Evaluating household repair mortgage Apr and you can overall will cost you

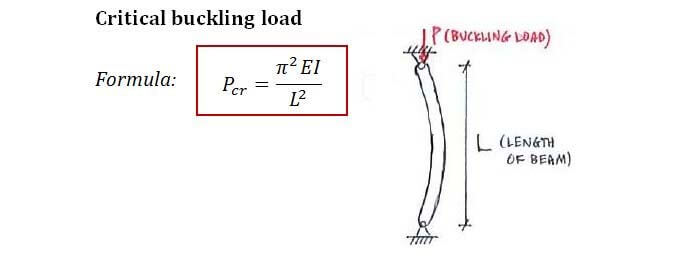

Such as for example, by firmly taking away a great five-12 months personal bank loan to possess family solutions to possess $10,000 at 8.24% focus, you are going to spend all in all, $12,230. It means the expense of borrowing from the bank the bucks is about $2,230. Should your financial costs one prepaid service finance charges (a kind of commission that doesn’t cover a third-people costs), people is mirrored throughout the annual percentage rate (APR), that gives the complete price of the borrowed funds just like the a portion.

When you compare, make use of the Annual percentage rate plus the interest rate. However, be sure to determine exactly how much might spend when you look at the overall over the life of your home resolve mortgage.

You need to look at the mortgage title, which is the timeframe you choose to pay off the mortgage. TD Lender also provides signature loans to own thirty six-sixty months. Short-name financing might have big monthly installments and lower complete can cost you regarding credit than simply long-label fund. Dependent on your allowance, you might prefer an extended term that have faster monthly payments, even although you can get spend a great deal more during the desire historically (and in case you pay just the repayment matter and absolutely nothing significantly more).

How will you get a home improve loan?

First, check your credit history and you may review your credit score throughout the larger three credit agencies: Experian, Equifax and TransUnion. Make sure there aren’t any errors. When you see any, ask to possess all of them remedied. Select elements which might be costing you facts and take measures to fix them.

Now you have to determine simply how much you should acquire for your endeavor Build your absolute best imagine towards the whole cost of your residence advancements.

Certain lenders enables you to look at the rates and you may term solutions for a loan getting home recovery on their website (TD Bank’s personal bank loan options).