Article Guidelines

In case your homebuying preparations had been put-on keep due to good personal bankruptcy, take center: You may want to qualify for an FHA mortgage immediately following a bankruptcy proceeding you to definitely could have been released over the past one or two ages. Even if a bankruptcy get remain on your credit report to possess seven so you’re able to 10 years, FHA recommendations enables you to qualify for financing at some point, based if you registered a section 7 or Chapter 13 bankruptcy.

- Methods to take to help you qualify for an FHA loan immediately following bankruptcy proceeding

- 5 tips to alter your funds after bankruptcy

- FHA financing conditions

Actions for taking so you can be eligible for a keen FHA loan shortly after bankruptcy proceeding

The rules getting being qualified to own a keen FHA mortgage just after bankruptcy differ centered on what type of case of bankruptcy is actually released. There are two sort of personal bankruptcy accessible to people, and each is sold with its own guidelines to get an enthusiastic FHA financing.

A bankruptcy proceeding

After you file a chapter seven bankruptcy, all your property are sold and the continues are widely used to shell out financial institutions and you may lose the eligible financial obligation. It’s the typical form of bankruptcy in fact it is an educated option for individuals who don’t possess sufficient earnings to repay its expense.

Youre qualified to receive a new FHA financing 2 years once your own personal bankruptcy are released. A beneficial discharge is actually a legal purchase you to launches you against this new costs integrated from the bankruptcy, as well as the date-stamp with the discharge initiate the latest clock with the the prepared period. You should plus fulfill a few other standards together with the waiting period:

- You truly need to have re also-dependent good credit. Loan providers pays attention to how you will be dealing with credit once a bankruptcy, especially your own previous fee record on one the brand new personal debt and how much the newest financial obligation you take toward.

- You ought to explain the cause for new case of bankruptcy. A letter out-of need is generally expected and so the bank is also understand what taken place and how stuff has altered economically on better because the bankruptcy is discharged.

You are able to be eligible for FHA funding 1 year shortly after a case of bankruptcy launch, whenever you show the new case of bankruptcy is caused by issues past the control. The brand new FHA calls this type of extenuating circumstances, in addition they become:

- The fresh loss of a wage-generating lover

- Serious infection

- Delivering laid off

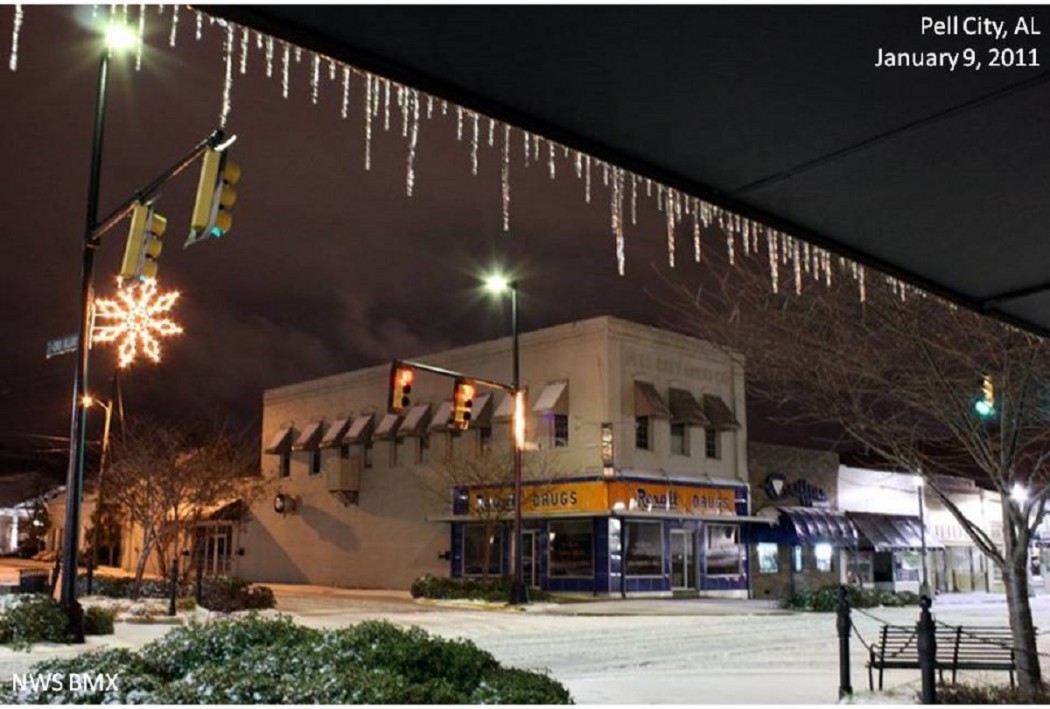

- Sheer crisis one to destroys your residential property

Section 13

A part thirteen bankruptcy is made to render individuals with a beneficial consistent money a legal-ordered fees plan. When a chapter 13 was recorded, anyone (called a borrower in this instance) deals with a great trustee to settle loan providers toward a routine over a about three- in order to five-seasons months. If the payment bundle is completed, one kept qualified debts is released.

To track down a keen FHA financing, you have got to prove you have made into-day money towards the Section 13 policy for one or more 12 months. The lending company will require papers to display new due dates and you may you want authored consent on courtroom to apply for this new urgent hyperlink mortgage.

Items you Should know

The Government Housing Government (FHA) backs loans produced by FHA-accepted loan providers to consumers having all the way down credit rating minimums and you can qualifying conditions than just traditional funds succeed. This is accomplished because of the asking FHA mortgage insurance rates, which is paid off because of the borrower to safeguard loan providers against loss if you default and they have to help you foreclose. Consumers have a tendency to favor FHA funds once a personal bankruptcy just like the several-12 months waiting months are far less than the four year wishing months requisite once a personal bankruptcy having conventional loans.

5 tips to alter your money after bankruptcy proceeding

And additionally fulfilling the minimum prepared periods, you will need to show the financial institution debt home is from inside the order in order to meet the fresh re-built a good credit score rule. Case of bankruptcy have a large influence on your own fico scores, however the the total amount of your own damage depends on your current credit reputation.