These are some of the financing models which are often available to choose from when purchasing a manufactured house

Are manufactured land has typically considering a way to very own a property in place of breaking your finances. For this reason, more folks are planning on are formulated land among all of their home ownership solutions when you look at the Ca.

If you find yourself wanting to know simple tips to be eligible for a manufactured domestic financing, we have come up with a handy publication with the financial support a produced family appear to find out if it’s possible to utilize of it.

It is only because well-known to invest in the purchase out-of are formulated property since it is to have generally-established property, nevertheless techniques and you can certificates vary. Were created land are sometimes named cellular home otherwise standard residential property, however, you can find technical differences that will affect the loan. The latest California Are created Property Work out of 1980 renowned are formulated home vs. mobile otherwise standard home concerning family quality, flexibility, and you can financing methods.

Particularly, are manufactured home are at minimum 540 square feet, possess a long-term base, and will meet the requirements real‘ estate compared to. personal property otherwise a motor vehicle for cellular land. Are manufactured house are manufactured from inside the formal production facilities and you may have other types, also single, double, and you may triple large. They are certainly not built to be moved on connected wheels, in addition to their mortgage systems mirror it.

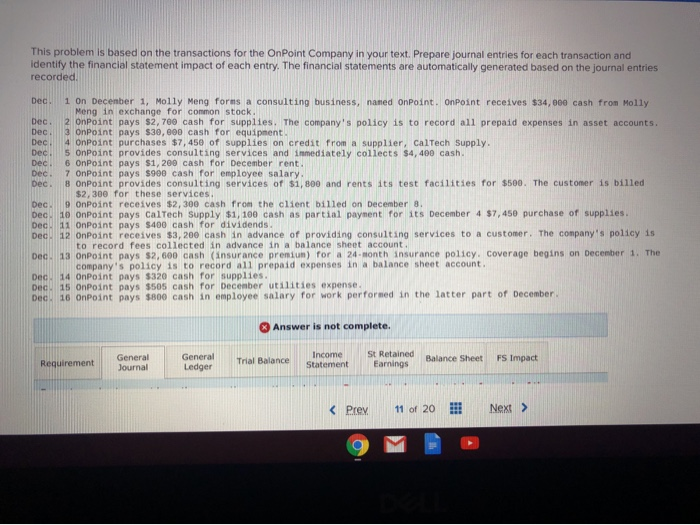

With respect to the class of the were created domestic, you can be eligible for a number of sorts of finance, including:

FHA Label II Program: FHA Term II financing are utilized to possess are produced property who do not be eligible for private otherwise vehicles loans. Simultaneously, FHA financing are ideal for buyers exactly who might not have higher level credit score. FHA loans do not have income restriction otherwise geographical constraints, and therefore are assumable meaning that for individuals who offer your house, the consumer loans Louisville could probably take over payments. This type of terms make FHA funds preferred alternatives for are manufactured house purchases.

Freddie Mac computer Funds: Freddie Mac Financing usually need many different fixed rate or variable rate mortgage loans, and additionally terms of fifteen, 20 and you can thirty years. Freddie Mac computer funds also provide among the many lower down payments, and will explore give or present currency. This is going to make her or him glamorous and reasonable loan alternatives for earliest-go out were created homebuyers.

Chattel Loans: A chattel mortgage is a mixture anywhere between a real estate loan and you can an auto loan. Brand new chattel financing uses vehicles mortgage conditions on the are created household given that guarantee. To the are available household delivering economic protection on bank, chattel financing may offer far more competitive financing rates than personal finance. Another thing to consider that have a beneficial chattel mortgage ‚s the payment period may be fifteen otherwise 2 decades quicker than simply a fundamental 31 12 months fixed rates mortgage mortgage, resulting in high monthly financing payments.

USDA Rural Casing Funds: Don’t let the name deceive you such loans are created to let get house from inside the California on the new outskirts out of locations. A created house close by may be entitled to this form away from financing, that is certainly useful for homebuyers seeking finance with little if any currency off. Such loans offer 29 12 months repaired rates that can become closure costs and you will judge charges, and may offer common and you can economic an approach to purchase an experienced are available household.

We usually be concerned that have a conversation together with your bank concerning your certain financial predicament observe what’s going to perform best to you.

These fund typically have low down repayments and loans-to-earnings conditions, but make sure to ask your financial

Such standards can vary centered on your own financial, this is why it’s very crucial that you display early and you can usually that have accredited lenders regarding most readily useful problem to you personally. Particular financial institutions have experienced loan providers loyal entirely so you can are built household financing as well as happening within Area Western Bank and thus you’re going to get suitable desire you deserve.

During the Area Western Bank, nothing causes us to be happier than just enabling residents get to their requires. That is why i’ve several are produced mortgage specialist who will try to offer a receptive financing state for your requirements and your family unit members.

If you are searching having are built a home loan, please contact us now. That conversation you will initiate you towards an approach to result in the domestic you have always wanted a reality.