How to get A Virtual assistant Financing That have A great 580 Credit score

The latest Virtual assistant financial work with helps make home ownership simple for Veterans, effective solution people and you can thriving partners. In the place of old-fashioned financing, The fresh Agency out-of Experts Products doesn’t require a particular credit history. You still would not like with less than perfect credit just like the Virtual assistant lenders commonly however check your credit history that can reject your according to severe borrowing situations on the previous. It is important to go over your credit report that have a Va financing professional from the 800-720-0250.

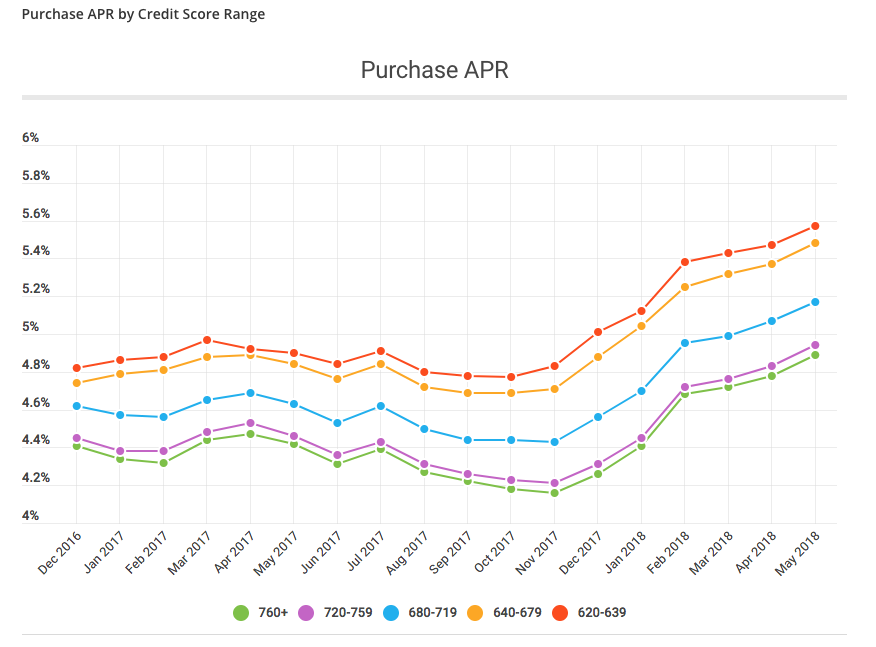

Therefore, and just have less than perfect credit otherwise a minimal credit score doesn’t mean you’ll end up rejected a good Va loan, a higher rating may help keep rate of interest down. This may support less costly money along side lifetime of the loan. You may also delight in to find a property without the need to create a downpayment.

You will need to keep in mind that many personal Virtual assistant lenders usually set their unique minimal credit score standards for Virtual assistant money applicants. An average personal lender constantly need a credit score minimal ranging ranging from 580 660. Perhaps you have realized, Virtual assistant loan credit history criteria can be hugely other each financial.

With respect to Virtual assistant mortgage loans, your credit rating is not necessarily the simply question in fact it is requisite because of the loan providers to qualify. Va loan providers might must dictate your capability to repay the mortgage back. They will certainly require proof of work, proof of your existing earnings, plus latest financial obligation in order to earnings ratio. Other requirements lenders must thought is the length and you will reputation of provider also.

Ideas on how to Repair Good 580 Credit rating To have A great Va Financing

When you yourself have a great 580 credit score you will possibly not qualify to possess a great Virtual assistant loan with lots of lenders. You should never disheartenment since you may initiate raising your get. You could label HomePromise today observe where you stand and you can find out more about the way to get An effective Va Loan Having An excellent 580 Credit score

- Credit rating Your own length of credit rating is the amount of time you provides put borrowing. Uniform repayments more a long period commonly enhance your rating.

- Fee History A normal fee history will assist improve credit score amount. So, if you’ve been later in your expense, initiate using all of them promptly.

