Do you know the different types of prepayment penalties?

Almost every other financing prepayment considerations are secure outs inside the commercial a house. Although many variety of commercial a house financing possess prepayment punishment, of numerous likewise have lock out periods– a certain time period where a debtor try not to pay the mortgage, whatever the. Therefore, individuals would be careful when examining industrial a residential property loans which have long lock out attacks. In the long run, it can be tough to offer the house before secure aside period is over.

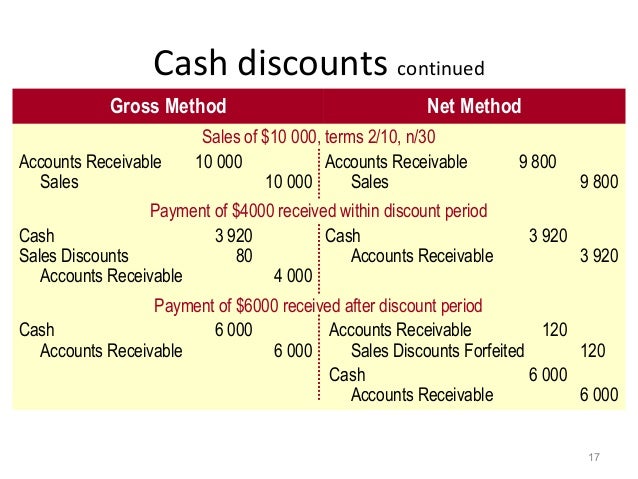

The 3 head brand of prepayment charges is actually defeasance, produce restoration, and you will step-down prepayment. Defeasance pertains to replacement the mortgage with a portfolio out-of regulators securities. Give restoration requires the debtor to blow a charge to the bank and make up on forgotten focus. Step-off prepayment involves a declining commission agenda in line with the kept equilibrium on prepayment and also the amount of time since the financing closing otherwise rate reset.

/cdn.vox-cdn.com/uploads/chorus_image/image/64047569/casino_CST_0621_17A.0.jpg)