Exactly how In the near future Could you Re-finance a mortgage? | 2025

How soon would you re-finance your residence shortly after to get they?

When you are wanting to know how in the future you can re-finance home https://paydayloanalabama.com/harvest/ financing, whether or not you have just bought a property otherwise recently refinanced, the solution you are going to surprise your.

Anybody else might only have to hold off only six months. It means there can be a robust possibility you are entitled to a good home loan re-finance at the the present positive pricing.

Information refinancing a mortgage timelines

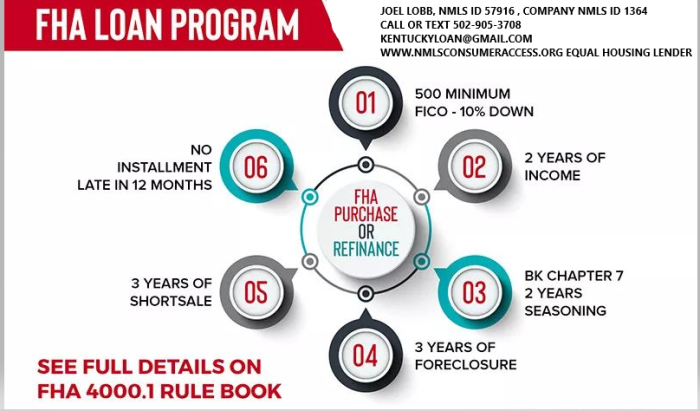

Exactly how in the near future could you re-finance the mortgage? The clear answer depends on the type of home loan you really have and your current financial situation.

Exactly how in the future would you refinance a conventional loan?

If you have a conventional financial supported by Fannie mae or Freddie Mac, you are in a position to refinance just after closing your residence get otherwise an earlier refinance. not, you should keep in mind that of numerous loan providers features a half a dozen-few days “seasoning months” before making it possible for a current borrower so you can refinance with the same providers.

If you would like refinance with your newest lender, you’ll likely need certainly to hold back until the brand new flavoring requirements has gone by. Although not, you can tend to circumvent it prepared period by looking around and refinancing having a different lender.