You’ll income tax advantages of a money-away refinancing

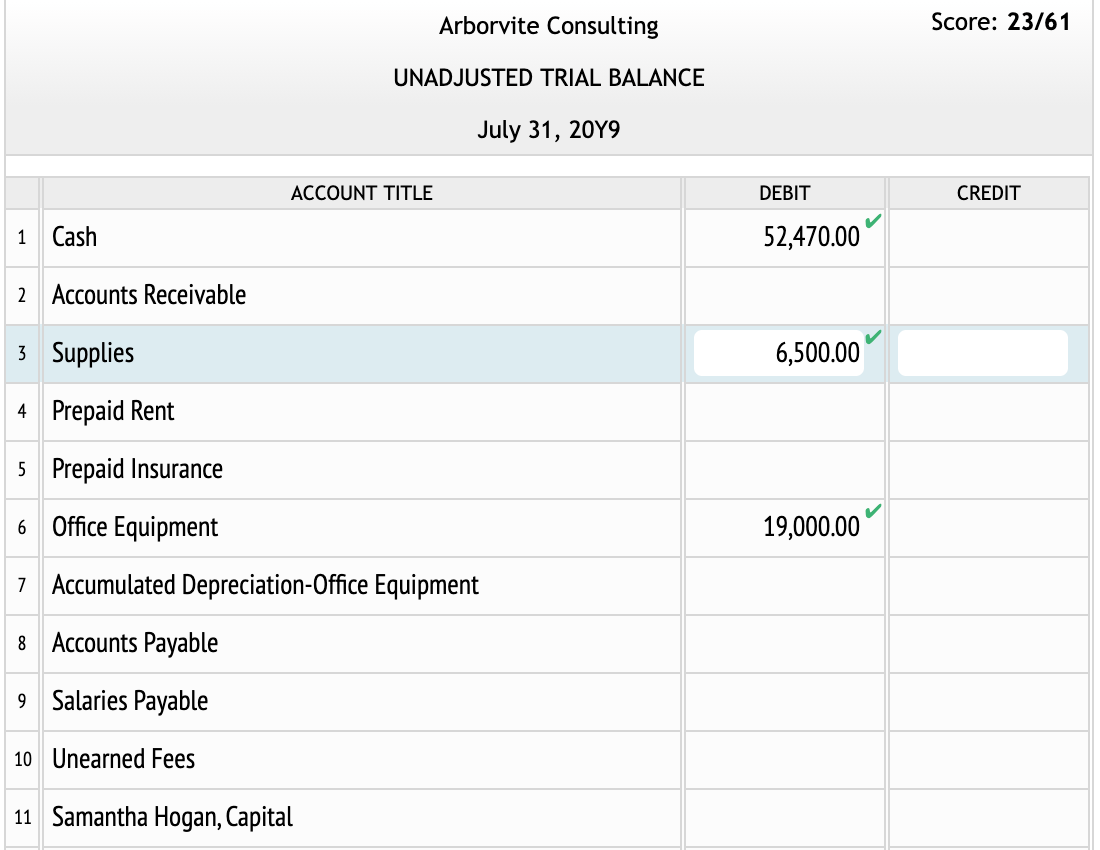

- Your own house’s market price try $400,000

- Your mortgage harmony is $two hundred,000

- The maximum. cash-out loan amount try $320,000 (80% x $eight hundred,000)

- The maximum. cash-straight back is actually $120,000 ($320,000 – $200,000)

Merely Va fund (mortgages getting pros and provider people) let you create a finances-away re-finance wherein you’re taking out 100% of the equity.

You aren’t utilising the the fresh new loan to repay your one to. However the first-mortgage and you may next mortgage shared constantly cannot be significantly more than 80 per cent of the home’s well worth. And so the math works out a comparable.

Although not, particular family security loan companies be much more versatile and will make it you to obtain to 85 per cent of your own residence’s worthy of.

How to make use of the fund

But not, you generally speaking want to make use of the bucks to possess anything having a good an excellent return on the investment. That’s because you’re paying interest into cash and it’s secure by your house.

Prominent ways to use house collateral tend to be household home improvements and debt consolidation (making use of the currency to pay off high-notice personal loans or credit card debt).

People can be capable deduct the attention on basic $750,000 of the the home loan if the dollars-aside money are accustomed to make resource advancements (regardless if given that a lot fewer individuals today itemize, really home would not make the most of it generate-off).