Other sorts of household recovery otherwise fix funds

It is important to note that if you’re an enthusiastic unsecured personal bank loan does not incorporate the possibility of foreclosure on your own domestic (the latest collateral) if not spend your own mortgage payments, unsecured loan providers have most other legal remedies to pursue repayment of a great defaulted personal bank loan. Those people judge treatments you could end up judgments otherwise liens towards good assets, which will next decrease selling or refinancing.

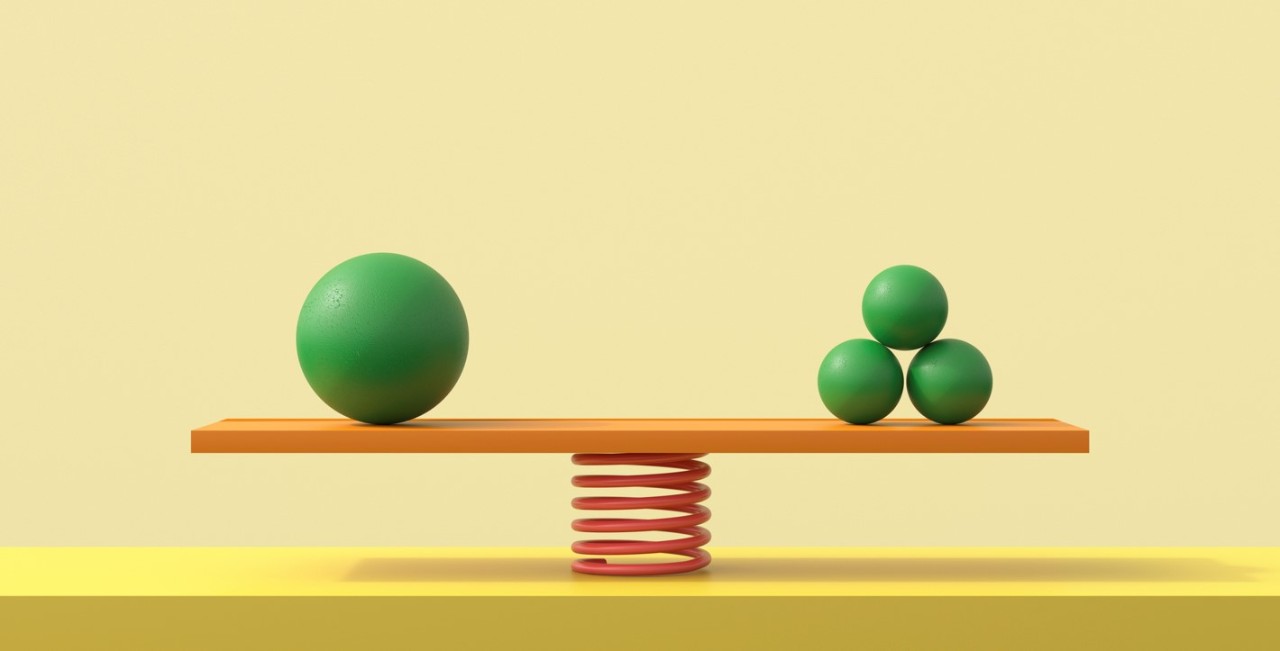

Other prominent alternatives for financial support a house renovation enterprise are situated towards equity a resident provides. Equity is the worth of property without what’s owed into the financial. Like, in case your house is valued at the $300,000 while nevertheless owe the mortgage financial $two hundred,000, you may have $100,000 when you look at the security. Security develops once the home loan was repaid of course, if the property well worth increases, particularly whenever a house inventory is lower as there are a beneficial seller’s housing industry.

Home guarantee fund, including TD Bank’s, try secured loans that allow residents borrow on their residence security. Lenders phone call this type of second mortgages, and additionally they take on this new security as security. Another option predicated on security, the home guarantee line of credit (HELOC), is much like a credit card account. Brand new TD HELOC, a secured financing, brings an effective revolving credit line, like credit cards, and will be studied for many different plans.

It is very important take into account the pros and cons regarding personal loans compared to. home security fund and you will personal lines of credit because you bundle your own do-it-yourself venture.

Do it yourself loan pricing and you can costs

Banking companies, borrowing from the bank unions, on the web loan providers or any other financial institutions can charge origination charges, appraisal costs, or other settlement costs to have home equity fund and HELOCs.