The lower the brand new deposit, the higher the fresh new LMI

It’s well worth playing with our very own Mortgage repayment Calculator to convey specific concept of just how much even more reduced deposit loans will set you back along side identity of the financing.

LMI, or loan providers financial insurance, are a charge added with the from the lenders after you borrow far more than simply 80% of your own property’s really worth. But let’s end up being clear, it’s to guard their bank for people who standard to your financing, not you.

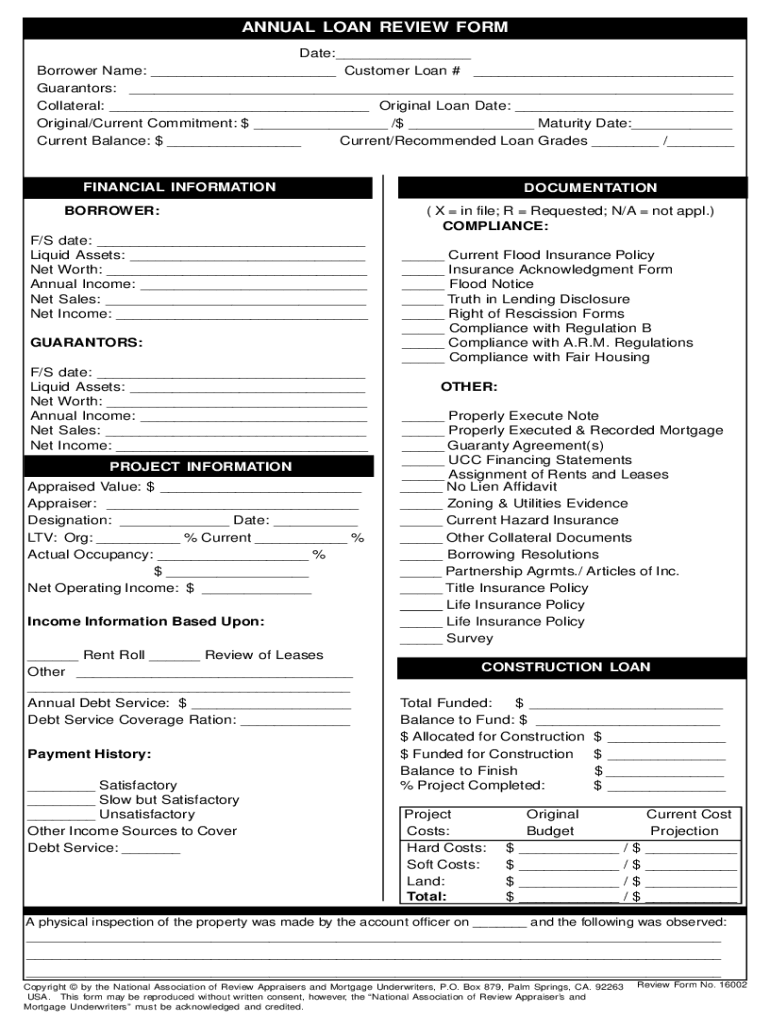

Clearly from the desk less than, the lower the put, the higher the LMI prices. A good 95% mortgage will add tens of thousands of bucks for the initial mortgage can cost you.

Would it be better to sign up for the lowest deposit financial or remain rescuing to own a bigger put?

First and foremost, inside a trending assets markets, instance there are due to the fact pandemic, there clearly was a quarrel that particular home buyers might have been best off getting into the market industry having the lowest deposit while the property rates raced ahead within a much higher rate than simply the put savings.

It escalation in assets values can be efficiently boost an excellent homebuyer’s security within property without them being forced to create far at all.

Subsequently, new make-up out of equity over this time around could have desired specific homebuyers so you can refinance its large interest finance in order to a lowered attention rate while you are to avoid LMI another go out up to. However, which, of course, relies on the lender, the mortgage unit, and you may private facts.

Over the exact same months, those individuals however protecting getting large deposits was hit on double whammy of skyrocketing possessions rates and you will grows regarding cost of traditions, effortlessly while making rescuing harder.