Conforming and you may FHA Loan Limitations from the Condition

Article on Alabama Mortgage loans

In a condition lineup, Alabama ranking nearly dead center with regards to people size. So it southern state’s mortgage field pursue match, coming in right around average compared to historical federal rates. Most of the time, Alabama counties‘ conforming loan limitations and you may FHA financing limitations and additionally hover at mediocre.

National Home loan Cost

- Alabama assets fees

- Alabama later years fees

- Alabama income tax calculator

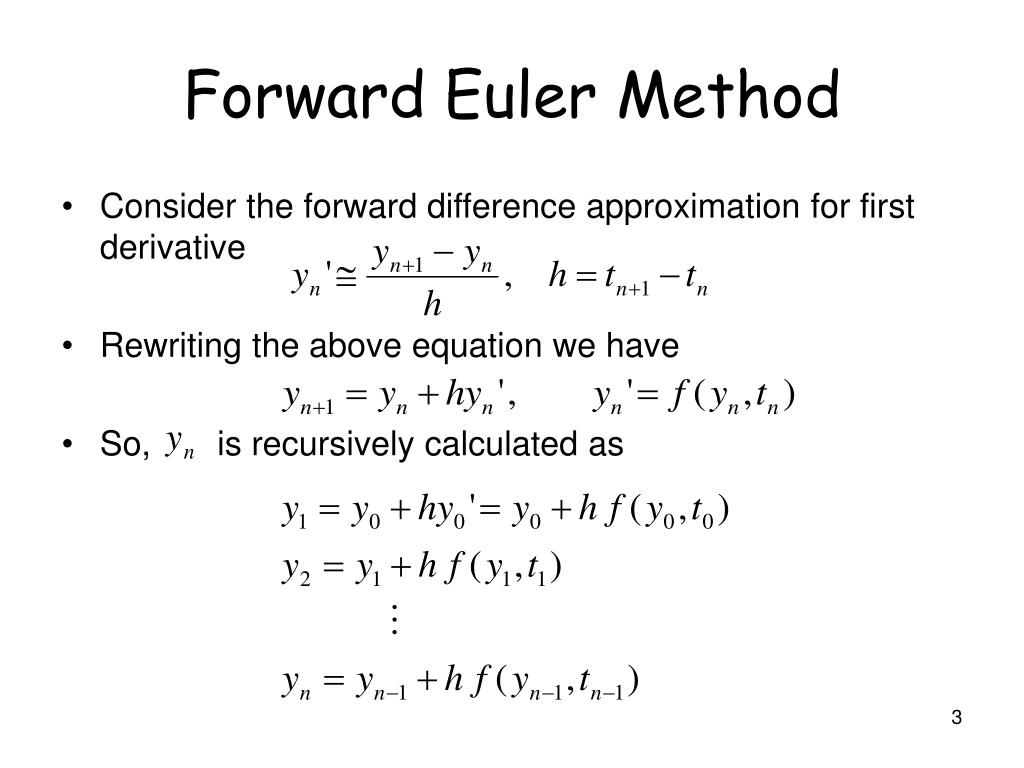

- Find out more about mortgage rates

- How much cash house can you afford

- Calculate month-to-month mortgage payments

- Infographic: Better locations to get a home loan

Alabama Mortgages Review

Alabama is just one of the more affordable claims buying a beneficial family. This new average domestic value the following is $172,800, really according to the relevant national contour of $281,eight hundred.

All state about state provides an elementary compliant mortgage limit from $726,200. The information again puts Alabama from the the typical, reasonable level compared to remaining portion of the nation. All of the condition is served by the high quality FHA limitation out-of $472,030.

It is very important note that Alabama is actually a “caveat emptor,“ and this is called good “visitors beware” state. It means duty drops greatly with the customer to learn one flaws for the assets before you buy. Property checks was an extremely worthwhile unit to verify good property’s criteria prior to pick. All about home inspections commonly mandatory, however they are absolutely critical to the new stability from a buy.