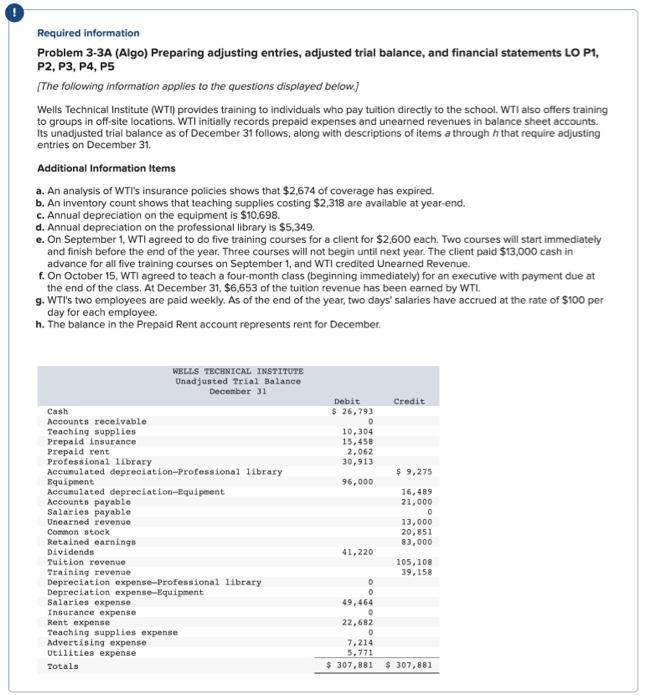

That have authorities-backed home loan arrangements, to purchase a home without having to pay a large chunk out of a down fee might only seem it is possible to. But not, government-backed providers including Freddie Mac and you can Fannie mae features apps that give lowest-put loans. These represent the Freddie Mac Family You can easily and you may Federal national mortgage association HomeReady financial programs.

Such software render a beneficial step three% down-payment otherwise a great 97% LTV (loan-to-value) with the antique finance. These are the typical funds awarded from the extremely loan providers about financial s allow it to be consumers to put down a little downpayment. The primary distinction is the credit rating requisite. HomeReady means a rating regarding 620, if you’re Home It is possible to requests good 660 credit history that could potentially connect with the eligibility into mortgage.

What’s Fannie Mae’s HomeReady Loan?

HomeReady of the Fannie mae is a mortgage system open to both new and you may recite homeowners with a credit rating of at the minimum 620. Which have versatile down payment conditions, individuals only need to pay a beneficial step three% https://paydayloanalabama.com/hanover/ deposit on one-family relations family, which matter can be partially or completely had been an offer otherwise gift. This is ideal for earliest-big date residents who try not to set large sums of cash because the dumps. The three% down payment needs is actually below brand new Federal Property Government (FHA Fund) payment to possess fund, which is step 3.5%. Just like other customary mortgage loans, individuals will have to take into account the personal financial insurance policies (PMI) if the a down payment from below 20% is generated into the HomeReady mortgage.

While making matters simpler, the insurance advanced is actually smaller to have consumers which be eligible for Fannie Mae’s mortgage, allowing them to contain the monthly payment dramatically reduced than just a beneficial traditional financing.

Brand new HomeReady earnings limitations may differ. In addition to the main income source, other different money are often used to end up being eligible toward mortgage, including a beneficial co-signer’s income otherwise an effective roommate’s money. In the event your 1st step 3% downpayment are paid, then there is a leading probability of adding a good renter’s income that could then express the method.

The funds limitations from HomeReady are determined based on geographic venue. Underserved components do not have such as earnings restrictions, if you’re qualities from inside the appointed disaster and you can higher-minority parts has a limitation regarding 100% of your area’s median earnings.

Secret Provides And you can Options that come with The newest Fannie mae HomeReady Mortgage

- An excellent 3% deposit is needed.

- All the way down PMI superior.

- Sourced elements of this new deposit range from water dollars, gift suggestions, gives, and money off their direction apps.

- Ability to fool around with money off non-renter co-individuals becoming qualified.

- Income away from a roommate should be shown to help the possibility of qualifications.

- Rental money away from a mother or father-in-laws tool otherwise basements unit are revealed.

Benefits of the newest HomeReady Mortgage

- Brand new HomeReady financing is ideal for basic-time homeowners whilst need an excellent step 3% advance payment which can be sourced thanks to different choices. it likes those getting a paycheck equal to or below 80% of area’s average income.

- First-time consumers otherwise individuals with no early in the day credit score are expected to complete a good Homebuyer education course out-of a qualified source. That it supplies the fresh homeowners using necessary information which can help them browse from the process far more effortlessly.

- Brand new liberty to make the deposit that have cash on hand could very well be one of several great things about Fannie Mae’s HomeReady program. We rescue their liquid dollars yourself as an alternative than simply in the bank. Many financial plans need the borrower to open a beneficial conventional latest or savings account, put their funds and expect a minimum of 2 months, following they have to reveal their financial statements. On top of that, HomeReady allows applicants to put on quickly having certain protection confirmation monitors. Even though, the process is nonetheless faster and more convenient.