The journey from a mortgage App to help you Closure

The journey from a home loan Software to Closure

While a potential homebuyer and you’re thinking about jumping towards the business, it probably implies that you will want a mortgage. Eighty-7 % regarding homebuyers perform, therefore you’ll end up happy to know that, with a bit of perspective together with help regarding a loan administrator, the process is simple enough so you can browse.

To in route, there is detailed your way of an interest rate lower than. This easy-to-follow- guide outlines the way of a typical home loan and you may preapproval procedure. Our very own purpose is to try to make it easier to comprehend the methods that will be necessary after you purchase your earliest otherwise 2nd house.

The journey regarding a home loan App to help you Closure

- Getting started into Financial Travels

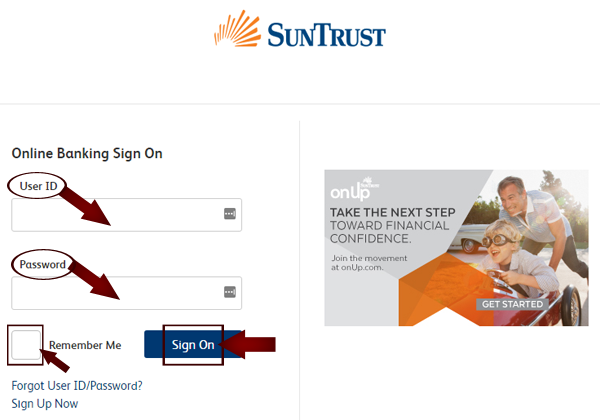

The loan techniques starts, merely adequate, that have determining that loan administrator. Which home loan lending top-notch might be truth be told there to help you while in the your own travels and will start with enabling you to acquire a beneficial preapproval, otherwise good pre-qualification, and they will give an explanation for variation.

Rather than a good pre-qualification, where a quote is offered based on how much household you might manage, good preapproval requires they a step further and you will decides the total amount youre entitled to obtain. This is accomplished by using a further look at the monetary status and you may goals.

Brand new preapproval procedure is in spot to a great deal more precisely ensure that you will fundamentally getting acknowledged for your home loan. Since the majority vendors like to accept offers off a buyer whom try preapproved, this is certainly a life threatening step you need to undertake before you start your home search, especially when the latest housing marketplace is actually competitive.