Tom generated using and having pre-accepted in regards to our FHA loan effortless

In reality, it may limitation one just the finance supplied by her or him

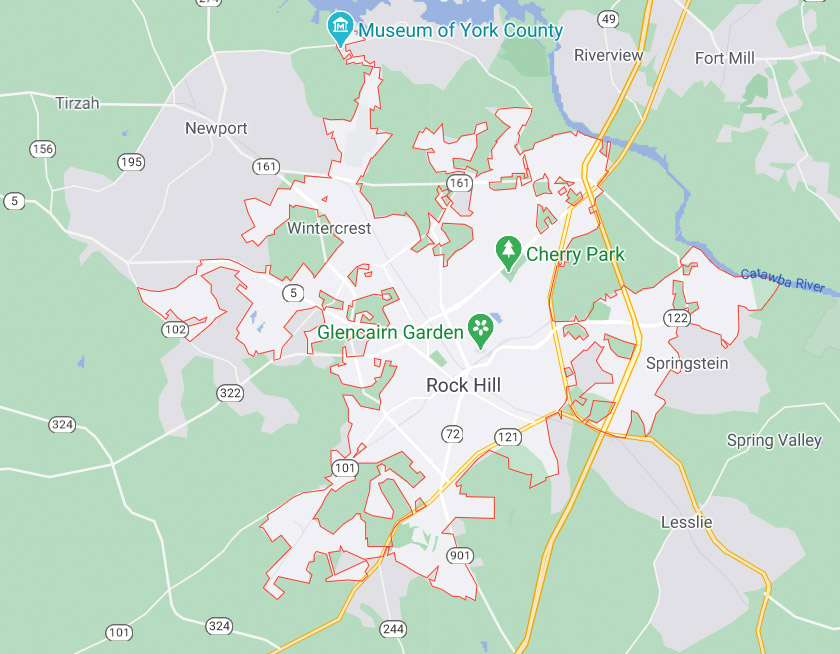

Whether you’re buying a first Georgia home using our great FHA mortgage system or refinancing a Georgia home you already own using traditional Georgia mortgage financing, nothing helps more than having a seasoned Georgia mortgage lender working hard to make your dreams a reality.

Give us a call 1-954-667-9110 or use our Full Georgia Mortgage Application to find out more about the many Georgia mortgage programs we can make available.

Just like the an established and you will seasoned Georgia home loan business, all of our employees are from being the the brand new children into the Georgia financial block. All of our situated and elite mortgage pros features introduced reasonable financial costs, great terms, as well as on time real estate closing in order to Georgia home loan members having ten years. You need to call us now otherwise use our simpler Full App to see what we can be to do along with her!

Some tips about what about three of one’s current Georgia house credit members was required to say regarding the Home loan financing they gotten of all of us.

As first time Homebuyers, we were not sure what to expect from a Georgia mortgage company. Tom was very thorough in explaining our loan options and staying in touch with us from start to finish. We’re happy to recommend him to anyone needing a home loan.

I needed to Re-finance my home right away to stop Property foreclosure. Tom provided excellent service and extremely fast turnaround for my refinance. Tom saved my home and I simply can’t thank him enough!

The financial would not funds this new are created family we need, but Tom paired all of us which have an incredibly affordable FHA mortgage. It had been nice talking about good https://paydayloansconnecticut.com/quinnipiac-university/ Georgia bank that basically made obtaining the financing a nice sense.