- The fresh borrower need to have no derogatory borrowing (collections) on the go out out-of declaring bankruptcy;

- The new borrower need to have a minimum credit rating out-of 530-640 (centered on where they live and you will financial assistance).

What are USDA Finance?

USDA funds try supported by brand new U.S. Company of Farming to have reduced-and-middle-earnings borrowers exactly who may not qualify for a traditional financing. The newest mortgage loans have low down costs without closing costs to have individuals who buy a house into the a being qualified outlying area, that has on the 97% of your own You.S. A borrower’s income are unable to meet or exceed 115% of your average money with the urban area. Mortgage loans try 29-season, fixed-rate.

Due to the fact USDA will not set the very least credit score, very loan providers which processes USDA financing need no less than 640.

- A bankruptcy proceeding Qualified 36 months immediately following launch.

- Part thirteen Eligible shortly after one year if they will have stuck on their plan money.

Possibly a bankruptcy is not the simply monetary problem a prospective mortgage debtor are dealing with. The latest bankruptcy was preceded by the foreclosure toward home financing.

With one another a property foreclosure and bankruptcy proceeding get prolong the borrowed funds procedure more than simply a bankruptcy proceeding, and may create other criteria.

Extenuating Factors

A bankruptcy get come from something that you never watched future, a single-date feel one caused a giant loss of earnings and you may/or rise in obligations and you will try away from manage. A lot of people within the COVID-19 pandemic found themselves within the a dreadful financial predicament it never ever might have forecast ahead of time. Jobs layoffs, medical problems and you will divorces all are traditional tipping issues getting an effective bankruptcy proceeding. The important thing to consider try outside the manage shedding a giant chunk of money so you’re able to a financial investment or an out-of-manage Auction web sites to find routine, or another financial choice you made that sends your bank account careening, does not amount. You should be capable prove that you cannot steer clear of the factors one to added that seek bankruptcy relief.

Whenever a bankruptcy proceeding results from extenuating affairs, it will suggest a smaller prepared period to the all types of mortgages.

- FHA, Virtual assistant, USDA 12 months after release;

- Traditional 2 years once discharge.

Tips to alter Your Credit ratings just after Bankruptcy proceeding

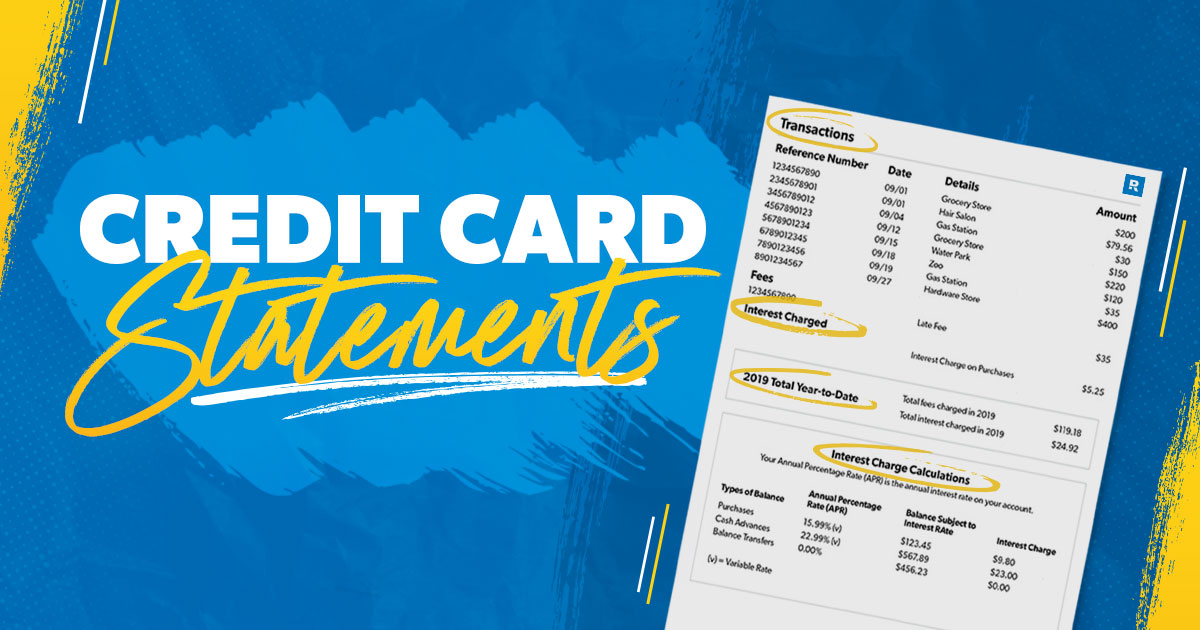

You will find things that’s true when making an application for a mortgage, whether it uses a case of bankruptcy or otherwise not credit score try queen. no credit check installment loans Central The higher the newest score, the latest shorter you will be recognized additionally the reduce the appeal rates could well be. The pace makes a positive change on your payment, as well as how much you have to pay more than you to thirty years.

The fastest means to fix fix their borrowing to possess a mortgage once bankruptcy is to generate on-day payments into all the loans, (specifically playing cards) and also to contain the count make use of to lower than 31% of the borrowing limit, the borrowing application speed.

Percentage record and borrowing application rate take into account 65% of one’s credit history. Missed payments and you will overspending having playing cards is actually borrowing-get killers.

Additional factors is period of credit rating, borrowing from the bank blend and you can the fresh new borrowing from the bank. It can help your own get if you have various borrowing (mortgage, auto loans, student loans) and certainly will harmony having fun with playing cards you have got consistently which have playing with brand new ones.

Everything may sound a tiny abstract, but if you do the math for the a 30-12 months mortgage the difference between a decreased and you may high rating provides it towards the focus. For the a good $250,000 mortgage, a beneficial step three.5% interest function a great $step one, payment. A cuatro.5% rate of interest would mean a good $step one, payment.

Credit score requirements to have old-fashioned mortgage loans differ certainly one of lenders, but usually the get has to be at least 620. Va financing also require an effective 620 lowest. USDA mortgages want a good 640 lowest.