Try a beneficial 680 credit score an effective otherwise bad?

Image this. You’re planning towards the purchasing your very first domestic. You complete the study for the best wishes areas, have picked out the best assets variety of, and you can understand the current sold costs of the equivalent house in the the room. But, have you pre-qualified for a mortgage? Do you know your credit rating? And do you understand how your credit rating you’ll apply to your capacity to get loans York AL your house?

Is actually a beneficial 680 credit rating good otherwise crappy?

Whether you are to buy a property, making an application for a rental, considering to purchase a house, if you don’t in search of a special work, your credit score have a life threatening impact on your next. Even although you see the rating, could you know very well what it indicates? Otherwise, we’ve you. Say you’ve got a good 680 credit history – how much does that mean for you plus power to use cash in the near future?

According to Equifax, a good 680 credit score falls in “good” range – meaning you put up some very nice borrowing habits but nevertheless involve some area and make improvements. We are going to make suggestions how. But first, a lot more about how loans scores inside the Canada really works.

Credit rating selections in the Canada

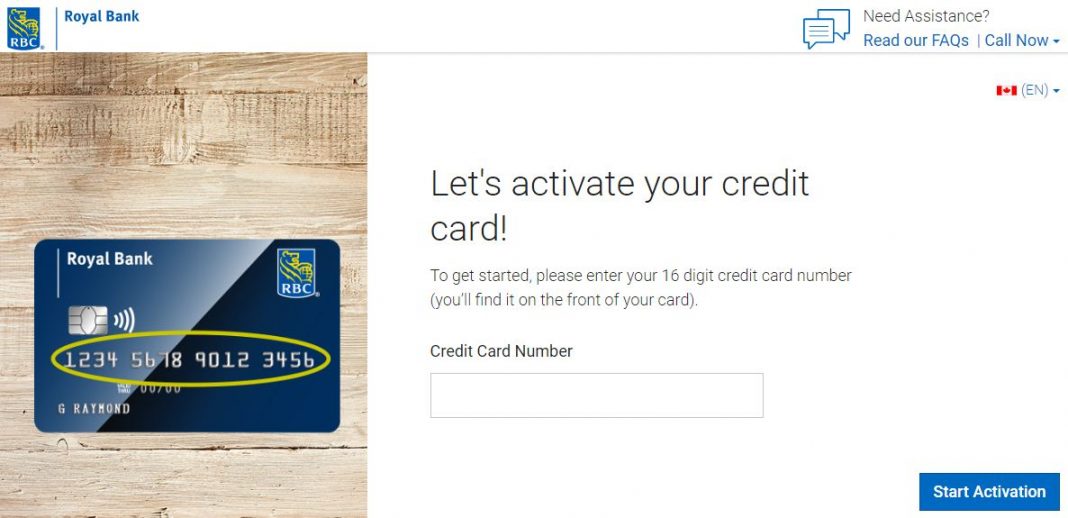

There have been two biggest credit agencies for the Canada, and this designate and you will song credit ratings for all adult Canadians just who have a credit score. You can generate credit rating by the opening borrowing accounts, particularly playing cards, credit lines, car loans, or mortgages. The newest bureaus assign around three digit quantity to decide another person’s “credit worthiness” – which is a way of predicting how good one often create any credit that’s made available to them.