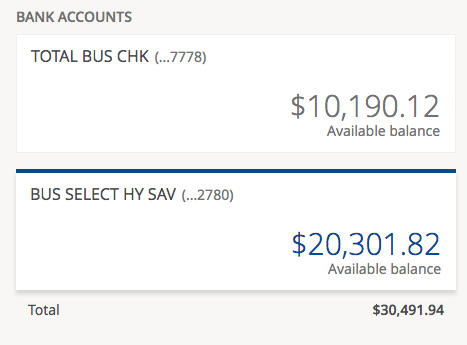

Need help With Insurance coverage or Providers Capital?

Whether you need guidance navigating financing to suit your home business – for example SBA fund, has, or any other investment solutions, otherwise guidance having bodies-related services – instance TSA PreCheck otherwise DMV appointments, our company is happy to help

Do you want let finding a business insurance company or taking capital for your needs? We are able to help you with SBA funds, offers, or other business money solutions. Get lingering custom help from we. Signup Skip Superior now while having step 1-1 support for your business.

Homeowners insurance Suggestions

For those who individual a home otherwise condominium, you should insure your residence and household effects of the committing to homeowners insurance. You tend to already have insurance rates on your own family, if you have home financing towards the possessions, because most lenders build insurance policies an ailment of your own loan.

Home insurance offers the really complete coverage available. Yet not, very property owners rules cannot shield you from a ton, an excellent hurricane, otherwise an earthquake loss.

- Homeowners insurance pays claims to possess injury to your house, driveway or other outbuildings; as well as death of furniture or any other personal possessions on account of destroy otherwise theft, each payday loan Park Center other yourself and you may away from; and you may homeowners insurance covers most bills for those who rent short term residence if you are your property is being fixed.