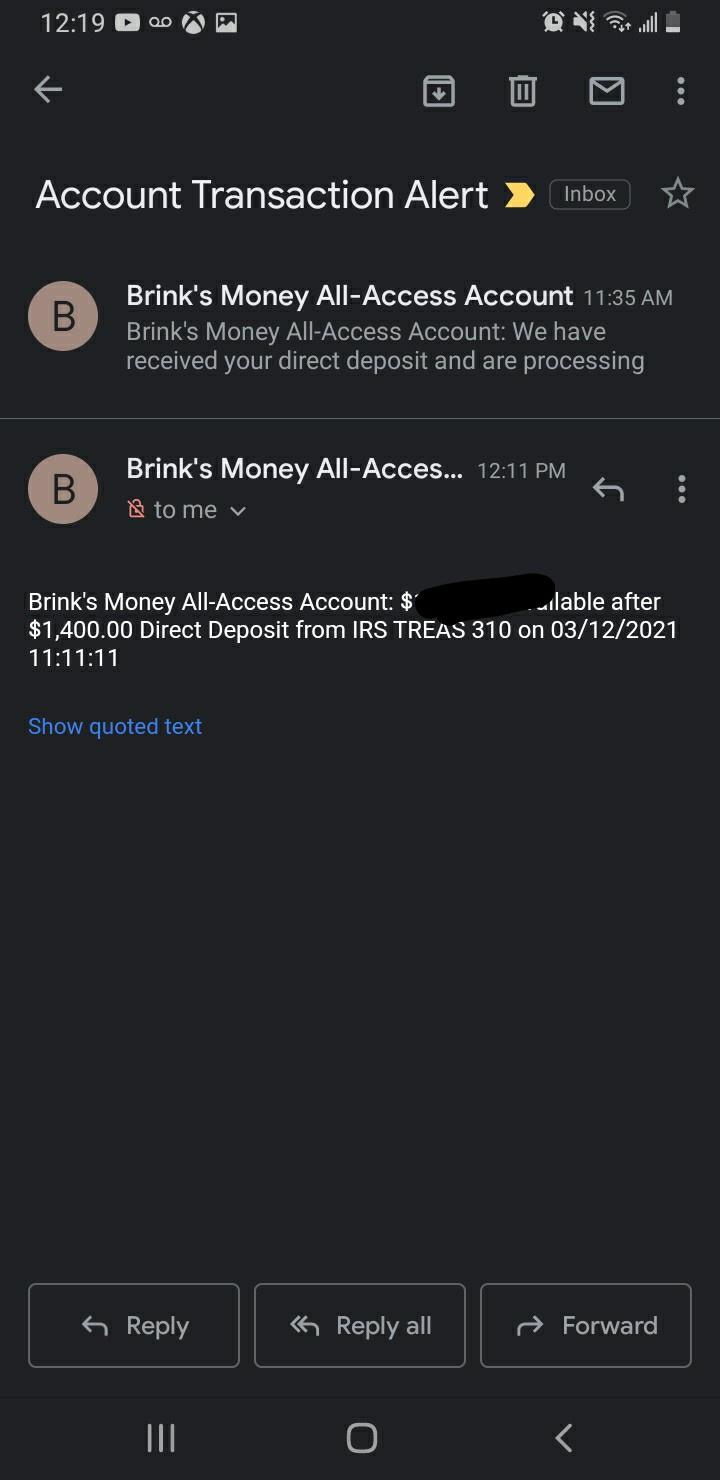

I sooner or later received it all. (And also make a long tale small: the charity increased off multiple technical world funders, appear to having a hefty lag between verbal connection and you can bill out-of the brand new cord. We had been functioning within an excellent cadence a lot faster than extremely funders.