Simply how much Was Settlement costs inside Utah? + How exactly to All the way down Them

This might be most man’s reaction to closing costs. But not, you are not simply are nickel and you will dimed. In this article, we shall mention:

- What you’re in reality investing in after you spend settlement costs

- How much average settlement costs have Utah

- How to adjust your loan’s conditions to own straight down closing costs

- Tips and tricks that can potentially lower your closing costs

Constantly, asking to truly get your settlement costs in advance from your financial feels as though draw white teeth. Not at Urban area Creek Home loan. The goal was visibility and you may openness, so we readily provide closure costs rates if you are using our price finder and closing pricing estimation product. It requires below 2 times. However some of them wide variety try subject to changes ahead of closure, we based it unit is while the transparent, comprehensive so that as specific as possible.

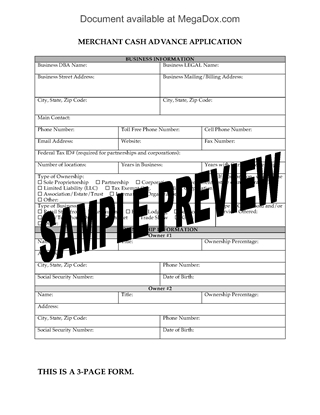

To locate an estimate like the one the truth is about visualize significantly more than, merely play with our very own rates and you will closing costs calculator equipment by selecting a choice lower than.

What is actually Involved For my situation? As to the reasons Even Expenses Settlement costs?

The average home consumer does not understand why these include spending closing costs, they just know they must attain their new house.