- Borrowing Application The method that you make use of your borrowing from the bank is yet another essential requirement you to find your credit score. The rating can benefit out of an everyday fee records and additionally given the way you make use of your borrowing. While around the borrowing limit on the mastercard costs the score certainly will feel paid down so you should maintain your charge card balance on less than 50% of your own borrowing from the bank limits and you will ideally actually significantly less than 25%.

- Bankruptcy. Fico scores will shed rather for everyone immediately following processing personal bankruptcy. Often it will require a bit to suit your get to increase once you have finished a bankruptcy proceeding. The key are interested in a beneficial Virtual assistant bank for https://paydayloanflorida.net/taft/ example HomePromise that will help you meet the requirements reduced than other loan providers to possess a good Virtual assistant mortgage shortly after personal bankruptcy.

- Foreclosure. Credit ratings may also drop a lot when a home loan goes on foreclosures. The rating commonly gradually rise throughout the years immediately after their foreclosure. But, just like the a veteran, you ought to telephone call one to a HomePromise Virtual assistant financing specialist at 800-720-0250. HomePromise will help you meet the requirements faster than many other loan providers for a great Virtual assistant loan immediately following a property foreclosure.

- Credit Mistakes There are three credit reporting agencies, Experian, Transunion, and you may Equifax and you may not one of them are fantastic. They generally make mistakes that seem on your credit history ultimately causing one have a lower score. It is preferable to pull the free credit file and you will review all the information each bureau is wearing your records. When the mistakes are located, work at getting them removed to aid replace your rating.

Prequalifying Can help you Start Restoring An excellent 580 Credit rating

When planning on taking a leap forward in fixing a decreased credit history you really need to prequalify to have a Virtual assistant loan that have HomePromise. Many times HomePromise will find an effective way to offer the fresh Va financing you would like though your credit rating is actually low. However,, if not meet the requirements then the HomePromise Virtual assistant financing pros usually make you advice on how to raise your score. It is very important telephone call a good HomePromise Va loan professional correct off to rating a concept of all you have to fix otherwise rebuild the borrowing from the bank so you can be eligible for a good Va mortgage soon. It might not become just like the tough as you want to get good Virtual assistant loan having a 580 credit score.

Just remember that , when you have an excellent 600 credit rating, a 620, 640 if you don’t an excellent 680 credit score, improving your score is worth it. Gaining a higher number doesn’t merely raise your possibility of taking acknowledged to possess good Virtual assistant mortgage it helps enable you to get a lower price also.

Lenders Want Your own Virtual assistant financing eligibility

There can be another important step up bringing an excellent Va loan. It has nothing at all to do with your credit rating and therefore try checking your qualifications. Your certification regarding eligibility is an important file available with the new Agencies of Veterans Activities. HomePromise as a great Va financial could possibly get the Certificate regarding Eligibility. It document shows that you meet up with the services requirements you’ll need for an effective Va financing.

Outlined by Va, you will find all service requirements to have Experts and you can productive obligation service users, National Guard players and you may Set aside users at the web site.

Dishonorable Discharge

You may not be eligible if you were dishonorably released owed in order to bad perform or other dishonorable grounds. But, if you feel their dishonorable discharge is actually wrong, it is possible to use to the Virtual assistant to have the release position changed.

Service-Linked Impairment

If you don’t meet these types of conditions to own eligibility you may also nevertheless qualify if you were discharged on account of a help-linked handicap. Label HomePromise today during the 800-720-0250 for more information on qualifying with a support-connected impairment.

How-to apply for a Virtual assistant financing that have Good 580 Borrowing from the bank Score

With HomePromise, you can make an application for good Va mortgage on line. We have been a good Virtual assistant mortgage lending company that produces Va fund fast and easy. However,, even though the processes will start online, all of our process was individual, do not set computers ranging from both you and your Va financing benefits.

Most other lenders make the error from clogging you against Va financing masters but we never ever usually. This will make the procedure fast and easy whether or not your position is different. Everything you must do to apply having HomePromise try contact us in the 800-720-0250. We are going to help ensure you get your certificate of qualification, next we’ll feedback your own proof a job, proof of money plus most other monetary suggestions. We’ll need similar suggestions for those who have an effective co-borrower. We deal with the rest, phone call today!