- Guarantor Mortgage brokers

- Loved ones Home loan

With the use of good guarantor loan, you could fundamentally assist both to order a home or also an investment property to one another.

Benefits associated with a family home loan

- You don’t need to in initial deposit.

- You always won’t need to shell out LMI (Loan providers Financial Insurance coverage).

- Particular lenders render deal interest levels.

- You could consolidate slight bills for example unsecured loans and you may borrowing from the bank credit.

- You could reduce measurements of your ensure.

You can talk to one of the lenders exactly who specialize for the nearest and dearest mortgage loans to the 1300 889 743 or by doing our very own cash loan in Salt Creek online investigations function.

How is actually family mortgages planned?

Such as, good daughter or son to acquire a property by using the mothers, an older pair to acquire a house by using its child and stuff like that.

Parents to purchase a home because of their adult youngster

Moms and dads have a tendency to assist the mature youngster pick a house when the its child is still a student or is merely getting started. They do this by providing their house with the lender while the a promise with the loan.

At some point, the parents could well be liable in the event the its daughter or son cannot see their home mortgage debt. They will have to sometimes pay off the loan within infant’s put or sell their residence entirely.

Having a good guarantor loan, you could borrow 100% of the property rates in addition to a supplementary 5% to help you 10% to have related can cost you such as legal charge and you can stamp responsibility.

Adult youngsters to shop for a home due to their parents

Particularly, while over the age of forty then the bank could possibly get decrease your mortgage name. This is done so as that possible pay our home financing before you reach the standard retirement age of 65.

When you find yourself avove the age of 50 this may be get almost feel impractical to rating a loan recognition. You will be necessary to bring thorough home loan records and a leave method to show that you could potentially pay back the borrowed funds before you could retire.

In this situation, you might pose a question to your mature college students in order to pick an effective household otherwise capital. This performs similar to good guarantor loan.

New adult pupils put their residence due to the fact a security otherwise be certain that to suit your mortgage. They eventually end up being liable for individuals who default on the house mortgage and will need to pay away from the financial to you.

A family to buy property to one another

In this case, mom and dad will give security off their assets or deliver the deposit additionally the students provide their earnings to pay for repayments.

The mortgage can split up into numerous levels and each member makes their particular repayments within respective profile.

These formations can be utilized with other family unit members too. Call us to the 1300 889 743 otherwise fill out our 100 % free on the internet evaluation form for more information on the way to obtain with your family unit members.

Particular banking institutions ily people such as for instance siblings, grandparents, uncles, aunts, partners and de facto couples. Members of the family, workmates and you will couples commonly generally speaking accept because of the banking institutions.

You will have to meet extra financing requirements if you are searching so you can pick a house having anyone other than your parents.

What exactly is minimal guarantee?

You can use a limited be certain that to minimize the chance confronted by the guarantors for your house loan. With a limited be certain that, he is simply responsible for a part of your residence financing.

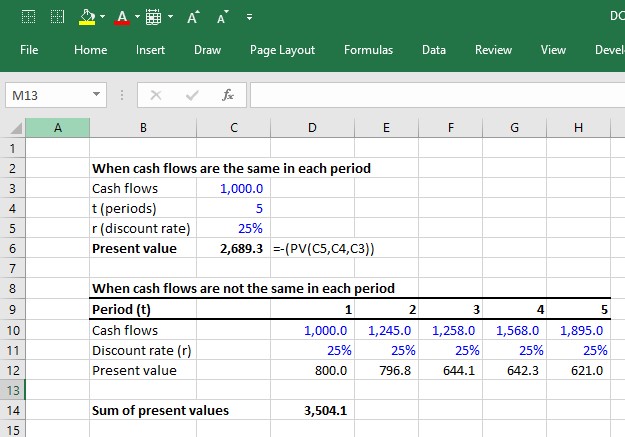

To calculate this, you have to know how much cash you want to obtain and you may the house rate. You’ll be able to determine their limited be certain that toward formula:

Just remember that , this algorithm is to work out how far restricted be certain that make an effort to keep the overall LVR from the 80%. Additionally, you will must make sure your guarantor at the least features adequate security to cover the computed count.

You are able to label the brokers whom specialize inside guarantor fund with the 1300 889 743 or submit our online assessment means and does the data for you.