Lowest FHA Financing Conditions having Properties Prepared by Wells

If FHA and HUD authored the latest unmarried house financing laws and regulations from inside the HUD 4000.step 1, they changed most of the prior FHA/HUD books which have rules to have FHA mortgages. Complete with assessment conditions and other points, therefore it is useful to opinion the legislation for the HUD 4000.1 without a doubt very first affairs. The brand new FHA has actually upgraded, replaced, modified or restated several things regarding the this new laws book.

That includes FHA financing guidelines coating minimal assets conditions into the water-supply so you can property that will be bought that have a keen FHA home loan. The brand new FHA financing minimum assets standards about this procedure boasts the next:

Minimal FHA Mortgage Standards having Services Made by Wells

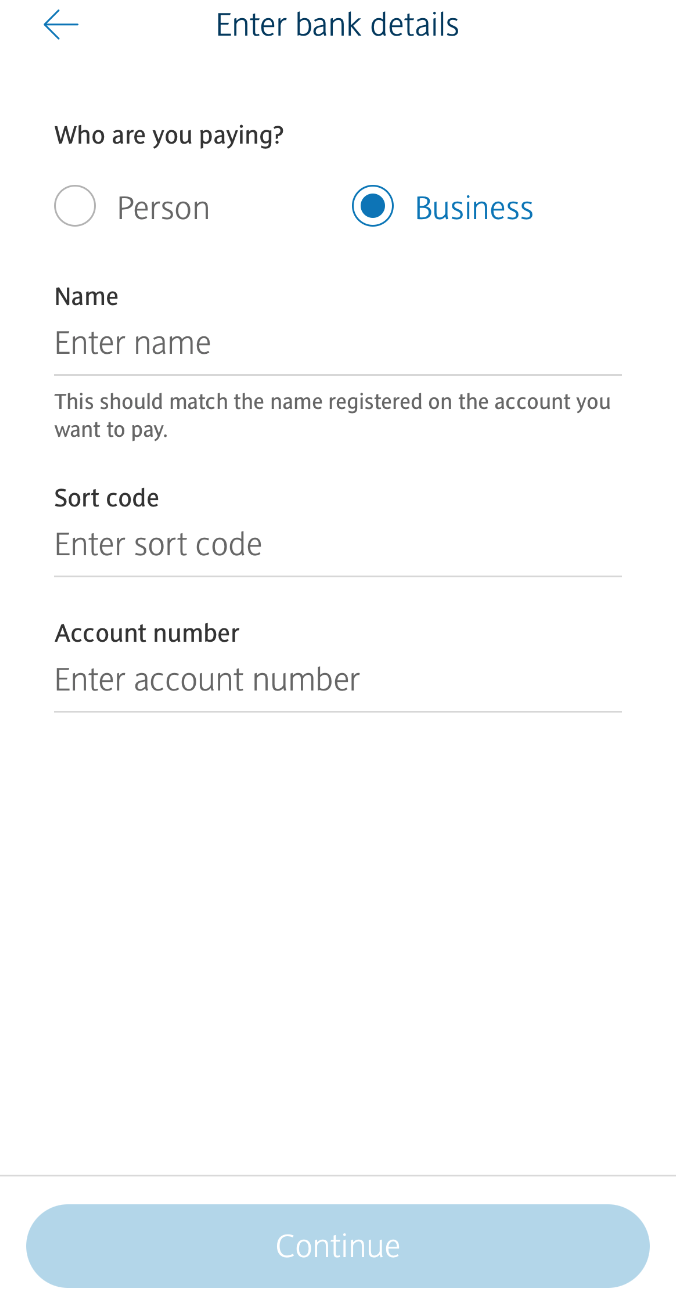

The brand new Mortgagee need certainly to confirm that a link is made to good social otherwise Area Water system whenever feasible and you may offered at an excellent sensible pricing.