Due to the fact student loan payments improve DTI, you may possibly have concerns about being qualified for home financing. But loan providers believe other factors as well. So regardless if education loan loans takes a big amount of one’s monthly money, it’s still you can easily to locate home financing.

But not, you will find techniques to pay them regarding faster and you may certain loan systems tends to be much better.

Was to buy a home with student loan loans you can?

Pupil debt – as well as any other kind regarding financial obligation – expands your own DTI ratio, that may introduce a different difficulties when purchasing a home.

DTI compares your own motivated payments on the income. It is conveyed as a share and computed of the separating their total month-to-month debt money by your disgusting monthly money. Like, when your student loan, car loan, and you may bank card costs complete $step 1,500 a month, along with a gross monthly money away from $5,000, their DTI was 29%.

Lenders utilize this proportion to evaluate your capability to consider more debt, and generally choose an effective DTI lower than 43%.

A high DTI form you’re currently playing with a giant percentage of your income to settle debts, which could make it harder to manage most other very important costs, such as for instance a home loan.

When the education loan repayments significantly enhance your DTI proportion, you can qualify for a much reduced home loan, or you could maybe not be considered after all.

But, it is not constantly wanted to pay a student-based loan in advance of trying to get home financing-especially when your income is assistance both loans.

What kind of financial should i qualify for?

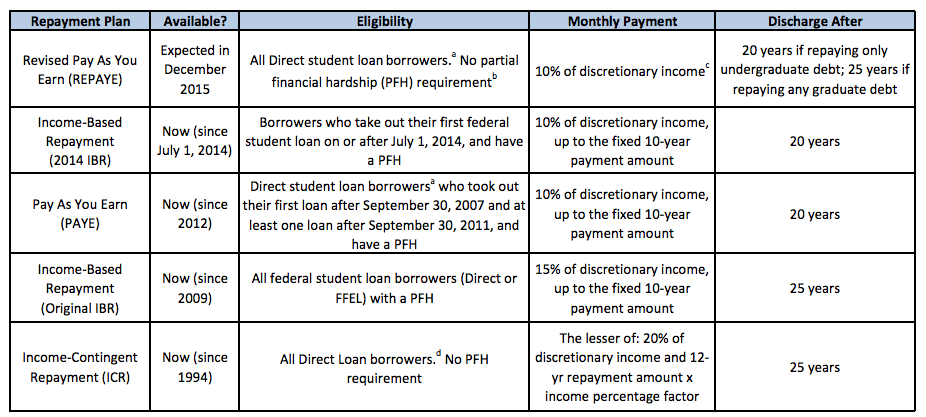

Additional money enjoys different DTI standards, thus providing home financing which have college student personal debt is easier less than particular applications. Here is what to expect from four well-known mortgage sizes.

Such non-bodies fund given by individual lenders (financial institutions, borrowing unions, financial people) generally have more strict DTI criteria. Some lenders prefer an excellent DTI ratio up to thirty six% having antique financing, even though anybody else will get make it a top proportion (up to 45%) whenever a debtor enjoys an effective credit file.

These fund, insured by Government Homes Management, have significantly more flexible criteria. It make it reduce payments and lower credit scores, along with a higher DTI ratio compared to the antique finance. Maximum deductible DTI proportion to have an enthusiastic FHA mortgage is normally 43%, although some loan providers could possibly get approve financing with a ratio up to 50%.

These money insured of the Institution regarding Experts Circumstances are available in order to qualified pros, active-obligation services professionals, and choose thriving partners. These financing bring attractive experts, and additionally no cash off. As well, Virtual assistant funds keeps flexible DTI percentages, enabling doing 41%.

This type of funds are covered by U.S. Company of Farming and you will accessible to reduced-to-moderate-earnings individuals which purchase services when you look at the eligible outlying section. These types of loans bring 100% funding and generally require a max DTI ratio out of 41%.

Simple tips to change your DTI

This is going to make your an even more glamorous debtor, which expands your chances of getting recognized as well as a favorite financial rate. Suggestions to improve DTI were:

- Imagine a means to boost your earnings, particularly trying out a member-big date employment otherwise self-employed performs. A top earnings reduces your DTI proportion once the you should have a lot more currency to fund your debts.

- Pay down established expenses (and college loans) in order to significantly replace your DTI ratio. Build additional repayments when possible, and get away from taking on the newest personal debt – such as car and truck loans, unsecured loans, and you may credit debt.

- Review your own month-to-month costs observe where you can remove spending. Immediately after trimming so many expenses, redirect those funds so you can personal debt installment.

- Improve your deposit to lessen your home loan matter and possibly improve your DTI ratio.

- Mention refinancing options to potentially reduce your present monthly loans payments.

An approach to pay student loans quicker

Though it is far from usually needed seriously to pay students financing before applying to have a mortgage, getting rid of so it harmony can make the process simpler.

The lack of obligations than the your income escalates the probability of an acceptance, and you may probably qualify for a larger loan.

Plus, settling a student loan is also improve your credit rating. This should help you get a better interest, hence saves profit the long run.

Create more repayments: Paying more minimal per month can aid in reducing the main balance less and you may are obligated to pay shorter attract through the years. Allocate windfalls on student loan, particularly a-work added bonus, taxation reimburse, otherwise present currency.

Speak about loan integration: Consolidating the student education loans can explain repayment. This involves consolidating multiple fund on the just one loan, have a tendency to causing a lower life expectancy interest rate minimizing payment per month.

One to choice is the new Federal Lead Combination Mortgage and this integrates the the federal figuratively speaking on the just one mortgage which have a fixed rate of interest. You might combine private figuratively speaking from the refinancing having a personal financial.

Explore domestic security to pay off an educatonal loan: An alternative choice is utilizing a property guarantee loan or domestic collateral personal line of credit (HELOC) to help you combine college student loans. Each other alternatives allow you to borrow on the new collateral on your home. Learn, but not, this involves converting personal debt (student education loans) towards the a protected loans (home acts as security). Even though you will get a lower life expectancy rates and flexible cost terms and conditions, there was the risk of property foreclosure if you cannot pay off loans.

Find workplace recommendations: Certain companies promote student loan repayment guidance applications within its advantages plan.Search eligibility to have federal financing forgiveness apps. Public service Financing Forgiveness otherwise earnings-motivated repayment preparations could easily lower your mortgage balance otherwise limit monthly obligations considering your earnings.

The bottom line

To personal loan with good credit but no job order a house is achievable to the proper means – and if you’re proactive. This can include examining different financing software (instance those with flexible DTI standards) and you can improving your DTI ratio so you can at some point make it easier to qualify with advantageous words.

When you are happy to see what you can purchase recognized getting which have beginner personal debt, reach out to a district financial top-notch now.