Family collateral fund enables you to borrow secured on the house’s guarantee, giving you entry to dollars getting repairs, renovations, and other tactics.

The amount of money you can aquire away from a home equity loan relies on certain activities – your existing household guarantee, debt-to-earnings ratio, and also the lender you choose.

What things to discover household collateral fund

- Home equity fund allow people to help you borrow money contrary to the well worth of the property that they have. The cash can be finance methods such as for example home improvements or solutions.

- You’ll find limitations in order to exactly how much individuals normally borrow having fun with a beneficial house equity loan.

- You will be capable use as much as 90% of home’s economy well worth, however, maximums will vary across the lenders and you will states.

- Area of the issues choosing home security financing number tend to be borrowing from the bank, money, family well worth, and you may financial obligation-to-income percentages.

How does property equity mortgage works?

A home guarantee loan allows you to borrow a set number of money out of a lender that with your house’s security since the collateral. Your house guarantee refers to the difference between the house’s newest worth and you can any latest home loan with the property.

When you sign up for property security mortgage, your own lender will provide you with the loan proceeds from inside the a swelling share. Should your residence is value $three hundred,000, and you nonetheless owe $130,000 with the your own home loan, you really have $170,000 off guarantee. If you were looking to acquire around 85% of your residence’s worthy of, you could potentially take out property collateral loan to have $125,000.

Since your house is put since the equity so you’re able to keep the house security mortgage, rates is actually seemingly reasonable compared to almost every other products like private finance. Including, house security financing generally speaking feature a predetermined rate of interest, so you’re able to know exactly how much you borrowed per month on the life of the mortgage.

House equity loan vs HELOC: what’s the improvement?

Domestic equity personal lines of credit (HELOCs), such as for example family collateral funds, allow you to borrow cash using your home’s collateral since the security. Unlike family equity money, HELOCs try rotating lines of credit. It means borrowers have access to funds as needed on the drawing several months and only need to pay straight back whatever they invest. This is exactly ideal for longer-name ideas that have unknown parameters. HELOC rates of interest and you can costs also are adjustable. They’re able to increase through the years whenever you are family security loan repayments continue to be fixed.

Each other options also have finance must fund a venture, and each gift suggestions unique professionals and you may prospective disadvantages over the other. Be sure to evaluate costs and store lenders to greatly help determine whether or not a HELOC otherwise household collateral mortgage suits you.

