An element of the facts you to definitely determine the HELOC pricing is actually the credit rating, debt-to-income ratio, in addition to quantity of collateral you have got of your home. Dependent on your area for the Connecticut, you have got even more collateral to access as opposed to others.

By way of example, considering Zillow, Connecticut’s average house worth was over the federal average ($399,242 versus. $358,734). In some wealthy locations, like Darien, the typical domestic worthy of are $dos,007,032. For those who have 20% collateral on the assets, that’s almost $80,000 which have Connecticut’s average domestic really worth-however, $eight hundred,000 on the a property in the Darien. Usually, the better brand new part of security you possess of your house, the low the HELOC cost tends to be.

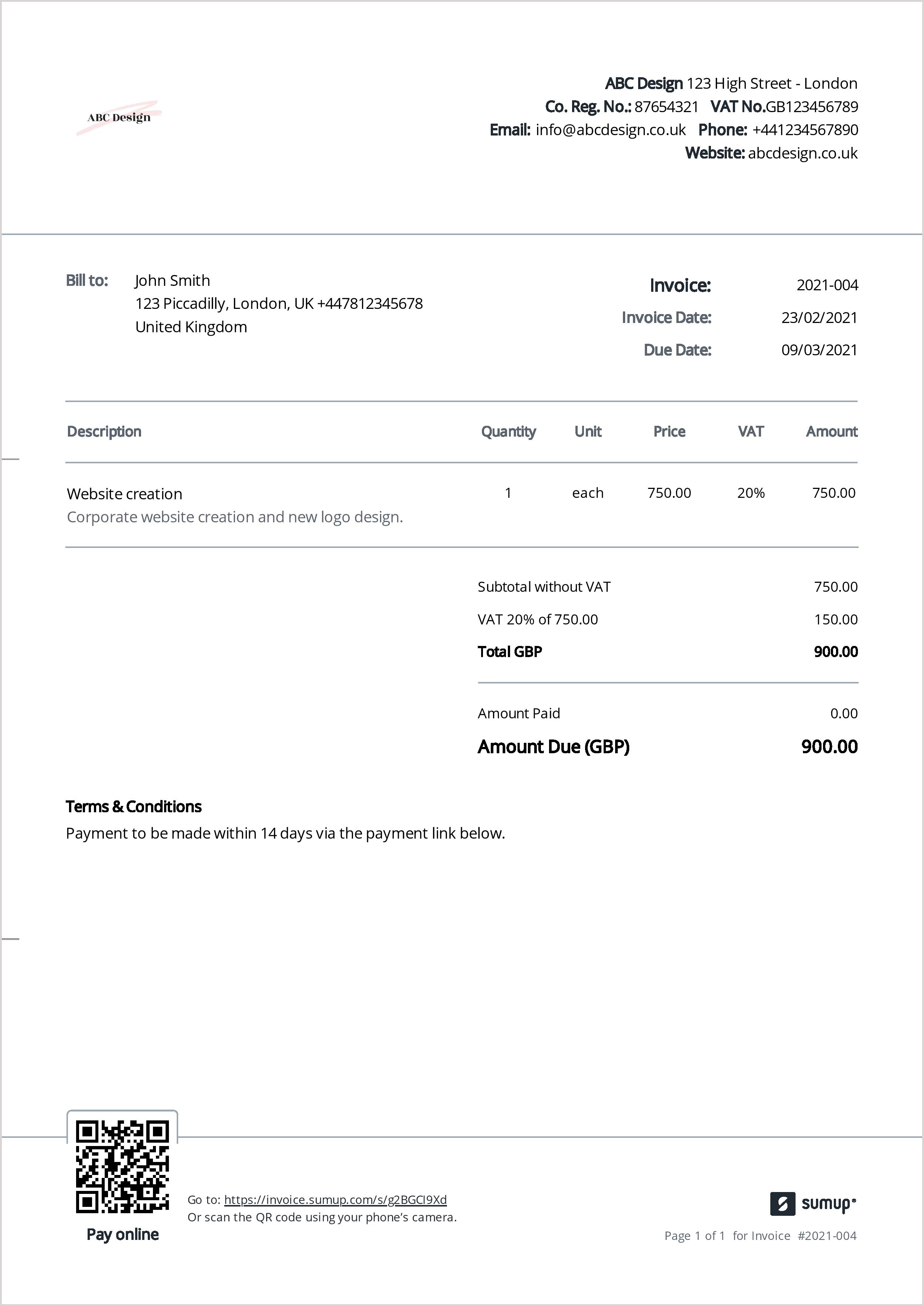

Obtaining the better HELOC rates inside the Connecticut should be important. Even shaving one percentage area off the price can help you help save thousands using your financing. About analogy less than, qualifying to own a keen 8.50% rate in the place of 9.50% saves you $ten,000.

As you can see, Apr has a massive impact on the cost of your loan. However will want to look not in the matter in itself to notice whether or not the rates try changeable or fixed and you will what the installment terms and conditions was.

Really HELOCs has varying rates of interest you to fluctuate into the Wall surface Highway Primary Price. This means their monthly obligations can change when, which can make they more challenging to assume your total borrowing from the bank can cost you.

Specific HELOC lenders let you move a share or all of what you owe to a fixed rate. Seeking a lender using this perk is going to be smart if you happen to be concerned about interest increases making the loan higher priced.

Repayment conditions and gamble a critical role on the complete financing costs. HELOCs possess two phases: a blow phase and you will an installment stage.

- Inside draw stage, certain lenders allow you to create appeal-merely repayments, that keep the initially payments down.

- But when you look at the installment phase, you start and come up with complete money. For people who haven’t been paying off their principal balance most of the together, you can find yourself purchasing alot more interest full.

Getting the lowest HELOC cost during the Connecticut

- Increase credit score. Lenders generally speaking supply the ideal cost so you can consumers having advisable that you sophisticated fico scores. The nearer your own FICO score should be to 720 or more, the higher. Its Okay to hold away from on the providing a good HELOC to improve your borrowing very first.

- Consider the collateral. Loan providers basically enables you to obtain as much as 85% of one’s house’s worthy of without their a fantastic home loan balance. Not sure what this means to you personally? Deduct your existing home loan balance from the residence’s worth in order to determine your own guarantee commission.

- Score several even offers. You will probably find an educated HELOC cost when you look at the Connecticut any kind of time of your federal lenders in the list above or in the local associations.

- Select basic prices. Always think about the introductory rates and how they could changes throughout the years. Also check your price as the basic period finishes as well as how which can dictate their costs.

Ideas on how to apply for good HELOC for the Connecticut

Trying to get an effective HELOC into the Connecticut is much like bringing a good HELOC anywhere else throughout the You.S. After you have shopped to and discovered the best selection to suit your finances, you will need to submit an official app.

- Learn how to implement. Really loan providers enable you to apply on the internet as a result of their site. But for regional organizations, you might have to go to a district branch. Find out this article very first, in order to ready yourself.

- Collect enhance files. It is possible to always you desire a duplicate of advice newest financial and most latest charging statement, money verification data (shell out stubs, W-2s, and you will taxation statements), as well as your own personal information, together with your Public Coverage number and government-granted photo ID.