After you approach lenders for an unsecured loan, the initial thing they often manage was look at the credit history. Your credit rating are a rating of your credit rating, the degree of credit availed from you, your fees results, etc. Once the personal loans are guarantee-100 % free otherwise signature loans, loan providers will examine in the event that lending for you might be a risky suggestion and you will a credit rating will help all of them influence that.

While it’s a general sense that folks that have reduced credit ratings don’t score a personal bank loan, the truth is that there are various lenders who promote private finance for people with low credit scores. A number of all of them were given below:

What is a great CIBIL Get?

The way in which financial institutions or other creditors is also see your own creditworthiness is by using your own CIBIL (Borrowing from the bank Suggestions Agency Limited) rating. Its lots that is associated with the both you and informs the lending company how responsible youre together with your funds and borrowing from the bank cards. The new CIBIL score is amongst the primary variables accustomed determine the brand new recognition out-of a loan. New CIBIL rating try India’s basic-previously credit history program in fact it is accepted because of the all banking companies as an https://paydayloancalifornia.net/montalvin-manor/ expert into the an individual’s credit score.

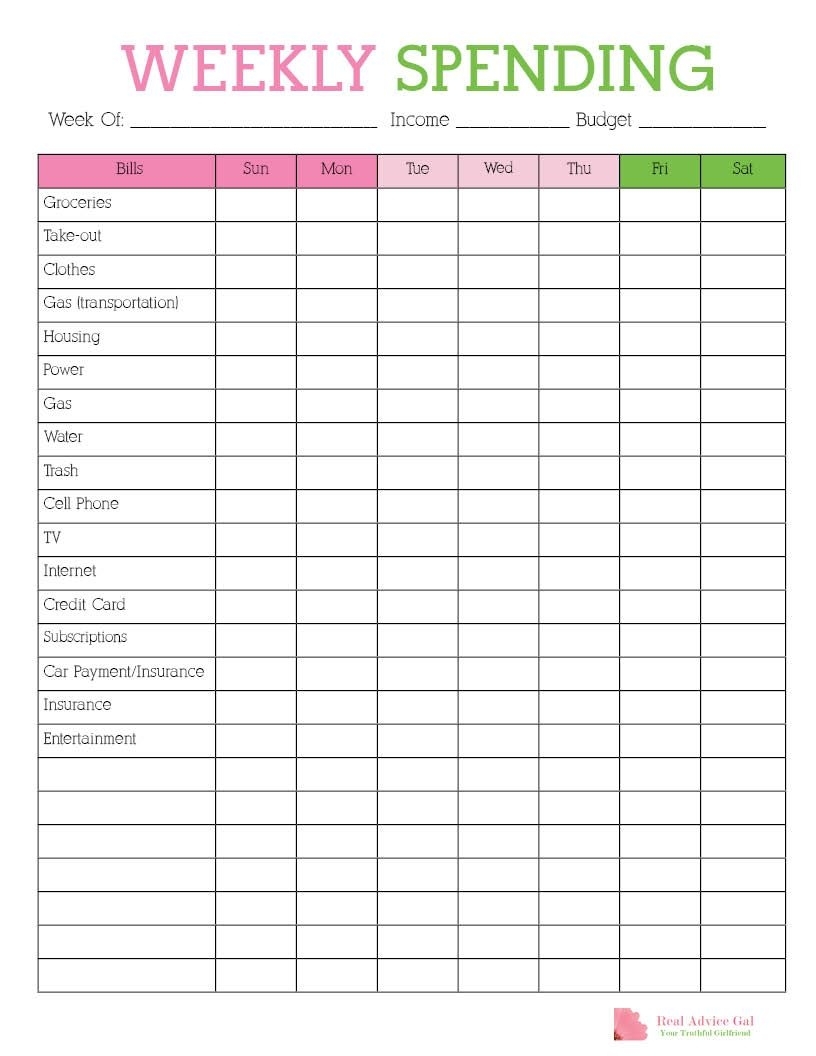

The latest desk stated lower than offers a much better concept of a beneficial and you may a bad CIBIL get for a personal loan:

How come CIBIL Get work?

The CIBIL get program really works is a lot like the financing score assistance used in of numerous nations. Youre assigned a get, a variety, anywhere between three hundred and you may 900. The amount that you will get is a result of what the banking companies forward to CIBIL. This article is a set of your repayments out of Unsecured loans, lenders, automobile funds and you can playing cards. In the event that all payments are created timely, then you may aspire to have a good score.

For those who skip money otherwise don’t spend the money for borrowing from the bank right back over time, it may reduce your credit rating which could, through the years, tends to make challenging for you to get accepted getting a financing. CIBIL is also browsing is household bill costs and therefore that your rating you certainly will boost or damage depending on when you pay their cell phone, power or drinking water bills.

- Reduced Personal debt-to-income Ratio: By keeping the debt-to-earnings ratio lower, you will be able to improve your chances of bringing approved for a loan.

- Steady Money: Have indicated a regular and credible income source to compliment the qualifications.

- Co-applicant: Imagine applying with a beneficial co-applicant that a better credit score to boost the possibilities away from approval.

- A lot more Files: Be ready to promote a lot more documentation to bolster your loan app.

Exactly what affairs down CIBIL Rating?

Since CBIL scores should feel a sign of economic habits, the new get changes based on how you handle the money and you will playing cards. These are some of the items that may enjoys a poor impact on your CIBIL rating.

- Signature loans – Since the unsecured loans try signature loans, providing way too many unsecured loans can result in your credit score so you’re able to slip.

- Missing financing instalments – For folks who skip an enthusiastic instalment on the loan then it may be considered once the worst economic believe so your credit score are affected therefore it is problematic for you to secure money later.

- Coming also around the restriction with the credit cards – When you’re too close to the restrict of one’s credit cards too frequently, they also circumstances on ongoing obligations and you will a failure to handle currency intelligently leading to a decrease in their CIBIL get.