Expenses associated with Home ownership and you will Mortgage loans

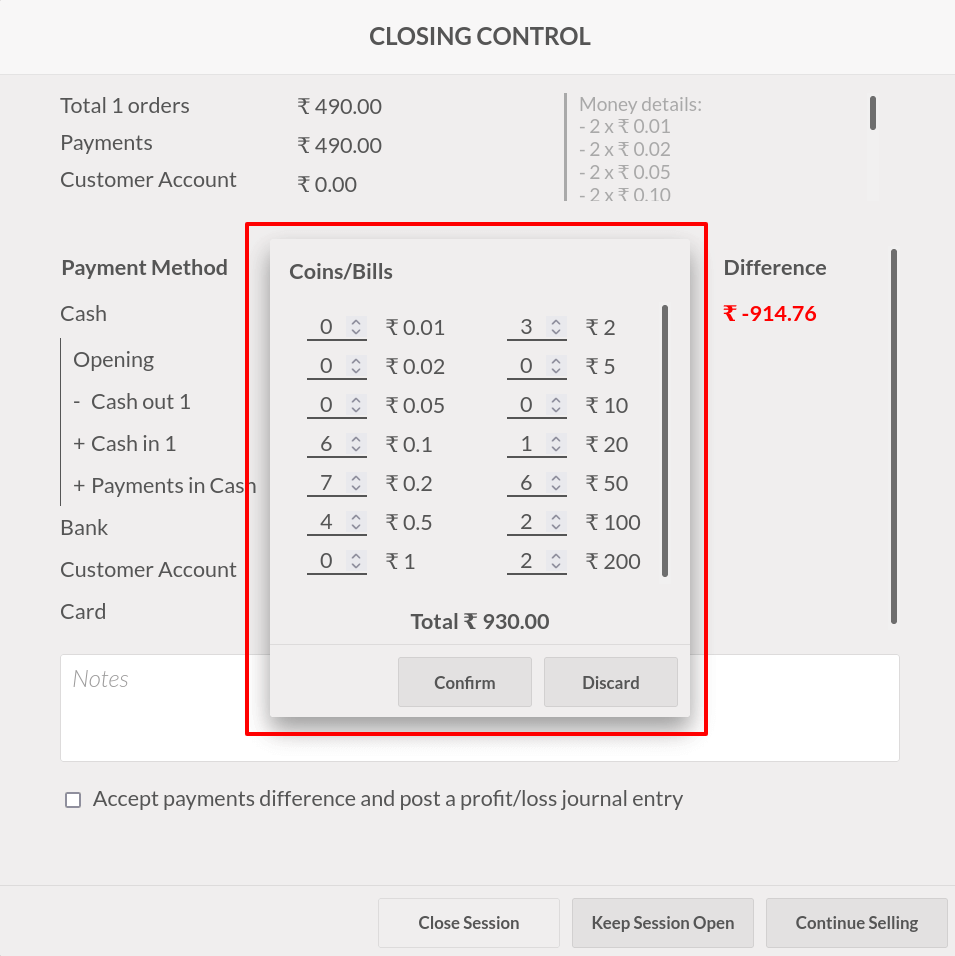

The mortgage Calculator assists imagine brand new monthly payment owed and additionally other economic costs associated with mortgages. You will find choices to is most payments or yearly payment expands off preferred mortgage-relevant expenses. The new calculator is mainly meant for use because of the U.S. customers.

Mortgages

A mortgage try financing safeguarded because of the assets, always real-estate. Loan providers explain it as the cash borrowed to pay for actual home. Essentially, the financial institution helps the consumer afford the merchant from a home, and also the visitors believes to repay the cash lent more a good time frame, always 15 or 30 years regarding You.S. Every month, a fees consists of client so you can lender. A portion of the payment is called the main, which is the modern amount borrowed. Another part is the loans Malcolm attract, which is the costs repaid into the financial for using this new money. There could be a keen escrow membership inside it to purchase costs out-of property taxes and you can insurance policies. The consumer can’t be felt a complete owner of one’s mortgaged assets before the history payment per month is generated. On You.S., the best real estate loan is the traditional 29-12 months repaired-appeal mortgage, which is short for 70% to help you ninety% of all the mortgages. Mortgages is actually how many people are able to individual home during the the newest You.S.

Mortgage Calculator Parts

- Amount borrowed-the quantity lent out-of a loan provider or financial. In a home loan, it number on the cost without people downpayment.