How-to dictate home equity mortgage maximums

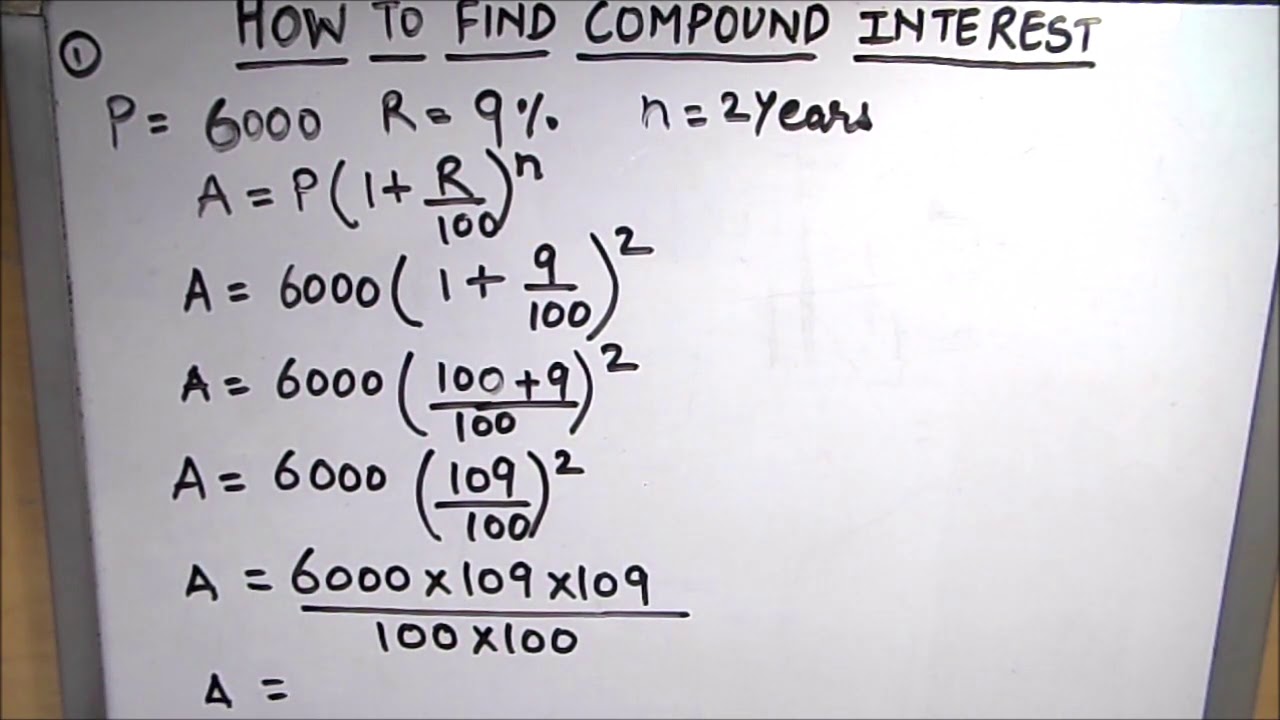

Although many lenders wouldn’t enable you to obtain more ninety% payday loan Shaw Heights in your home collateral, loan providers weighing a number of other factors to influence the amount your in the course of time located. Several data is actually central to your home guarantee financing maximums: your loan-to-really worth proportion (LTV) plus joint loan-to-worth proportion (CLTV).

The brand new LTV compares your existing mortgage number plus appraised home worth. If for example the appraised home really worth try $250,000 and also you still owe $180,000 in your financial, possible estimate the LTV because of the isolating $180,000 from the $250,000 and changing it in order to a percentage away from 72%.

Your CLTV ratio takes new computation after that of the factoring when you look at the maybe not simply your first home loan, plus any additional secured finance on your own household, together with a second mortgage such as property collateral mortgage. Very, by using the example over but reason behind an extra $30,000 financing, you might determine your CLTV by breaking up $210,000 from the $250,000 and you will changing the new quantitative to 84%.

The lower their LTV and CLTV, the greater. Such percent connect with their limit loan amount, rate of interest, and complete eligibility.

Other factors that decide how much family collateral financing you could rating

When you find yourself your own guarantee, LTV, and you will CLTV are definitely the significant choosing products based on how much you can also be borrow against property collateral loan, lenders contemplate your credit score, income, and you may financial obligation-to-money ratio. All lender weighs in at such circumstances in different ways, so it’s vital that you know them before applying to have good loan.

Credit score

Your credit score is actually good around three-fist figure centered on your credit report that lets lenders understand how almost certainly you are to settle bills punctually. The greater your credit rating, the more likely loan providers accept your for a loan. Pick Home loans needs a credit score with a minimum of 680 for the home equity loan, however, conditions differ together with other loan providers.

Earnings

To try to get a home equity financing, you should let you know proof of money. Lenders should make sure to make enough currency to repay the borrowed funds. Boosting your consistent earnings as a consequence of an advertisement otherwise an additional employment may help replace your odds of researching the borrowed funds terms and conditions you need.

Debt-to-income (DTI) proportion

You might dictate your DTI proportion because of the breaking up your own month-to-month debts by the revenues. Figuratively speaking, automobile financing, and you will credit cards matter towards their monthly personal debt, but bills such as for example market otherwise resources generally speaking usually do not. DTI restrictions are very different across the lenders and you will financing but settling expenses may help with qualifications.