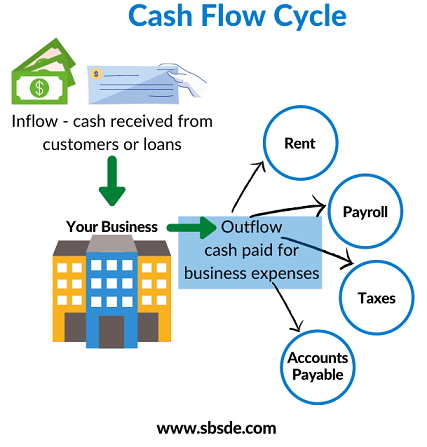

Personal loans : These are signature loans regarding banking institutions or creditors

Exploring financing options for to find a mobile residence is crucial for first-big date buyers, homeowners, and you may realtors. We now have gained some possibilities in order to old-fashioned investment that may suit varied need and circumstances.

Because they do not require guarantee like the family itself, interest rates could be high. But really, they’re an option when your cellular family does not be eligible for a great home loan.

Chattel Mortgage loans : Created specifically to own movable assets, chattel mortgage loans allows you to money the acquisition out-of a cellular otherwise are designed home that isn’t forever affixed so you can home. It is more versatile than old-fashioned mortgage brokers.

Holder Financing : Possibly, the seller of your mobile home get commit to loans brand new get themselves. This means you can easily make money right to all of them under decided terms and conditions in place of taking out fully financing owing to a financial.

Borrowing Unions : These types of representative-owned loan providers usually bring money which have all the way down interest rates than traditional banks. When you are a person in a cards partnership, speak about their choices to own funding a cellular home.