Now that the fresh new Fed has actually technically pivoted to rates cuts, financial pricing are expected to continue reducing. Yet not, positives be concerned that it will getting a slow procedure. This new Given would not cure rates all at once, or right away, unless you’ll find signs and symptoms of good pending economic crisis.

Within his remarks following the Sept. 18 coverage meeting, Fed Couch Jerome Powell told you, While we normalize pricing, you will see the newest housing industry normalize. not, he also accepted the other difficulties afflicting the new housing marketplace — higher home values and you may low index — are not fixable by main bank.

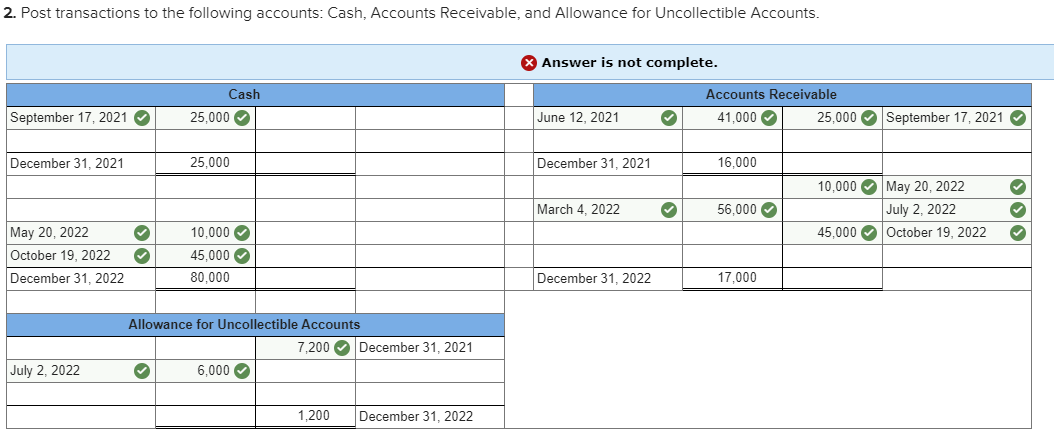

Tend to mortgage pricing belong 2024?

Mortgage cost have previously dropped roughly 1% from their 2024 top. Pursuing the very first 0.5% rate loss in September, the new Provided is actually projecting cutting prices of the another 1 / 2 of a % this season, with cuts inside 2025.

Mortgage cost had been popular off as the later , which will more than likely continue if your Fed cuts pricing by way of with the rest of this current year, told you Matt Vernon, head of user credit at the Lender out-of The usa.

According to newest forecasts, we are able to find mediocre 30-12 months fixed home loan rates lose to 6% towards the end of the season. But there is always room for volatility about financial business. In the event that upcoming rising cost of living study otherwise labor industry reports inform you new savings softening continuously, the Provided is generally obligated to create larger and/or more constant rate slices. That may cause a much bigger dip from inside the financial costs.

Nonetheless, of many possible people cost from the business is going to continue wishing up until financial pricing miss another type of pair percentage things. Masters plus alert you to a return to the two-3% home loan rates off but a few years back is unlikely.

Which are the other financial brands?

For each mortgage has financing term, or commission schedule. The most used home loan conditions try fifteen and you can 3 decades, regardless of if 10-, 20- and you may 40-year mortgages along with exists. Having a fixed-rate financial, the pace is decided for the duration of the borrowed funds, offering balance. That have a changeable-rate home loan, the pace is fixed to possess some date (aren’t five, seven otherwise ten years), immediately after which the rate adjusts a year according to research by the market. Fixed-speed mortgage loans is actually a much better choice if you plan to live for the property in the long run, however, varying-rate mortgage loans can offer straight down rates of interest upfront.

30-seasons fixed-price mortgage loans

The average 30-season fixed home loan interest rate was 6.17% now. A thirty-seasons fixed mortgage is among the most prominent loan name. It does often have increased interest than simply a 15-seasons financial, but you’ll has a lowered monthly payment.

15-12 months repaired-speed mortgages

Today, an average price having a beneficial 15-season, repaired mortgage was 5.44%. No matter if you have a more impressive monthly payment than a thirty-seasons fixed mortgage, an effective fifteen-season financing always is sold with a reduced rate of interest, enabling you to spend shorter need for the long term and you can pay-off your financial sooner.

5/step 1 changeable-rate mortgages

An excellent 5/step one varying-price home loan features the typical rates of 5.77% now. You’ll generally speaking score a reduced basic rate of interest which have a good 5/step one Arm in the 1st 5 years of your financial. However you you are going to spend so much more upcoming several i desperately need a dental implant but i don’t have money months, depending on how the rate adjusts annually. If you are planning to sell or re-finance your house in this four decades, an arm could well be a good idea.

Determine their monthly mortgage payment

Providing a home loan must always count on the money you owe and you will long-label wants. What is very important is to create a resources and check out to remain inside your form. CNET’s home loan calculator below might help homeowners get ready for month-to-month home loan repayments.