At the rear of the house purchase is a huge monetary collaboration. In more modern times, co-ownership is usual, along with joining up with family unit members or family relations. However, focusing on how most people is going to be for the a home loan are vital to deciding what you can get to to one another, and you can what you should think before you can dive from inside the.

Centered on JW Surety Bonds, nearly 15% of Americans interviewed keeps co-purchased property having men except that the personal lover, and another forty-eight% would think it over. Since the joint mortgage loans promote a good amount of masters, he or she is an appealing option to certain-monetary responsibility try common, borrowing from the bank power was improved, and you can larger money which have better rates is way more achievable whenever pooling resources that have an alternative class.

To better comprehend the ins and outs of co-borrowing from the bank, co-signing, or co-managing, let us establish a couple of things, for instance the joint mortgage loan.

Skills Joint Mortgages

A joint mortgage was a home loan agreement having two different people in it. The individuals signing the mortgage are revealing responsibility on financing repayment. Note that this is exactly different from shared control, which is possibly familiar with avoid setting one individual to the financing because of a reduced credit score (to acquire a far greater rate of interest and be eligible for a higher amount borrowed). One customer’s label look for the financial, although both sides commercially own the newest asset.

An effective way to Grab Term Having Numerous CO-Borrowers

Tenants in accordance. All of the co-debtor are a manager, but for each and every show tends to be distributed centered on exactly how much it lay out toward downpayment otherwise simply how much it lead on the month-to-month mortgage payment.

Home loan Qualification having Mutual Candidates

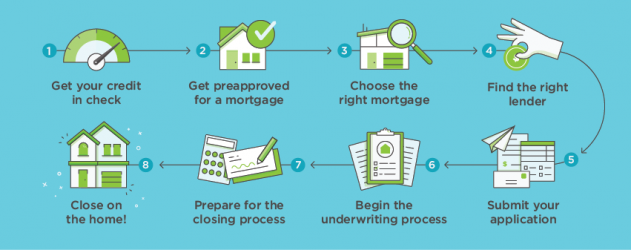

The procedure of obtaining a mutual financial is a lot like the method you might assume if you were taking out fully home financing by yourself. The lending company needs under consideration all your finances: your credit score, income, a career records, along with your current expenses. The lending company often thought everyone’s credit history to decide which loan the team tend to qualify for.

Differing people looking to be on the mortgage have to fill in an effective separate app.But exactly how the majority of people can be towards that loan, exactly?

Just how many Somebody Can be On the A home loan?

Generally, only about four to five co-borrowers are generally welcome into home financing. By application employed by Fannie mae and you will Freddie Mac, the fresh new constraints was simple as opposed to legal. There might be, in theory, even more individuals using one mortgage for individuals who discover a loan provider in order to underwrite the loan without needing that minimal app. Although not, extremely loan providers does not exceed five co-individuals getting a conventional financing.

It would be more to the point to adopt the fresh courtroom and logistical aspects of integrating that have multiple parties with the home financing.

Considerations Prior to CO-Credit

Before you sign for the dotted line, imagine enough time and difficult regarding the implications out of joint ownership and you will shared obligations. How well are you aware men and women you are co-borrowing from the bank which have? While the every person’s financials foundation toward acceptance, that outlier you certainly will lower the amount you might obtain or produce a reduced interest, causing the general prices across the longevity of the mortgage.

On the other side of one’s coin, Numerous co-consumers using one loan can perhaps work really for those without due to the fact much economic stability and you may higher credit standing-allowing all of them accessibility the homeownership path. Concurrently, a group you can expect to make an application for a larger amount borrowed to pay in a multiple-device strengthening to live in and you may rent out getting passive income.

Lawfully, co-borrowing from the bank will likely be tricky. Such as, a beneficial immediately following-married pair going through a separation and divorce may now need certainly to loan places Mystic either offer the home, pick out the most other lover, or broke up the new continues out of renting.

Essentially, if one co-borrower desires out (otherwise has gone by away), the remainder co-borrowers need dictate the following strategies to one another. That may include to order them aside, attempting to sell the express, otherwise refinancing having the label taken out of the mortgage-then you could end with increased notice rates.

How does Cosigning Apply at The Credit?

Basically, becoming an effective cosigner has the capacity to connect with the credit. Brand new people you might be cosigning for can affect your credit score which have its fiscal obligation. If they’re punctually having home loan repayments, their get might have to go right up. Alternatively, if they are late or trailing on mortgage repayments, your score might have to go off.

Difference between A great CO-SIGNER And you will A great CO-Borrower

So you’re able to loan providers, i don’t have a positive change anywhere between an excellent co-signer and you can good co-borrower-these include both fiscally in control, each other factor towards being qualified amount borrowed and you may interest, and you can one another was accountable in the event the repayments commonly generated on time.

But not, if you’re signing up to end up being a good co-borrower, it indicates their name’s to your action, while cosigners will not be named with the action into property. A great co-signer isnt area-proprietor.

Techniques for Improving Credit Energy

If you’re considering having multiple individuals on financing, you could greatly improve the financial eligibility to possess joint people-you and the individuals your companion withbining revenue can get assist you can also be accept more substantial mortgage. Also, combined fico scores are averaged. In past times, a minimal credit score are will concerned about the absolute most, however now, lenders are more willing to average the actual fico scores so you’re able to see a happy typical of all credit scores.

That being said, look at the borrowing users, profits, and you can property of your co-borrowers seriouslymunicate well and regularly doing your financial earlier in the day, present, and you will future to obtain a much better idea of in which you might homes when you need to indication a combined mortgage loan. Bear in mind: With anybody will come even more opinions and financial problem so you can examine.

While you are happy to discuss mutual home loan options, contact the new PacRes mortgage pros now to own personalized information and you will possibilities that suit your circumstances-together with needs of co-debtor or co-signer!