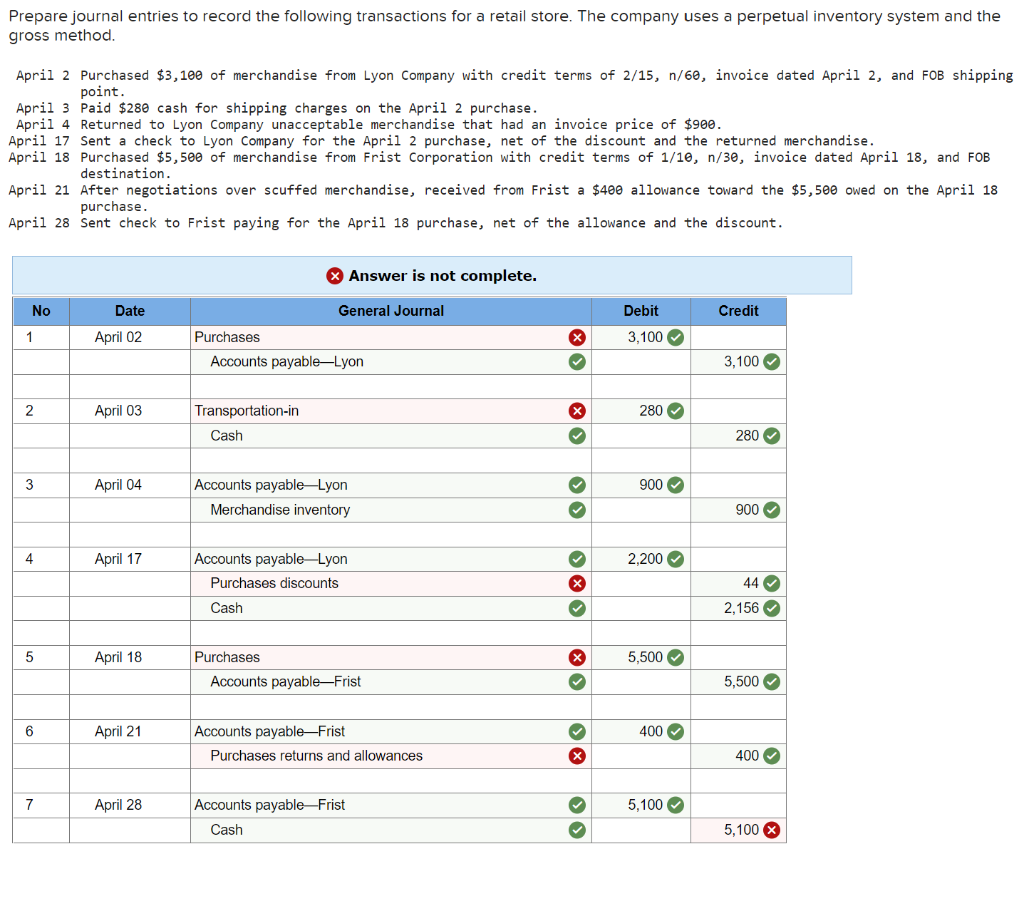

After that, deduct it well worth regarding the brand new equilibrium to discover the most recent financing harmony

- Commission amount

- Creating harmony

- Dominant paid

- Interest paid

- End harmony – In addition to the most recent balance, based on how of numerous payments you have made

How do you estimate the interest? The attention percentage are determined by multiplying the rate by the the new a fantastic loan harmony. Then, your separate the item by the a dozen.

Personal loans – Signature loans generally come in three-12 months terms and conditions

What about the main percentage? Subtract the attention payment from your own payment, while the change is the number you to goes to your own dominant.

Study the latest calculations below to produce a much better idea. Particularly objectives, what if the audience is calculating the initial attention fee to possess a great 30-seasons repaired-rate home loan.

So you’re able to assess another desire percentage, plus the succeeding costs, do this calculation.