The key benefits of Having fun with a large financial company

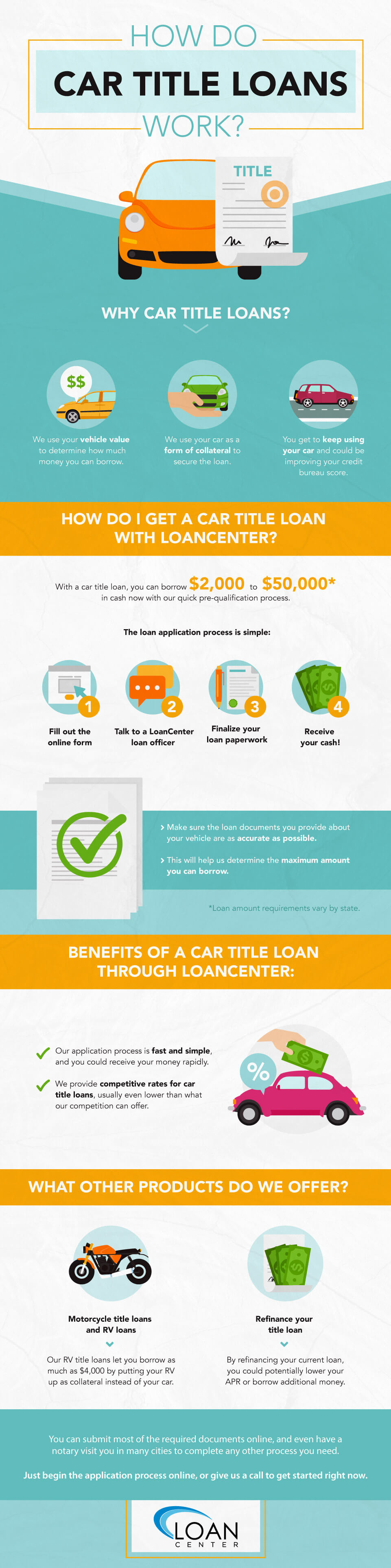

A large financial company will bring a thorough services by determining your financial state, shopping for suitable financing choices off a broad community of lenders, simplifying the application form processes, offering qualified advice, and you may negotiating beneficial mortgage terms in your stead.

Just like the a mortgage broker along with 18 years of feel, You will find dedicated my personal occupation to help you as being the crucial outcomes of consumers and you can lenders.

My personal character exceeds only assisting mortgage loans; it’s about information your unique monetary landscaping and at the rear of your into the the loan one to best fits your needs.

Let me walk you through the things i manage and just how my personal possibilities will benefit you on the visit homeownership.

Find the correct Mortgage to you personally

Which have use of a thorough network from lenders, We examine various financing facts to obtain the the one that aligns together with your economic needs and you can condition.

I envision all the critical facts, also rates, loan terms, charges, and you can cost selection, to ensure you get by far the most favourable package to your requirements.

Clarify the applying Process

Once we have chosen just the right loan for your requirements, I shall make it easier to collect every called for paperwork and you will carry out the latest app processes on your behalf.

I act as the new liaison between both you and the lender, guaranteeing a delicate and you may effective techniques, and you can helping you save the pressure.

Bring Qualified advice

Whether you are weigh some great benefits of a fixed-speed against. a changeable-rate financial or worried about financing has actually and you can charges, I am right here to add understanding and you will advice.