The newest Zacks Expert Website Shows ARKK, SoFi Technologies, Goldman Sachs, JPMorgan Pursue and you may Morgan Stanley

GS Short Price GS JPM Quick Price JPM MS Short Offer MS ARKK Short Estimate ARKK SOFI Brief Offer SOFI

For Instant Discharge

Chicago, IL – – Zacks announces the menu of stocks looked throughout the Expert Blog site. Daily the latest Zacks Guarantee Search analysts talk about the current information and events affecting brings together with financial areas. Holds recently searched on web log is: Ark Invention ETF ( ARKK Short Estimate ARKK – Free Report) , SoFi Innovation, Inc. ( SOFI Small Quote SOFI – Totally free Declaration) , The fresh Goldman Sachs Category, Inc. ( GS Short Price GS – Free Statement) , JPMorgan Pursue & Co. ( JPM Quick Price JPM – Free Statement) and you may Morgan Stanley ( MS Small Quotation MS – Totally free Declaration) .

Such Warren Buffett and you will Peter Lynch, Cathie Wood’s art from using provides earned far notice not too long ago. Wood’s Ark Invention ETF has actually attained over 20% for the past 12 months since it primarily is targeted on brings interested inside the disruptive development.

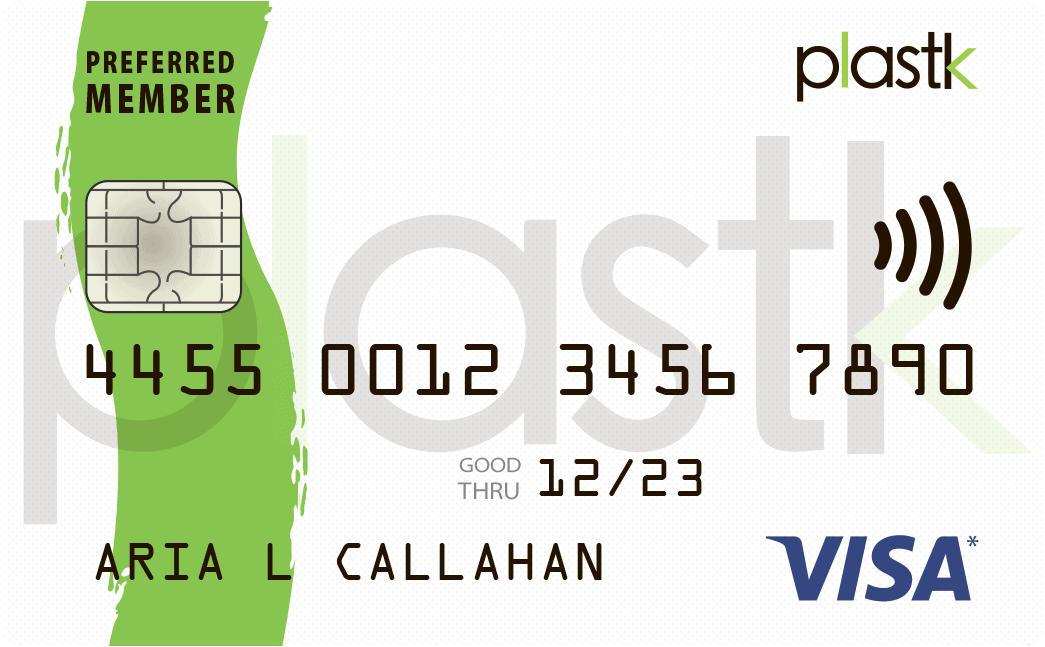

One such inventory are SoFi Development, Inc., and this began since the a student-loan provider and contains progressed into an adaptable fintech company. But not, even with raising their complete-year revenue frame of mind throughout the next one-fourth and you can witnessing an expansion in put legs, SOFI stock has actually underperformed technology payday loans Delta no credit Attributes world seasons to date (-20.4% compared to +25.1%).

This is because elevated interest rates features gagged SOFI’s credit organization, that’s guilty of producing the bulk of its incomes. But the latest jumbo interest rate cuts, with anticipated to come, been employed by wonders because of it beaten-down fintech inventory, therefore it is an enticing purchase at the moment. Let’s keeps a closer look.

As to why a speed Clipped Commonly Increase SOFI Inventory

The brand new Government Put aside, with its previous coverage fulfilling, cut interest levels by fifty base factors to help the cost savings and balance out the newest work field.