Virtual assistant lowest assets conditions: 2025 Virtual assistant financing MPRs

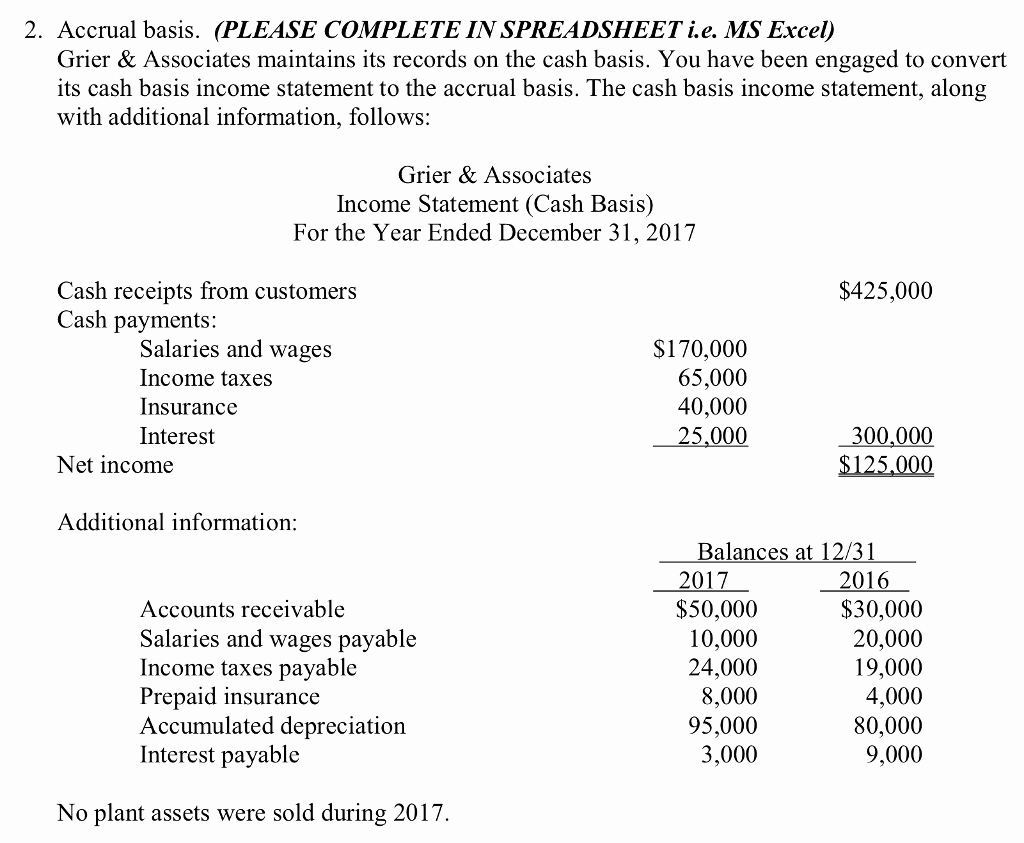

Skills minimal possessions requirements for a good Virtual assistant mortgage

You understand concerning Institution from Pros Affairs‘ qualification conditions to possess individuals. But did you know additionally sets rigorous qualification thresholds having the fresh new home it is willing to give facing?

- Va financing evaluation

- Complete MPR list

- Conquering MPRs

- Look at your financing possibilities

Va mortgage system review

The latest Virtual assistant loan program brings reasonable mortgage loans to have energetic-obligations army provider professionals and you can pros. In lieu of an FHA mortgage or antique financing, the brand new Virtual assistant financing often fund property pick without down commission and no constant mortgage insurance rates.

Just before exploring the detailed a number of Va MPRs, consider exactly what the Company regarding Experts Affairs has to state regarding its standards.

Va appraisers is to do the general condition of the home into the https://paydayloancolorado.net/fairplay/ account when determining the appraised worth.