So you’re able to be considered, you prefer a credit rating off 640

The fresh new IHCDA even offers home financing borrowing certificate that will help first-go out homebuyers and you will pros qualify for a much better mortgage.

There are offers and loans for advance payment or closing prices recommendations from the Iowa Finance Power. Assistance is readily available for each other basic-day home buyers and you may experts. If someone else try buying a home within the the lowest-earnings census region, they could even be qualified. The Iowa Finance Authority operates the same program having recite home buyers.

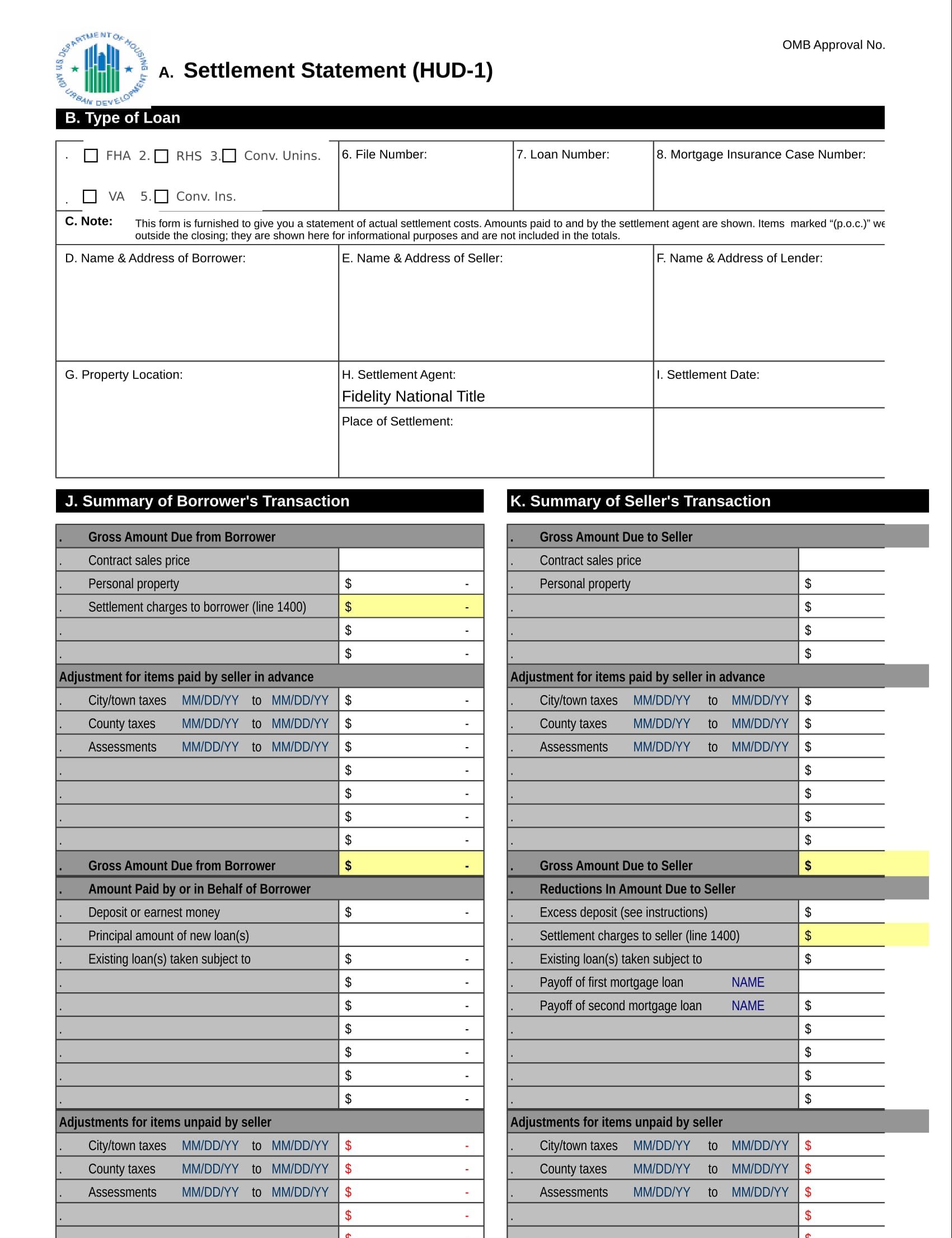

Very first Domestic DPA Mortgage

The original Home Deposit Guidelines (DPA) Mortgage system was created to let qualified basic-time homebuyers the help of its downpayment and you can closing costs. The application form even offers a no-attention loan of up to $5,000. Which deferred mortgage means zero monthly installments, nonetheless it will have to be repaid in the event the home is marketed, refinanced, or even the first-mortgage are paid in complete.

Very first Family DPA Offer

Eligible very first-day homebuyers is discovered a grant all the way to $2,five-hundred from the Basic House DPA Give to purchase down payment and you will settlement costs. Since it’s an offer and never a loan, it’s not necessary to pay it back.

House getting Iowans DPA Mortgage

The brand new Property to possess Iowans program brings a no-notice mortgage of up to 5% of the house cost for usage having a down fee and you will closing costs.