Get Personal loan into your account immediately

Was the helpful calculator

Should it be enhancing your property, planning your dream wedding otherwise investing in your own education we have been right here to help you make it all of the takes place. Get approval on the internet or in-software within a few minutes, and then have your loan to your membership immediately.

Here are some all of our pricing

Was our easy-to-fool around with calculator to ascertain the mortgage details certain as to what you want to borrow or exactly personal loans online in Pennsylvania how much you would want to pay off every month. You can find all of our effortless illustrative example less than otherwise the full list of our competitive Personal bank loan cost right here.

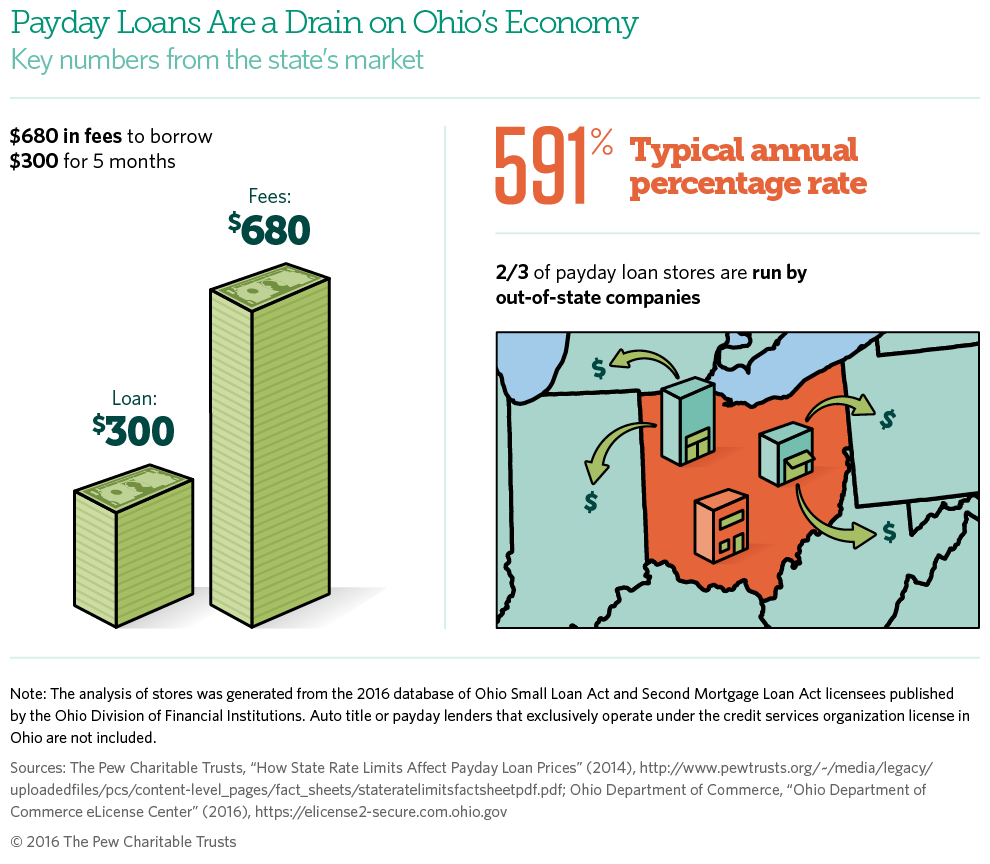

Monthly costs are derived from a 5-year varying interest rate regarding * (ount payable over an excellent 5 year months are 13,. This situation is actually for example intentions just.

Apr stands for Apr. Our very own Money features an adjustable price for example the latest price, along with your mortgage money, can go up or off inside the term of the mortgage. Restrict Annual percentage rate (Annual percentage rate) try fourteen.3%.

Warning: If you do not satisfy payments in your mortgage, your account will go towards arrears. This could connect with your credit score, that could curb your ability to availability borrowing from the bank, a hire-purchase arrangement, a customers-hire contract otherwise a good BNPL plan subsequently.

Advantages of a personal bank loan

- Approval on the internet or in-app in minutes to own funds off step one,500 doing 25,000

- Mortgage paid off to your account instantly, in the event that acknowledged

- Competitive costs

- Flexibility payment having regards to doing 5 years otherwise 10 years to own Home improvement Money

Submit an application for a personal loan today

While a beneficial PTSB customer the most basic and you will fastest means to make use of inside the-app or using your online Open24 account.