Family Security Lending: Possibility, Requirement otherwise Distraction?

Mortgage bankers are constantly focused on new products attain a good competitive line. That is generally speaking completed to enjoy the normal ebbs and you may streams interesting cost otherwise casing activity. Nevertheless unmatched expands in cost during the 2022 and you will to the 2023, combined with housing price develops in the last lifetime, features placed a focus on domestic guarantee lending – credit lines (HELOCs) and you will signed-stop family equity financing – as needed products in a weird, remarkable ways.

There isn’t any concern the primary items to have home loan organizations and you may banking institutions immediately are the ones that may permit a profit to help you no less than breakeven procedures. However the ecosystem also provides a chance to review enough time-label specifications.

On this page, we’re going to explore industry viewpoints into family collateral lending markets and you will strongly recommend you can easily tricks for mortgage brokers given how exactly to make use off the present unique industry problem.

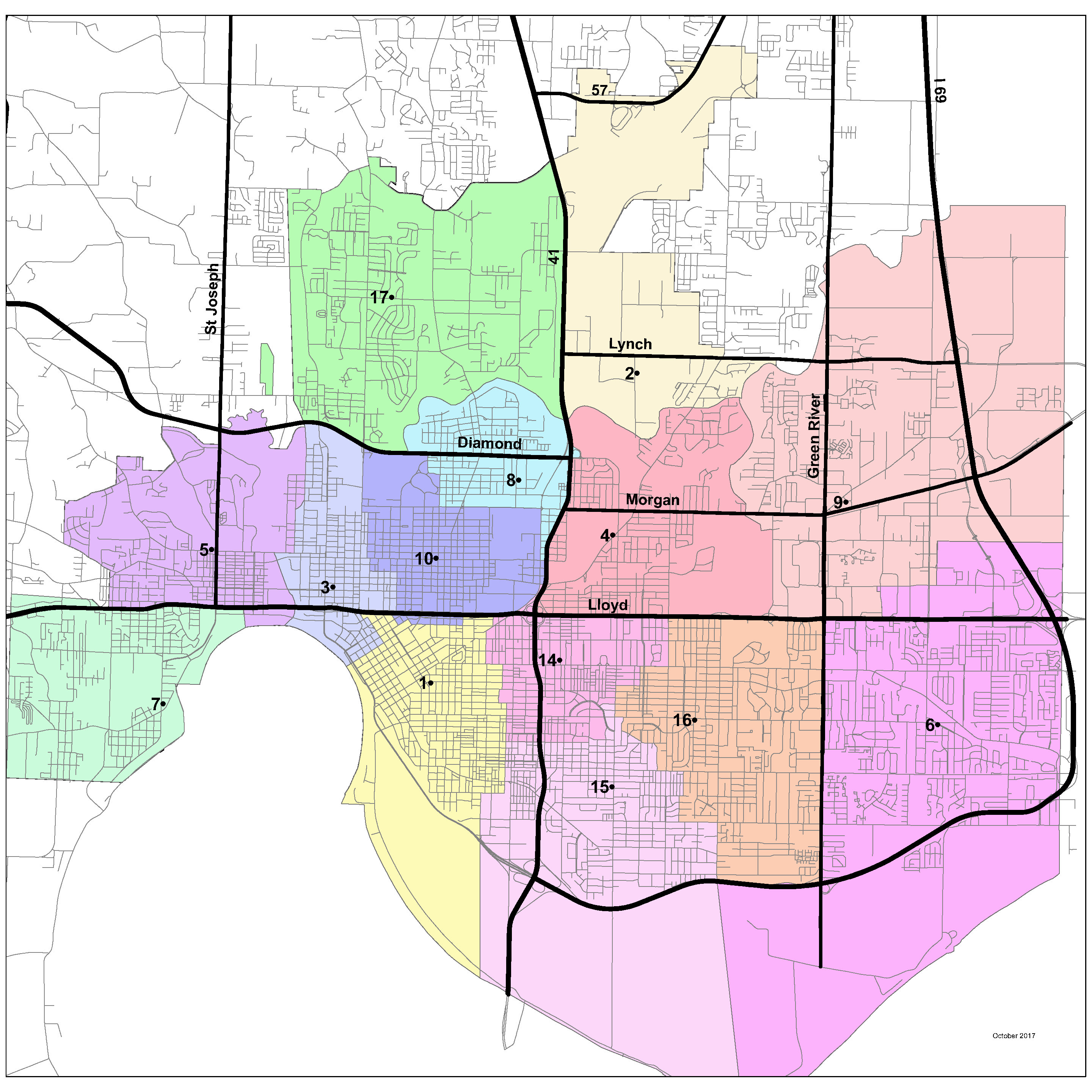

The business

The level of domestic collateral offered while the equity to possess household equity safeguarded credit has grown during the a sudden speed.