Their career and you will role

Their profession shall be a large contributing basis into the financial qualifications, particularly if your situation requires a professional experience otherwise certification. This indicates that you will not struggle to see really works, and now have certain part of economic balance.

Deal efforts are and additionally way more commonplace in some fields, and several loan providers even put aside favourable rates of these accredited inside specialities for example accountancy, practise, or treatments – aside from your own contractual standing.

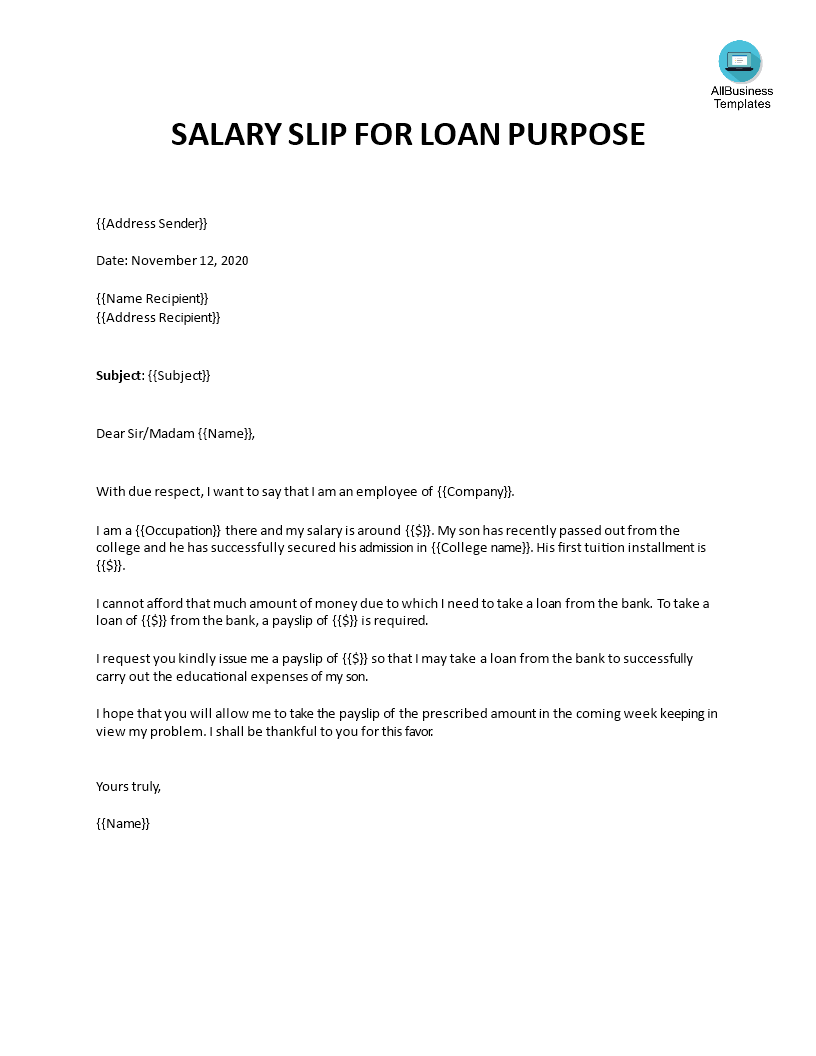

Capacity to program your earnings

Precisely how you plan the job tends to make most of the the difference. It’s all perfectly claiming your own yearly income so you’re able to a prospective financial supplier, however, without proof the sole provide you likely will end up being found ‚s the door.

To show your correct economic possible, you’ll want to give doing one year away from bank statements and you may payslips including earlier P60’s.

Even though 5% mortgage loans are making a return, candidates constantly have to have indicated excellent issues in other areas. Since are a builder contributes an element of chance, lenders normally have large deposit standards – tend to as much as fifteen – 20% – so you can counterbalance it.

While it may be you can easily locate a merchant who will give you a great ninety% if you don’t 95% loan-to-value (LTV) mortgage, a larger deposit usually nearly always work with the go for. This is exactly real aside from your job style of.

From inside the placing off a bigger put, you might be decreasing the financial support risk to own lenders. A lower life expectancy LTV results in a wider list of team and top rates, with every 5% LTV generally attracting more loan providers and you can unlocking all the way down desire selling.

How is money examined on the a no-time specialist mortgage?

Earnings and you may affordability tests might be trickier when you yourself have an effective zero-time package, particularly when your revenue frequently fluctuate. Locate a concept of your own month-to-month fees potential, lenders will always assess an average of your income through the years.

Just be sure to render evidence of your historic income via payslips and you can corroborating lender statements. To have no-hour specialists, certain home loan providers require two to three years‘ background, many commonly believe lending predicated on twelve months‘ trade.

What size home loan can a zero-hours staff member score?

When your average annual money has been situated, of a lot mortgage team fool around with money multiples given that a starting point to feet credit. The standard allotment was a multiple of step 3.5 – 4.5x the annual money, even though this will vary with regards to the financial, in addition to level of chance you present in other places.

For an employee delivering family typically ?sixty,000 a year, this may suggest you’re eligible for an excellent ?210,000 financial regarding lenders within the straight down lending group, and you can ?270,000 off the individuals for the high you to. That said, in exceptional products particular business may be willing to give upwards so you can 5.5 if you don’t six moments your revenue.

However, income multiples alone commonly adequate for loan providers in order to ft the conclusion; subsequent cost monitors are performed to test your revenue try enough to shelter brand new suggested payments, following the deduction of every outgoings.

Loan providers dictate that it because of the figuring the debt-to-income ratio, the total sum of your fixed monthly expenses split up installment loans in Ohio by the month-to-month money, increased by the 100 locate a percentage. Such as for example, for folks who gained normally ?5,000 1 month and spent ?2,two hundred to your rent, power bills and extra debts, your own DTI would be 49%.

Typically, the lower their DTI, the greater number of favourably loan providers will appear at the you since it means you have got more throwaway money available. A good DTI from 35% otherwise less is sometimes deemed good‘, thirty-six – 49% acceptable‘, and you can fifty% or higher poor‘.