twelve.Knowing the Notion of Vow [Fresh Writings]

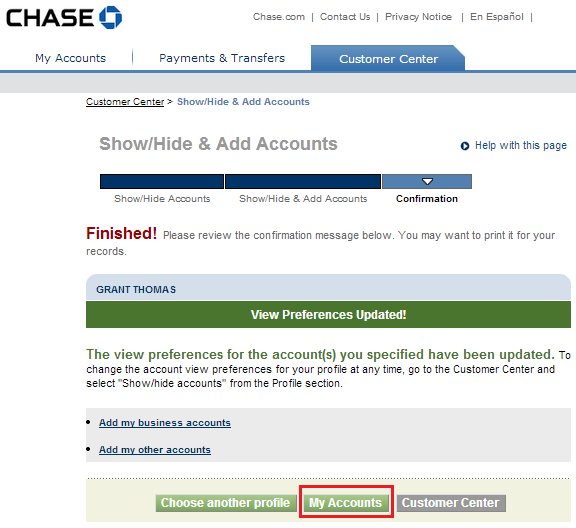

Valuation plays a crucial role in pledge agreements, as it determines the value of the pledged asset. It is essential to conduct an accurate valuation or appraisal to ensure the asset’s worth aligns with the loan amount. This valuation process can involve independent appraisers or experts who gauge the current market value of the asset. By ensuring proper valuation, lenders can mitigate the risk of inadequate collateral coverage.

Once a guarantee arrangement is done, it is important to implement a network to own persisted tabs on the new sworn asset. So it monitoring implies that the value of the latest resource remains adequate to afford a great loan amount. Typical examination might help pick people depreciation about asset’s really worth, prompting the lender when planning on taking necessary strategies to protect their appeal.